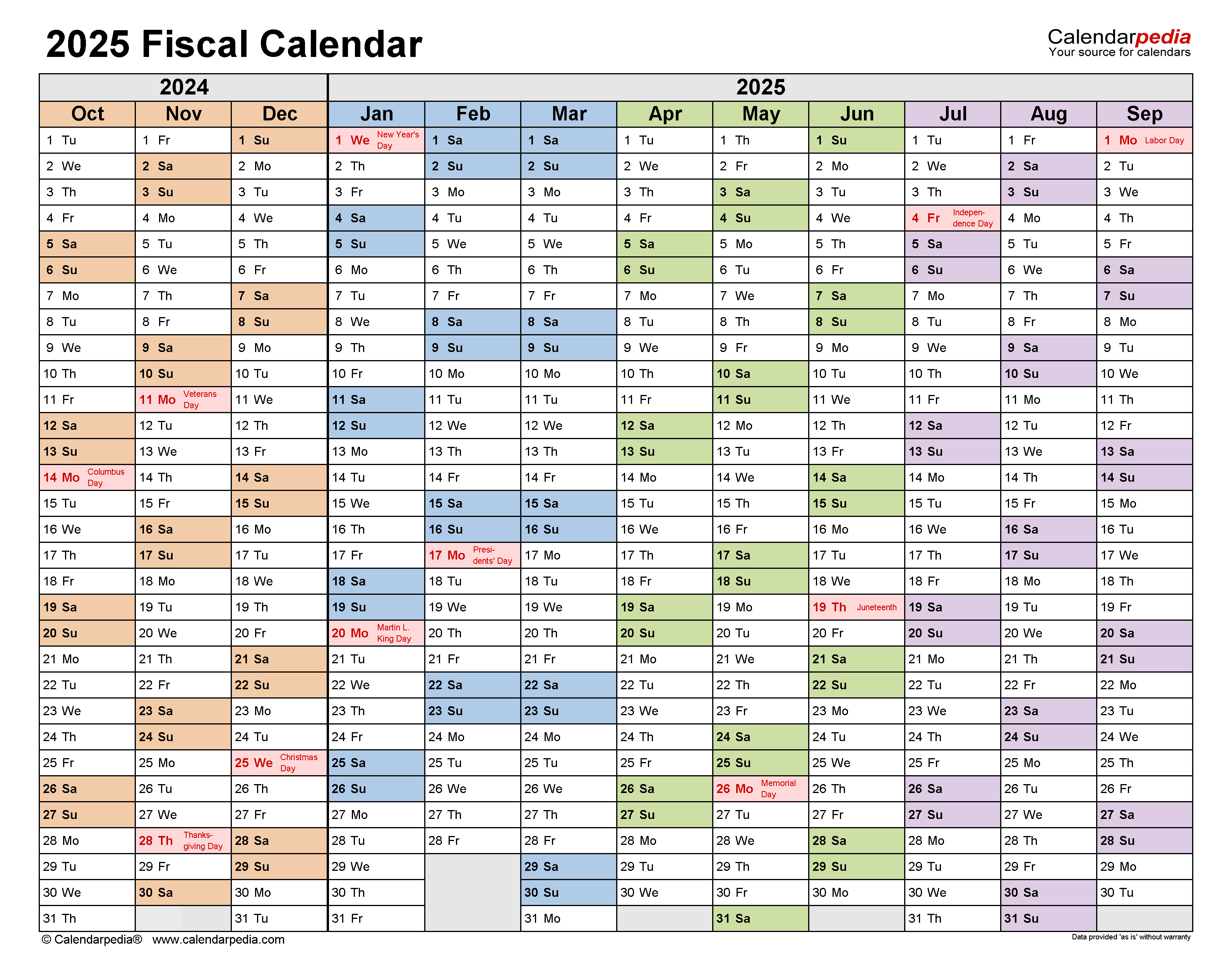

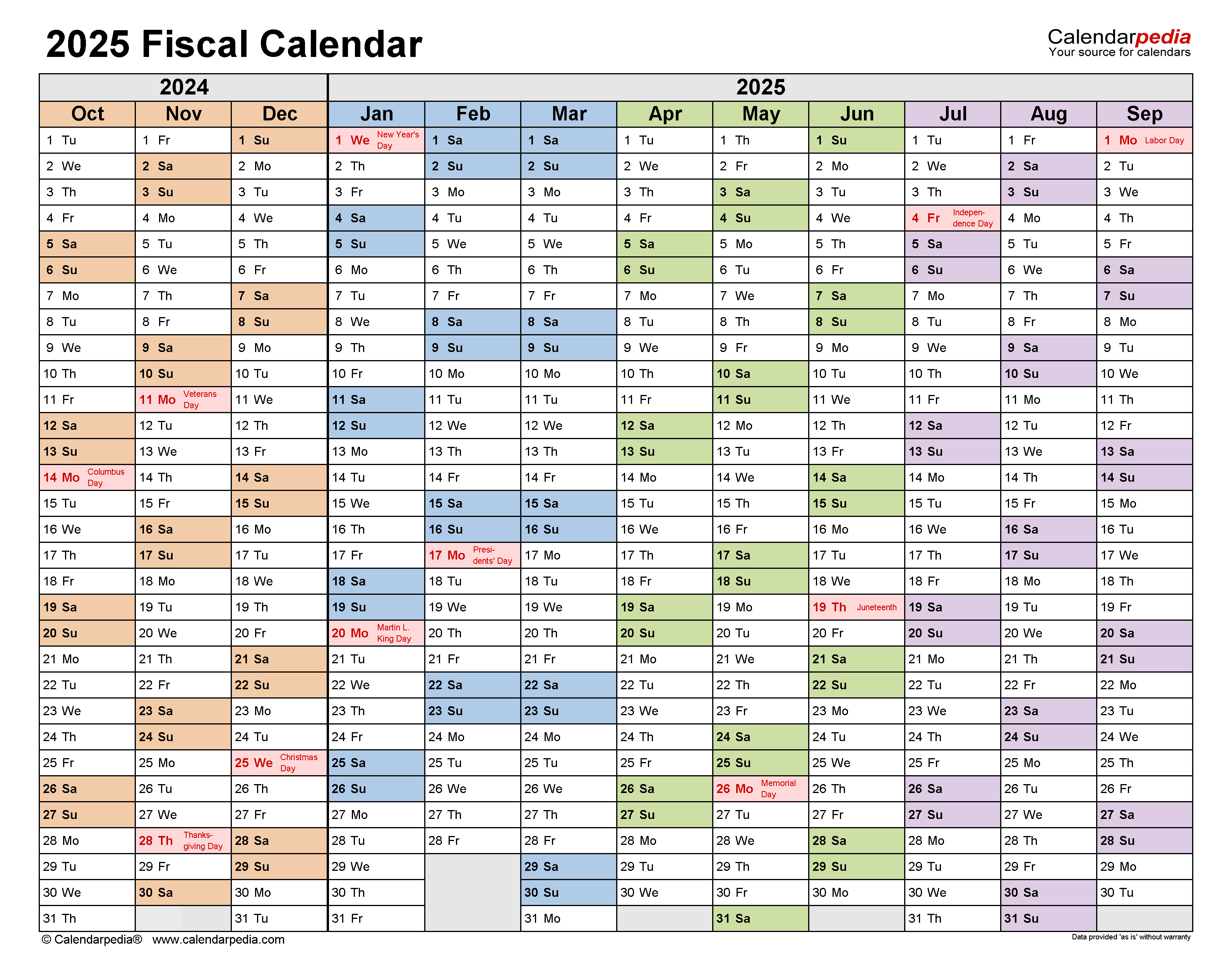

PFC FY25 4th Dividend Announcement: March 12, 2025

Table of Contents

Main Points: Understanding the PFC FY25 4th Dividend

2.1 Dividend Amount and Record Date: Key Figures for Investors

The PFC Board of Directors has declared a dividend of $0.75 per share (this is an example, replace with the actual amount). This is a significant development for PFC stockholders. The record date, the crucial date by which you must own PFC stock to receive the dividend, is set for [Insert Record Date]. The payment date for this dividend is anticipated to be [Insert Payment Date]. Remember these key dates to ensure you receive your payment.

