Land Your Dream Private Credit Job: 5 Do's And Don'ts To Follow

Table of Contents

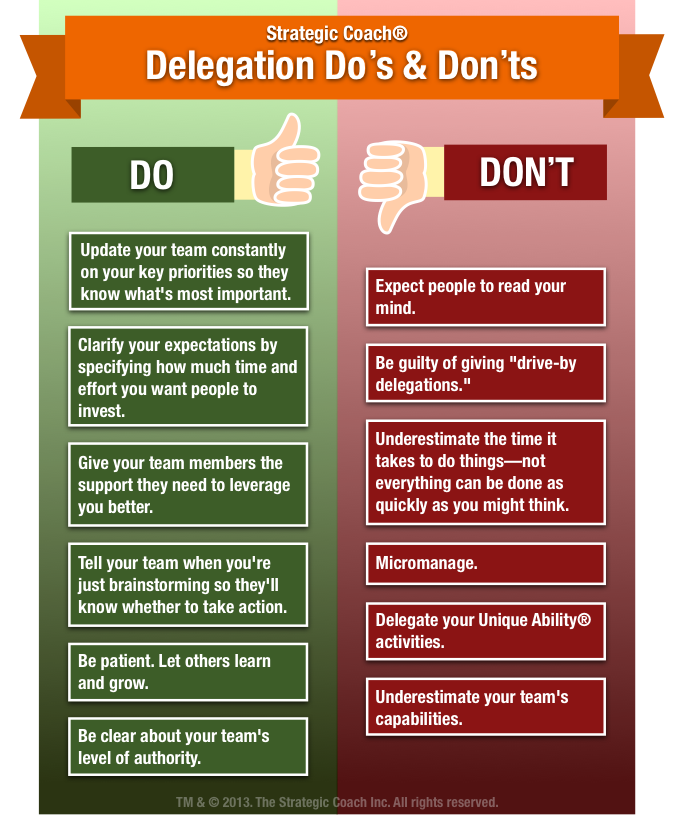

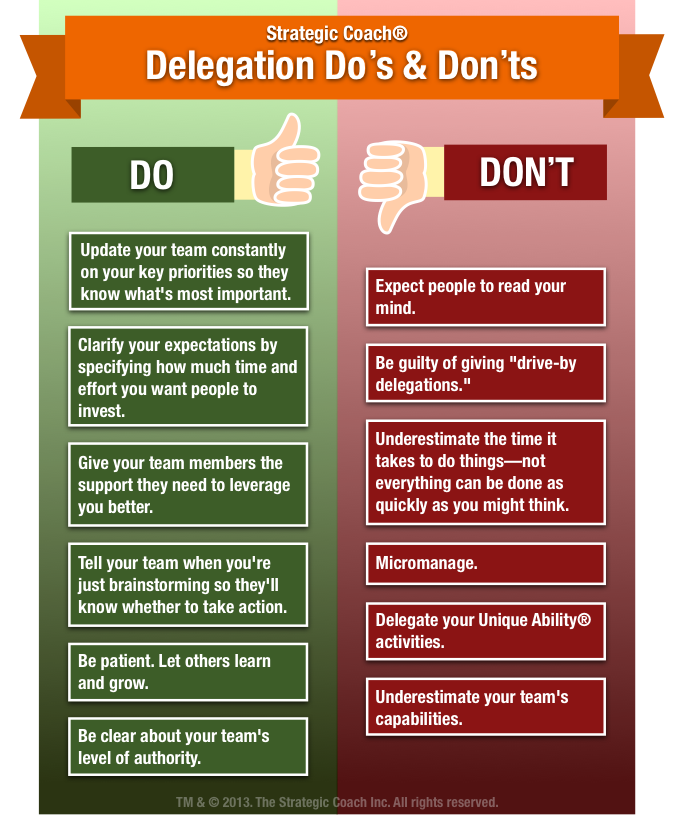

5 Do's to Land Your Dream Private Credit Job

Do 1: Network Strategically

Networking is paramount in the private credit industry. Building strong relationships can significantly increase your chances of securing your dream role. It's not just about collecting business cards; it's about cultivating genuine connections.

- Attend industry conferences and events: These provide excellent opportunities to meet key players, learn about emerging trends, and showcase your expertise. Look for conferences focused on private equity, alternative lending, and debt financing.

- Connect with professionals on LinkedIn: Actively engage with professionals in private credit. Join relevant groups, participate in discussions, and personalize your connection requests. Don't just send generic invitations; mention something specific that interests you about their profile or experience.

- Informational interviews: Reach out to professionals in roles you aspire to and request informational interviews. These are invaluable for gaining insights into the industry, learning about career paths, and making connections.

- Leverage alumni networks: If you have an alumni network from your university or previous employers, tap into it. Many professionals are happy to connect with and mentor fellow alumni.

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Generic applications are often overlooked. To stand out, tailor your materials to each specific job description.

