Navigate The Private Credit Boom: 5 Key Do's And Don'ts

Table of Contents

Do Your Due Diligence: Understanding Private Credit Investments

Investing in private credit requires meticulous due diligence. Before committing your capital, thoroughly investigate both the fund manager and the underlying assets. This crucial step minimizes risk and sets the stage for successful private credit investing.

Thoroughly Research Fund Managers and Their Track Records:

- Analyze the fund manager's experience, investment strategy, and historical performance. Look for a consistent track record of success across various market cycles. A strong understanding of their investment philosophy and approach is key.

- Check for regulatory compliance and any past legal issues. Ensure the fund manager adheres to all relevant regulations and has a clean legal history. This due diligence can be performed through reputable online resources and professional services.

- Look for transparency in fee structures and reporting. Clearly defined fees and regular, comprehensive reporting are essential for maintaining transparency and trust. Avoid funds with opaque fee structures or limited reporting.

- Consider seeking independent verification of fund performance data. Independent audits or verification from reputable sources can bolster confidence in the reported performance figures.

Evaluate the Underlying Assets:

- Understand the type of assets the fund invests in (e.g., direct lending, mezzanine debt, distressed debt). Each asset class carries a different risk profile; understanding this is crucial for aligning investments with your risk tolerance.

- Assess the creditworthiness of the borrowers. Thoroughly review the financial health and credit history of the borrowers. This involves analyzing financial statements, credit ratings, and other relevant indicators.

- Analyze the collateral backing the loans. If the loan is secured by collateral, assess the value and liquidity of that collateral. Understanding the recovery process in case of default is crucial.

- Consider the potential for default and the recovery process. Private credit investments inherently carry default risk. Develop a clear understanding of the fund's strategy for managing defaults and recovering funds.

Diversify Your Private Credit Portfolio

Diversification is a cornerstone of successful investing, and the private credit market is no exception. A well-diversified portfolio mitigates risk and enhances the overall returns.

Don't Put All Your Eggs in One Basket:

- Spread your investments across different fund managers, asset classes, and industries to reduce risk. This approach minimizes the impact of a single fund underperforming or a specific industry experiencing a downturn.

- Diversification minimizes exposure to individual fund manager performance or market-specific downturns. By diversifying across various strategies and managers, you reduce the impact of individual failures or market-specific events.

- Consider geographic diversification of borrowers as well. Expanding your investments across different geographical regions further reduces risk associated with regional economic downturns.

Leverage Different Investment Strategies:

- Explore opportunities in direct lending, mezzanine financing, distressed debt, or other private credit strategies. Each strategy offers a unique risk/return profile, allowing for portfolio customization.

- Each strategy has unique risk/return profiles, allowing for a customized portfolio approach. A balanced portfolio including multiple strategies can offer a more stable return with a tailored risk profile.

- Consult with financial advisors to determine the right diversification strategy for your goals and risk tolerance. Financial professionals can provide valuable guidance on building a portfolio that aligns with your investment objectives and risk appetite.

Understand the Liquidity Landscape of Private Credit

Private credit investments differ significantly from publicly traded securities in terms of liquidity. Understanding this key difference is crucial for successful investing.

Private Credit is Less Liquid than Public Markets:

- Be prepared for illiquidity. Private credit investments typically have longer lock-up periods and less frequent trading opportunities compared to public market securities. This means your capital may be less accessible for a longer period.

- Factor this into your overall investment strategy and cash flow projections. Plan for the illiquidity of your private credit investments when projecting cash flow and allocating funds.

- Consider the implications of potential early withdrawals or penalties. Many private credit funds impose penalties for early withdrawals. Understanding these penalties is crucial before investing.

Manage Your Liquidity Needs:

- Ensure sufficient liquidity in other parts of your portfolio to meet unexpected expenses. Maintain a balance between liquid and illiquid assets to ensure you can meet any immediate financial obligations.

- Don't invest in private credit with funds you'll need access to in the short-term. Only invest capital that you can comfortably commit for the expected lock-up period.

- Work with your financial advisor to develop a comprehensive liquidity plan. A financial advisor can help you create a well-defined liquidity plan to manage your investments effectively.

Consider Tax Implications

The tax implications of private credit investments can be complex and vary significantly depending on several factors. Understanding these implications is critical for maximizing after-tax returns.

Tax Implications Vary Significantly:

- Understand the tax implications of private credit investments. Tax treatment depends on factors such as the type of investment structure, your individual tax bracket, and applicable tax laws. Seek professional advice to fully understand the tax consequences.

- Consult with a tax professional to plan for potential tax liabilities. A tax advisor can provide tailored advice to minimize tax liabilities and optimize your overall returns.

- Explore opportunities for tax optimization strategies within your private credit portfolio. Tax optimization strategies can significantly impact your after-tax returns. Consult with a tax expert for suitable strategies.

Don't Neglect Tax Planning:

- Proper tax planning can significantly impact your overall returns. Failing to plan can lead to unforeseen tax liabilities that could reduce your overall gains.

- Integrate tax considerations into your investment strategy from the outset. Tax planning should be an integral part of your overall investment approach, not an afterthought.

- Proactive tax planning can help maximize after-tax returns. With proper planning, you can significantly increase your net returns from private credit investments.

