Minnesota Film And TV: Are Tax Credits The Key To Growth?

Table of Contents

The Current State of Minnesota's Film and Television Industry

Challenges Facing the Industry

Minnesota's film and TV industry, while promising, faces significant hurdles. Competition from states with more attractive film incentives, such as Georgia and California, presents a major obstacle. These states often offer significantly higher tax credits and rebates, making them more appealing destinations for large-budget productions. Furthermore, Minnesota's lack of extensive studio infrastructure, including a shortage of soundstages, hampers its ability to attract major projects. This is compounded by higher labor costs compared to some competing states.

- Limited soundstage space: Minnesota lacks the large-scale soundstage facilities prevalent in major film hubs, limiting its capacity to handle large-scale productions.

- Higher labor costs: The cost of hiring skilled labor in Minnesota can be higher than in some other states, impacting production budgets.

- Difficulty competing for large-budget productions: The current Minnesota film tax credit program struggles to compete with the more generous incentives offered by other states, making it harder to secure major film and television projects.

Existing Strengths of the Minnesota Film and TV Industry

Despite the challenges, Minnesota possesses considerable strengths. Its skilled workforce, encompassing actors, crew members, and technicians, provides a strong foundation for growth. The state's diverse landscapes, from bustling cityscapes to pristine lakes and forests, offer a wide variety of filming locations, attracting productions seeking unique backdrops. There's also a burgeoning interest from independent filmmakers and smaller productions drawn to Minnesota's creative community and supportive environment.

- Strong pool of local talent: Minnesota has a dedicated and skilled workforce ready to contribute to film and television productions.

- Varied filming locations: From the vibrant cities of Minneapolis and St. Paul to the tranquil beauty of the North Shore, Minnesota provides diverse and visually stunning backdrops for filmmaking.

- Growing interest from independent filmmakers: The state's supportive environment and creative community are attracting a growing number of independent film and television projects.

Analyzing the Impact of Minnesota Film Tax Credits

The Mechanics of Minnesota's Film Tax Credit Program

Understanding Minnesota's film tax credit program is vital. The program offers a credit against Minnesota corporate franchise or individual income tax liability. The percentage of eligible spending that qualifies for the credit, the types of productions eligible (feature films, TV shows, commercials), and any limitations on the total credit amount per production directly influence its effectiveness. Specific details on these aspects should be verified with the Minnesota Department of Revenue.

- Percentage of eligible spending: Determining the precise percentage is crucial for assessing the program's attractiveness to potential productions.

- Eligible productions: Understanding which types of projects qualify for the credit is essential for both filmmakers and policymakers.

- Credit limitations: Caps on the total credit amount per production can limit the program’s impact on large-scale projects.

Economic Impact Studies and Data

While concrete, publicly available data on the specific economic impact of Minnesota’s film tax credits can be challenging to find comprehensively, studies frequently show a positive correlation between film tax incentives and economic growth in other states. These studies typically highlight job creation in both direct (on-set employment) and indirect (supporting industries) sectors, as well as revenue generated for local businesses such as hotels, caterers, and equipment rental companies. The positive economic ripple effect extends to surrounding communities, boosting local economies. Further research into Minnesota-specific data is recommended to fully gauge the impact.

- Job creation: Film productions create jobs not just for actors and crew but also for support staff and local businesses.

- Revenue generation: Spending by film productions injects money into the local economy, benefiting hotels, restaurants, and other businesses.

- Economic ripple effect: The positive impacts of film production extend beyond the immediate film set, benefiting the broader community.