- Dividend per share: $0.75 (Example - Replace with Actual Amount)

- Record Date: [Insert Record Date]

- Payment Date: [Insert Payment Date]

- Ex-Dividend Date: [Insert Ex-Dividend Date - usually one business day before the record date]

Understanding the ex-dividend date is crucial. Trading on or after this date means you won't be entitled to the dividend.

2.2 Impact on PFC Stock Price: Analyzing Market Reactions

The announcement of the PFC dividend is likely to have a short-term impact on the PFC stock price. While it’s difficult to predict precisely, several factors will influence the market's reaction. Generally, dividend announcements can be viewed positively by investors, potentially leading to a slight increase in the stock price. However, the overall market conditions, investor sentiment towards PFC, and the general economic climate all play a significant role. Analysts [mention any analyst firms and their predictions here] predict [mention prediction range for stock price].

- Short-term impact: Potential slight increase due to positive investor sentiment.

- Long-term impact: Dependent on future financial performance and overall market trends.

- Influencing factors: Market conditions, investor confidence in PFC's future, and general economic outlook.

Keeping an eye on financial news and stock market analysis will be key in monitoring the PFC stock price movement following this announcement.

2.3 PFC's Financial Performance in FY25: A Strong Foundation for the Dividend

PFC’s strong FY25 performance underpins this generous dividend announcement. The company reported robust growth across various key metrics. [Insert specific financial data here. Examples include: EPS of $X, revenue growth of Y%, and profit margin of Z%]. These positive financial results demonstrate PFC's financial health and ability to consistently reward its shareholders. This solid FY25 performance justifies the dividend payment and signals confidence in the company’s future.

- Earnings Per Share (EPS): [Insert Data]

- Revenue Growth: [Insert Data]

- Profit Margin: [Insert Data]

This PFC financial results data highlights the company's success and reinforces the dividend announcement as a reward for shareholder investment.

2.4 Future Dividend Outlook: Looking Ahead at PFC's Dividend Policy

While the current dividend announcement is positive, investors are naturally curious about the future. PFC’s dividend policy is typically [explain the dividend policy – e.g., consistent, increasing, etc.]. Future dividend decisions will hinge on factors including future financial performance, strategic initiatives, and overall economic conditions. The company aims to maintain a sustainable dividend policy while continuing to invest in growth opportunities. Regularly reviewing the company's financial statements and investor communications will provide the most up-to-date information on future dividend prospects and PFC outlook.

- Factors influencing future dividends: Future financial performance, strategic investments, and economic conditions.

- Dividend sustainability: PFC is committed to maintaining a sustainable dividend policy.

Investors should stay informed about PFC's financial health to accurately gauge the long-term dividend sustainability.

2.5 Where to Find More Information: Accessing Official PFC Resources

For complete details on the PFC FY25 4th dividend announcement, including the official press release and further financial information, we recommend visiting the official PFC investor relations website: [Insert link here]. You can also access relevant SEC filings at [Insert link to SEC filings here]. For any investor inquiries, please contact PFC Investor Relations at [Insert contact information here].

- Official PFC Website: [Insert Link]

- SEC Filings: [Insert Link]

- Investor Relations Contact: [Insert Contact Information]

Conclusion: PFC FY25 4th Dividend – A Positive Outlook for Investors

The PFC FY25 4th dividend announcement, with its generous payout and positive financial backdrop, offers a promising outlook for investors. The dividend amount reflects the company's strong financial performance and commitment to shareholder returns. While future dividend payments will depend on various factors, the current announcement signals PFC's ongoing success and confidence in its future. Stay informed about future PFC dividend announcements by regularly checking the company's investor relations website. Understanding the PFC dividend and its implications is crucial for making informed investment decisions.