- Use keywords relevant to private credit job descriptions: Carefully review job postings and incorporate relevant keywords, such as "mezzanine financing," "direct lending," "credit analysis," "financial modeling," and "due diligence."

- Highlight achievements, not just responsibilities: Quantify your accomplishments whenever possible. Instead of saying "Managed a portfolio of loans," say "Managed a portfolio of $XX million in loans, resulting in a Y% decrease in non-performing loans."

- Quantify your accomplishments whenever possible: Use metrics to demonstrate the impact of your work (e.g., increased ROI by X%, reduced operational costs by Z%).

- Customize your resume and cover letter for each application: Generic applications show a lack of interest and effort. Demonstrate your dedication by tailoring each application to the specific company and role.

Do 3: Master the Private Credit Interview

The interview process is critical. Private credit firms assess not only your technical skills but also your personality and cultural fit. Prepare thoroughly for both behavioral and technical questions.

- Practice your responses to common interview questions: Prepare answers to questions about your strengths, weaknesses, career goals, and experience with private credit transactions.

- Research the firm and interviewer beforehand: Understanding the firm's investment strategy, recent transactions, and the interviewer's background shows initiative and genuine interest.

- Prepare insightful questions to ask the interviewer: Asking thoughtful questions demonstrates your engagement and curiosity. Focus on the firm's culture, investment strategy, and challenges within the private credit market.

- Showcase your understanding of private credit markets and investment strategies: Demonstrate your knowledge of different private credit strategies (e.g., direct lending, mezzanine financing, distressed debt).

Do 4: Showcase Your Financial Modeling Skills

Proficiency in financial modeling is essential for success in private credit. Employers seek candidates who can build complex models, analyze financial statements, and make sound investment recommendations.

- Mention proficiency in Excel and financial modeling software: Highlight your expertise in Excel, Argus, Bloomberg Terminal, or other relevant software.

- Showcase projects demonstrating your modeling abilities: Prepare examples of your work, such as discounted cash flow models, leveraged buyout models, or loan amortization schedules.

- Be prepared to discuss your approach to financial analysis: Explain your methodology and how you arrive at your conclusions.

Do 5: Demonstrate Your Understanding of Private Credit

Demonstrating a comprehensive understanding of the private credit market is crucial. Stay informed about market trends, regulatory changes, and emerging investment strategies.

- Stay updated on market trends and regulatory changes: Follow industry news, read research reports, and attend webinars to stay informed about the latest developments.

- Read industry publications and research reports: Familiarize yourself with key players, investment strategies, and market trends in the private credit space.

- Show your understanding of different private credit strategies: Demonstrate your knowledge of various lending strategies, including direct lending, mezzanine financing, and distressed debt investing.

5 Don'ts to Avoid When Seeking a Private Credit Job

Don't 1: Neglect Networking

Failing to network significantly limits your opportunities. Building relationships is crucial for accessing hidden job openings and gaining valuable insights.

Don't 2: Submit Generic Applications

Sending generic applications demonstrates a lack of interest and effort. Tailoring your application materials to each specific job is essential for making a strong impression.

Don't 3: Underprepare for Interviews

Insufficient preparation leads to poor performance in interviews. Thorough preparation is crucial for showcasing your skills and knowledge effectively.

Don't 4: Overlook Financial Modeling Practice

Strong financial modeling skills are a prerequisite for many private credit roles. Neglecting this aspect significantly reduces your chances of success.

Don't 5: Show a Lack of Industry Knowledge

A lack of awareness of current market trends and regulatory changes indicates a lack of commitment to the field. Stay informed to demonstrate your passion and expertise.

Conclusion

Landing your dream private credit job requires a strategic and proactive approach. By following these five do's and avoiding the five don'ts, you significantly increase your chances of securing your ideal private credit position. Remember to network strategically, tailor your application materials, master the interview process, showcase your financial modeling skills, and demonstrate a deep understanding of the private credit market. Implement these tips, and you'll be well on your way to securing your perfect private credit role. Start networking and building your expertise today to land your dream private credit job!

Featured Posts

-

Chinese Stocks Rally In Hong Kong Amidst Trade Optimism

Apr 24, 2025

Chinese Stocks Rally In Hong Kong Amidst Trade Optimism

Apr 24, 2025 -

The Financial Future Of Elite Universities Navigating Political Headwinds

Apr 24, 2025

The Financial Future Of Elite Universities Navigating Political Headwinds

Apr 24, 2025 -

California Wildfires Celebrity Home Losses In The Palisades Complete Report

Apr 24, 2025

California Wildfires Celebrity Home Losses In The Palisades Complete Report

Apr 24, 2025 -

The Bold And The Beautiful April 3 Recap Liam And Bills Explosive Confrontation And Its Aftermath

Apr 24, 2025

The Bold And The Beautiful April 3 Recap Liam And Bills Explosive Confrontation And Its Aftermath

Apr 24, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 24, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 24, 2025