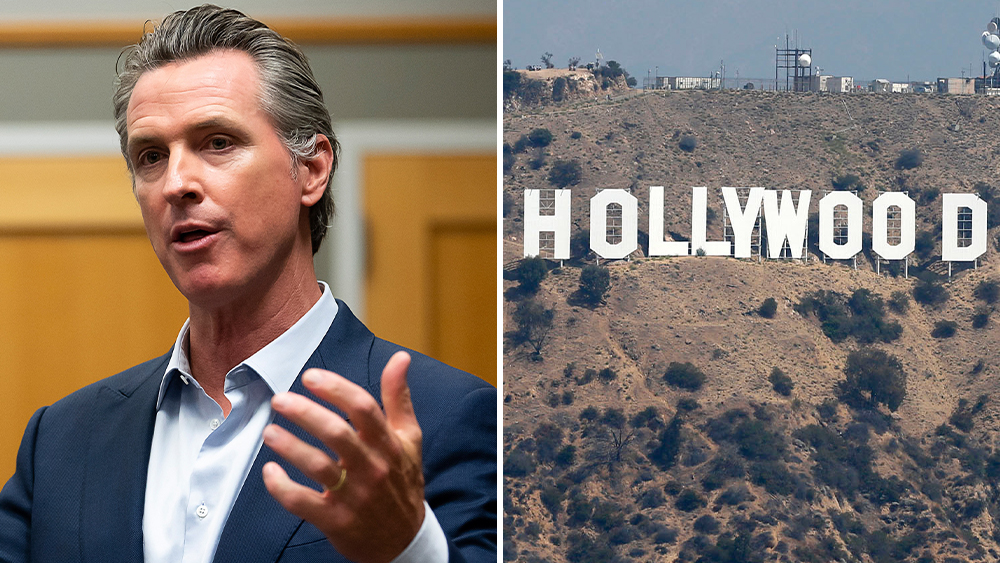

Comparison to Other States' Incentive Programs

To effectively assess Minnesota's film tax credit program, a comparative analysis with other states is essential. Examining credit amounts, eligibility criteria, and the effectiveness of different incentive models in states like Georgia, California, and New York can reveal areas for improvement. Identifying best practices and shortcomings in other jurisdictions informs strategic decision-making for Minnesota.

- Credit amounts and eligibility: A direct comparison of the financial incentives offered by different states reveals Minnesota's competitive position.

- Effectiveness of incentive models: Analyzing the success of various approaches taken by other states can inform policy improvements in Minnesota.

- Improving competitiveness: Understanding the strengths and weaknesses of competing states helps identify strategic adjustments for Minnesota’s program.

Recommendations for Growth and Improvement

Expanding the Tax Credit Program

To enhance the effectiveness of Minnesota's film tax credit program, several strategies can be considered. Increasing the credit amounts or expanding eligibility criteria could attract larger productions. Exploring options like refundable tax credits, where the credit exceeds the tax liability, provides a greater incentive. Investing in dedicated film infrastructure, such as soundstages, would significantly boost Minnesota's appeal to major productions. Finally, incentivizing post-production work within the state creates a more complete and sustainable industry.

- Refundable tax credits: Offering refundable tax credits could provide a stronger incentive for film productions.

- Dedicated film infrastructure: Investing in soundstages and other production facilities is crucial for attracting larger productions.

- Incentivizing post-production: Encouraging post-production work within Minnesota creates more jobs and keeps the economic benefits within the state.

Marketing Minnesota as a Film Destination

Promoting Minnesota's filming locations and talent to a wider audience is essential. Developing high-quality marketing materials showcasing the state's diverse landscapes is key. Active participation in industry events and film festivals helps attract producers. Collaboration with tourism agencies to promote film tourism can further enhance the state's profile.

- Develop marketing materials: High-quality promotional materials showcasing Minnesota’s diverse locations are crucial for attracting film productions.

- Industry participation: Attending and exhibiting at industry events and film festivals provides valuable networking opportunities.

- Collaboration with tourism: Promoting film tourism alongside traditional tourism initiatives expands the reach of marketing efforts.

Conclusion

Minnesota's film and television industry holds immense potential, but its growth hinges on a competitive film tax credit program. While the current program provides some support, its effectiveness pales in comparison to more generous incentives offered by competitor states. To fully unlock the industry’s potential, significant enhancements, including increased credit amounts, investment in infrastructure, and strategic marketing, are necessary. A thriving Minnesota film industry not only stimulates economic growth but also enriches the state's cultural landscape.

Invest in the future of Minnesota film and TV: learn more about the film tax credit program today! Contact your state representatives to advocate for stronger film incentives and support local film initiatives. Let's work together to make Minnesota a leading destination for film and television production.

Featured Posts

-

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025 -

Antlaq Fealyat Fn Abwzby 19 Nwfmbr Dlyl Shaml

Apr 29, 2025

Antlaq Fealyat Fn Abwzby 19 Nwfmbr Dlyl Shaml

Apr 29, 2025 -

Minnesota Immigrants Career Advancement A Study On Higher Paying Jobs

Apr 29, 2025

Minnesota Immigrants Career Advancement A Study On Higher Paying Jobs

Apr 29, 2025 -

Higher Earning Potential Minnesota Immigrant Workforce Trends

Apr 29, 2025

Higher Earning Potential Minnesota Immigrant Workforce Trends

Apr 29, 2025 -

Texas Woman Dies In Wrong Way Crash Near Minnesota North Dakota Border

Apr 29, 2025

Texas Woman Dies In Wrong Way Crash Near Minnesota North Dakota Border

Apr 29, 2025