Featured Posts

-

Revolucionario Wta Ofrece Licencia De Maternidad Pagada A Tenistas

Apr 27, 2025

Revolucionario Wta Ofrece Licencia De Maternidad Pagada A Tenistas

Apr 27, 2025 -

Farm Import Ban Update On South Africa Tanzania Discussions

Apr 27, 2025

Farm Import Ban Update On South Africa Tanzania Discussions

Apr 27, 2025 -

Con Alberto Ardila Olivares La Garantia Del Gol

Apr 27, 2025

Con Alberto Ardila Olivares La Garantia Del Gol

Apr 27, 2025 -

Couples Getaway Ariana Biermann In Alaska

Apr 27, 2025

Couples Getaway Ariana Biermann In Alaska

Apr 27, 2025 -

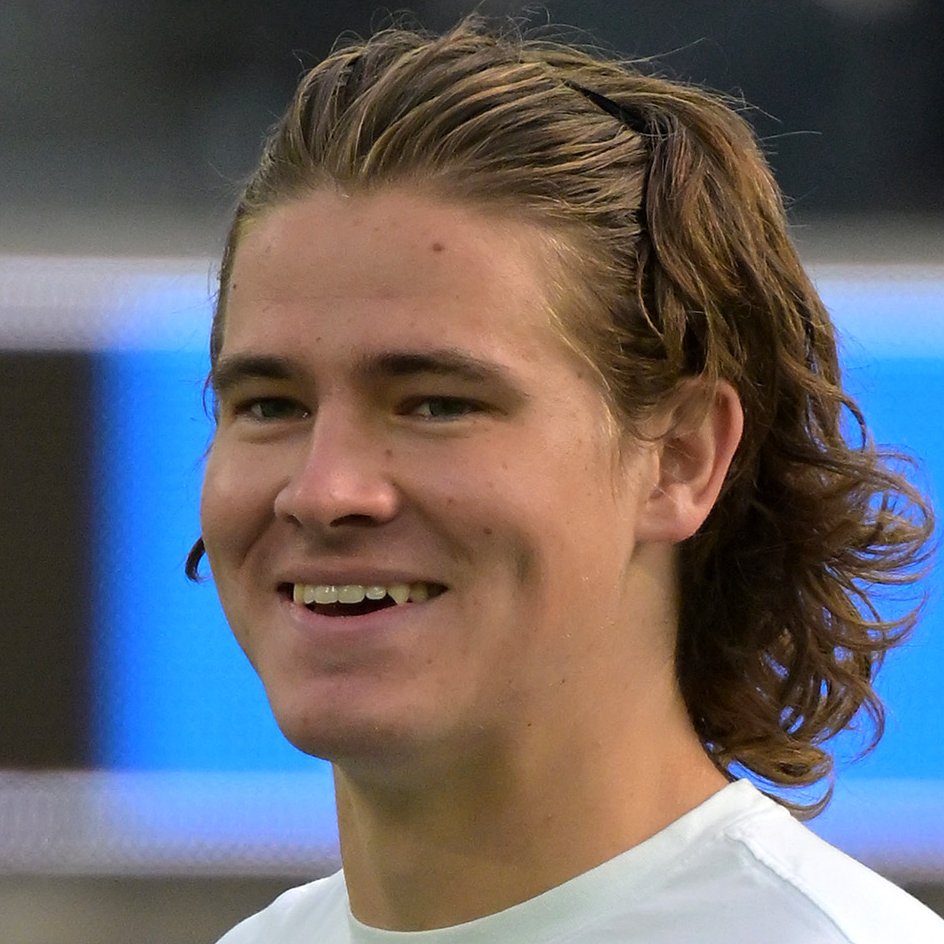

Nfl International Series Justin Herbert Chargers To Open 2025 In Brazil

Apr 27, 2025

Nfl International Series Justin Herbert Chargers To Open 2025 In Brazil

Apr 27, 2025