Monitor Your Investments Closely

Active monitoring and engagement are crucial for successful private credit investing. This involves staying informed, reviewing performance, and seeking professional advice.

Stay Informed and Engaged:

- Regularly review fund performance reports and communicate with fund managers. Regularly engaging with fund managers and monitoring performance reports provides valuable insights into the performance of your investments.

- Monitor economic conditions and industry trends that may impact your investments. Staying updated on economic and industry news is essential for making informed decisions.

- Don't passively hold your investments without proper oversight. Active monitoring and engagement are crucial for adjusting your strategy based on changes in market conditions and performance.

Seek Professional Advice:

- Working with experienced advisors can provide valuable insights and guidance. Financial advisors experienced in private credit can offer invaluable support and expertise.

- Leverage the expertise of private credit specialists or financial advisors. Private credit is a complex area, and professional advice can help you make informed decisions.

- Don't hesitate to seek second opinions or additional analysis. Seeking multiple perspectives can ensure you have a well-rounded understanding of your investments.

Conclusion

Navigating the private credit boom requires careful consideration of several factors. By following these "dos and don'ts"—performing thorough due diligence, diversifying your portfolio, understanding liquidity constraints, planning for tax implications, and actively monitoring your investments—you can significantly improve your chances of success. Remember that professional advice is invaluable in this complex market. Start exploring the opportunities in the private credit market today and position yourself for potential gains while minimizing risks. Don't miss out on this exciting investment opportunity. Learn more about effective strategies for navigating the private credit market and unlocking the potential of private credit investment.

Featured Posts

-

Two Oil Refineries Saudi Arabia India Energy Partnership Takes Shape

Apr 24, 2025

Two Oil Refineries Saudi Arabia India Energy Partnership Takes Shape

Apr 24, 2025 -

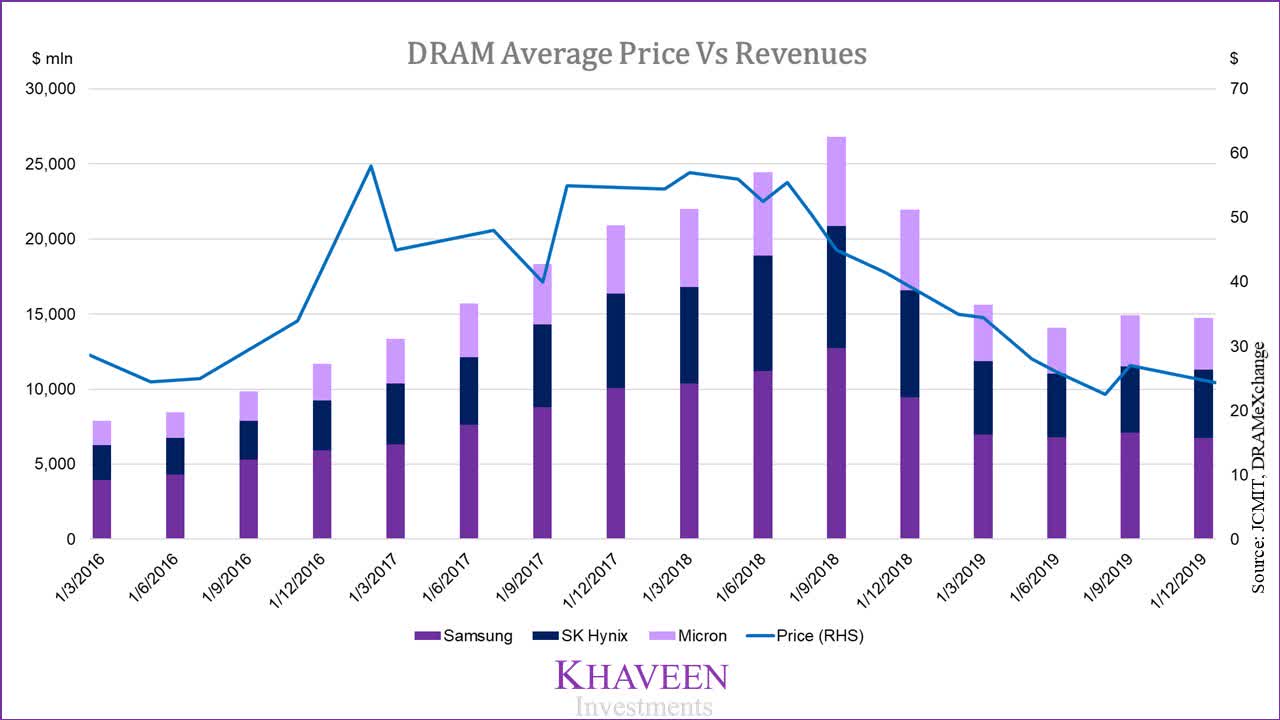

Sk Hynix Overtakes Samsung In Dram Market Ais Role

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market Ais Role

Apr 24, 2025 -

Activision Blizzard Acquisition Ftcs Appeal Against Court Decision

Apr 24, 2025

Activision Blizzard Acquisition Ftcs Appeal Against Court Decision

Apr 24, 2025 -

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 24, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 24, 2025 -

Eu Targets Russian Gas Spot Market Phaseout Discussions

Apr 24, 2025

Eu Targets Russian Gas Spot Market Phaseout Discussions

Apr 24, 2025