Is Betting On Natural Disasters Like The Los Angeles Wildfires The New Normal?

Table of Contents

The Rise of Disaster Prediction Markets and Betting

The concept of prediction markets, where individuals bet on the likelihood of future events, has expanded beyond politics and economics to encompass natural disasters. Platforms, while currently not explicitly offering bets directly on wildfire intensity or specific disaster outcomes in the way a sportsbook might, increasingly use data-driven models to assess risks associated with various natural events. These models often incorporate sophisticated algorithms and AI to analyze historical data, weather patterns, and other relevant factors. This information is then used to create probability assessments, which indirectly influence various forms of financial instruments.

- Examples (Hypothetical): While dedicated "disaster betting" platforms are currently largely absent due to ethical concerns and regulatory hurdles, the principles are applicable to existing platforms that use disaster-related data in their models. For example, insurance derivatives and catastrophe bonds could be interpreted as a form of indirect disaster betting.

- Data Sources: Weather forecasts, climate models, historical disaster records, satellite imagery, and even social media sentiment analysis are employed to predict the likelihood and severity of natural disasters.

- The Role of AI: Artificial intelligence algorithms are increasingly used to analyze vast datasets, improving the accuracy of disaster prediction models, potentially influencing the outcomes of any related financial instruments.

The Ethical Considerations of Disaster Betting

The ethical implications of profiting from the devastation caused by natural disasters are profound. Critics argue that such practices demonstrate a disturbing lack of empathy and could potentially exacerbate the challenges faced by disaster relief efforts. The potential for exploitation of vulnerable populations is also a significant concern.

-

Arguments Against Disaster Betting:

- It prioritizes profit over human suffering, potentially hindering compassionate responses to disaster victims.

- It could create perverse incentives, discouraging proactive disaster mitigation efforts.

- It raises concerns about equitable access to information and resources, disproportionately affecting vulnerable communities.

-

Counterarguments (with caveats):

- Some argue that accurately predicting disasters could incentivize better preparedness and infrastructure development, potentially saving lives and reducing long-term costs. This is a highly complex and sensitive argument.

- In certain scenarios, hedging against disaster risks through financial instruments could provide a necessary safety net for individuals and organizations. Again, this requires careful ethical considerations.

-

Regulatory Landscape: Currently, there’s limited specific regulation around direct betting on natural disasters. The legal landscape is complex and varies considerably by jurisdiction. However, the ethical questions surrounding such activities warrant a more robust examination and potential regulation.

The Los Angeles Wildfires as a Case Study

The Los Angeles wildfires provide a compelling case study. These devastating events, fueled by climate change and often exacerbated by human factors, have a significant economic impact, making them potentially lucrative targets for speculative investment, if such markets existed.

- Historical Data and Predictability: Historical records of wildfire frequency and intensity in Southern California offer data points for risk assessment. However, the complexity of wildfire behavior makes precise prediction challenging.

- Economic Impact: The destruction caused by wildfires leads to massive insurance claims, property losses, and economic disruption, creating the potential for significant financial transactions based on related risk assessment.

- Hypothetical Betting Scenarios: If a market for betting on the severity or extent of the wildfires existed, bets could have been placed on the number of structures destroyed, the total acreage burned, or even the specific areas most severely impacted. (These are purely hypothetical examples, as such a market does not currently exist.)

The Future of Disaster Betting and its Societal Impact

The future of disaster betting is uncertain. Technological advancements will likely continue to improve the accuracy of prediction models, potentially making such markets more attractive to investors. However, this also necessitates a stronger ethical and regulatory framework.

- Technological Advancements: Improvements in AI, satellite imagery, and climate modeling will enhance the precision of disaster predictions, potentially driving more sophisticated forms of related risk assessments.

- The Role of Governments: Governments will play a crucial role in establishing regulatory frameworks to address the ethical and societal implications of disaster betting, balancing the potential benefits with the need to prevent exploitation.

- Long-Term Societal Consequences: Normalizing profit from natural disasters risks undermining empathy, reducing the public's focus on mitigation efforts, and exacerbating existing inequalities.

Conclusion

Betting on natural disasters like the Los Angeles wildfires presents a complex dilemma. While some argue that it could incentivize better preparedness, the ethical concerns surrounding profiting from human suffering are undeniable. The potential for exploitation and the normalization of profiting from catastrophe demand careful consideration. We need a robust public conversation about the ethical boundaries of disaster speculation. Is profiting from catastrophe truly the “new normal,” or should we reconsider the ethical boundaries of disaster speculation? We urge readers to engage in this critical discussion and advocate for responsible regulation and ethical guidelines surrounding any financial instruments influenced by disaster risk assessments.

Featured Posts

-

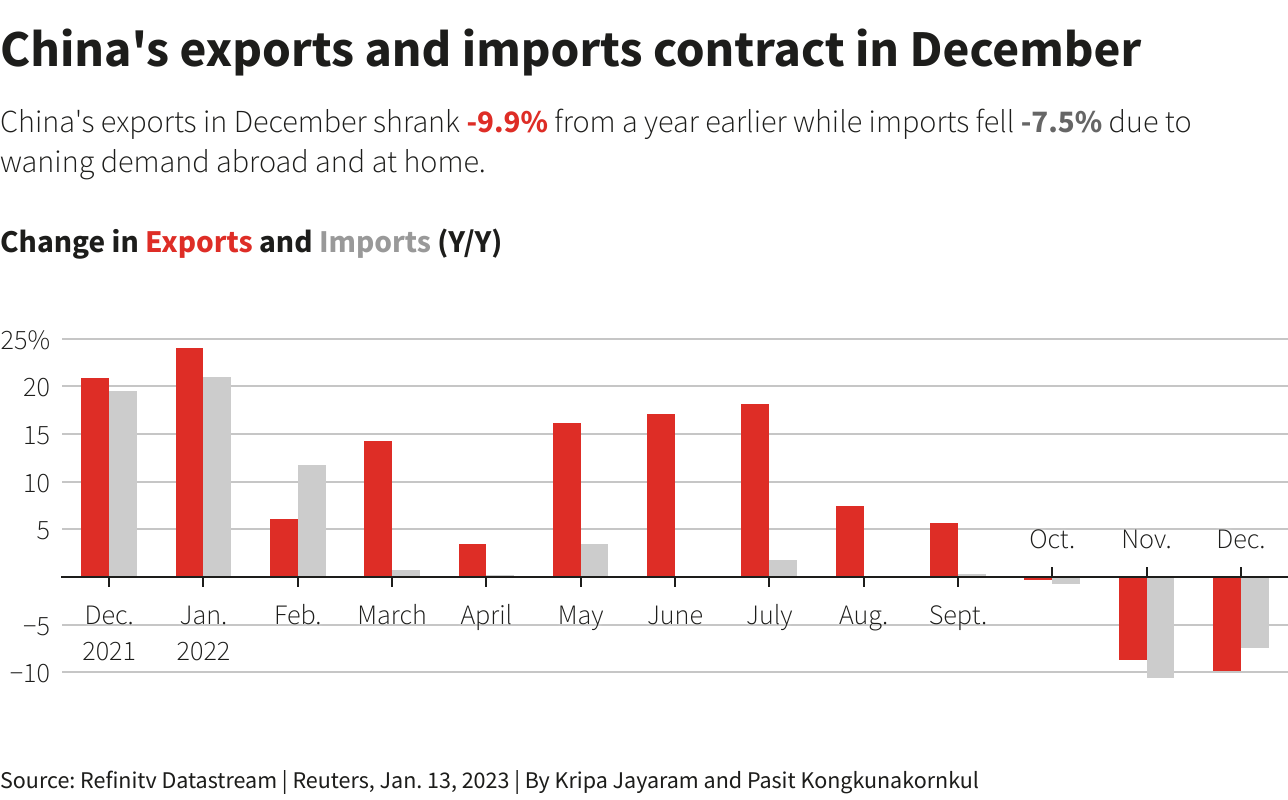

Chinas Economy Exposed By Reliance On Exports And Tariffs

Apr 22, 2025

Chinas Economy Exposed By Reliance On Exports And Tariffs

Apr 22, 2025 -

Pope Franciss Enduring Influence The Conclaves Verdict

Apr 22, 2025

Pope Franciss Enduring Influence The Conclaves Verdict

Apr 22, 2025 -

Auto Dealers Intensify Opposition To Mandatory Electric Vehicle Sales

Apr 22, 2025

Auto Dealers Intensify Opposition To Mandatory Electric Vehicle Sales

Apr 22, 2025 -

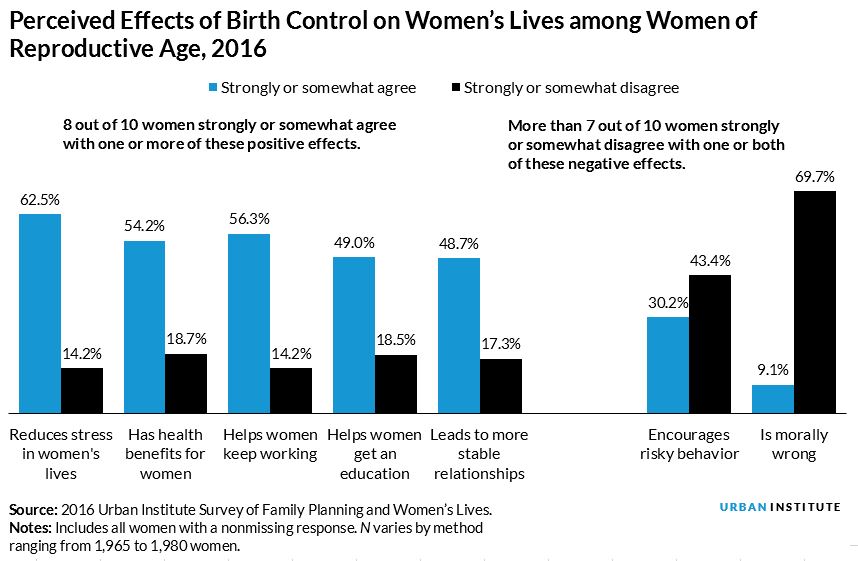

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 22, 2025

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 22, 2025 -

Florida State University Security Gap Fuels Student Anxiety Despite Rapid Police Action

Apr 22, 2025

Florida State University Security Gap Fuels Student Anxiety Despite Rapid Police Action

Apr 22, 2025