Invesco And Barings: Democratizing Access To Private Credit Investments

Table of Contents

Invesco's Approach to Democratizing Private Credit Investments

Invesco is actively working to make private credit investments more accessible to a wider investor base. Their strategy focuses on lowering barriers to entry, utilizing innovative investment vehicles, and prioritizing transparency and education.

Lowering Minimum Investment Requirements

Invesco is significantly lowering the minimum investment thresholds for its private credit funds. This directly addresses a major hurdle for smaller investors who previously lacked the capital to participate.

- Examples: While specific minimums vary by fund, Invesco offers several private credit options with minimums substantially lower than the traditional six-figure minimums common in the industry. Some funds may have minimums in the low five-figure range, making them attainable for a much larger pool of investors.

- Comparison: Traditional private credit funds often require minimum investments of $250,000 or more, effectively excluding most individual investors. Invesco's reduced minimums represent a significant step towards inclusivity.

- Impact: Lowering minimums dramatically increases participation. More investors can now diversify their portfolios with this asset class, leading to a more robust and diverse private credit market.

Utilizing Innovative Investment Vehicles

Invesco leverages innovative investment vehicles to improve liquidity and accessibility. Traditional private credit investments often lock capital for extended periods. Invesco counters this limitation through alternative structures.

- Examples: Invesco utilizes interval funds, which offer periodic liquidity windows, allowing investors to redeem a portion of their investment at specified intervals. This addresses the liquidity concerns of investors who prefer less illiquid assets.

- Advantages & Disadvantages: Interval funds offer more liquidity than traditional closed-end funds but may not provide the same level of immediate access as publicly traded securities. Understanding the liquidity terms is crucial before investing.

- Impact on Shorter Time Horizons: Interval funds and similar structures cater to investors with shorter-term investment horizons who might otherwise be excluded from private credit.

Focus on Transparency and Education

Invesco prioritizes transparency and investor education. Understanding private credit investments requires specialized knowledge. Invesco aims to bridge this information gap.

- Educational Resources: Invesco provides various educational resources, including white papers, webinars, and client presentations, explaining the complexities of private credit in accessible terms. These resources help investors make informed decisions.

- Importance of Investor Education: Private credit is a relatively complex asset class. Thorough understanding is critical for successful investing. Invesco’s commitment to education fosters informed participation.

- Role of Transparency: Transparency builds trust. By clearly outlining investment strategies, risks, and potential returns, Invesco fosters greater confidence and broader adoption.

Barings' Strategy for Expanding Access to Private Credit Investments

Barings employs a multifaceted approach to democratizing access to private credit, focusing on diversified strategies, technological advancements, and strong advisor partnerships.

Developing Diverse Investment Strategies

Barings offers a diverse range of private credit strategies catering to varying risk appetites and investment goals. This attracts a broader investor base with different needs.

- Examples: Barings offers strategies encompassing direct lending, mezzanine debt, and other private credit vehicles, each with a different risk-return profile. Investors can choose strategies aligned with their comfort level and financial objectives.

- Risk-Adjusted Returns: Different strategies offer varying levels of risk and potential returns. Investors should carefully consider their risk tolerance before selecting a strategy.

- Catering to Diverse Needs: A diverse offering allows investors with different financial goals and risk profiles to access the private credit market.

Leveraging Technology for Enhanced Accessibility

Barings uses technology to simplify the investment process, making private credit more accessible to a wider audience.

- Technological Advancements: Online platforms and digital tools streamline the onboarding process, making it easier for investors to access information and manage their investments. Automated reporting and communication tools improve efficiency.

- Impact on Investor Experience: Technological advancements enhance the overall investor experience, reducing complexity and improving accessibility.

- Lowering Barriers to Entry: User-friendly technology significantly lowers the barrier to entry, particularly for less sophisticated investors.

Building Strong Partnerships with Financial Advisors

Barings actively collaborates with financial advisors to extend its reach and provide informed guidance on private credit investments.

- Partnerships and Outreach Programs: Barings engages in extensive outreach to financial advisors, educating them about its private credit offerings and providing support to help them advise their clients effectively.

- Role of Financial Advisors: Financial advisors play a crucial role in democratizing access, providing guidance and education to clients who may lack the expertise to navigate private credit investments independently.

- Benefits of Advisor Networks: Partnering with advisor networks expands access to a much broader audience and ensures clients receive personalized guidance.

The Future of Democratized Private Credit Investments

The future of private credit investments points toward increased accessibility and competition.

Growing Demand and Increased Competition

Demand for private credit investments is growing rapidly, fueling competition among firms to develop innovative and accessible products.

- Market Trends: The private credit market is experiencing significant expansion, driven by attractive returns and the diversification benefits it offers.

- Future Projections: Continued growth is anticipated, with more firms entering the market and expanding their offerings.

- Benefits of Increased Competition: Competition fosters innovation, leading to better pricing and improved investment options for investors.

Technological Advancements and Innovation

Technological advancements will continue to play a vital role in lowering costs and increasing accessibility within private credit investments.

- Future Technology Trends: Artificial intelligence, machine learning, and blockchain technology have the potential to further streamline processes, reduce costs, and enhance transparency.

- Potential Innovations in Investment Structures: New investment structures and platforms may emerge, further expanding access and improving liquidity.

- Potential for Broader Participation: Technological advancements will likely lower barriers to entry, enabling even broader participation in the private credit market.

Conclusion

Invesco and Barings are at the forefront of democratizing access to previously exclusive private credit investments. By lowering minimum investment requirements, employing innovative investment vehicles, emphasizing transparency, and leveraging technology, they are making this asset class available to a far broader range of investors. The future of private credit investments appears bright, with continued innovation and increased competition promising to further enhance accessibility and affordability. Explore the opportunities in private credit investments today and discover how you can diversify your portfolio with these potentially high-yielding assets. Learn more about the offerings from Invesco and Barings to find the right private credit investment strategy for you.

Featured Posts

-

Landmark Lawsuit Harvard And The Trump Administration Clash

Apr 23, 2025

Landmark Lawsuit Harvard And The Trump Administration Clash

Apr 23, 2025 -

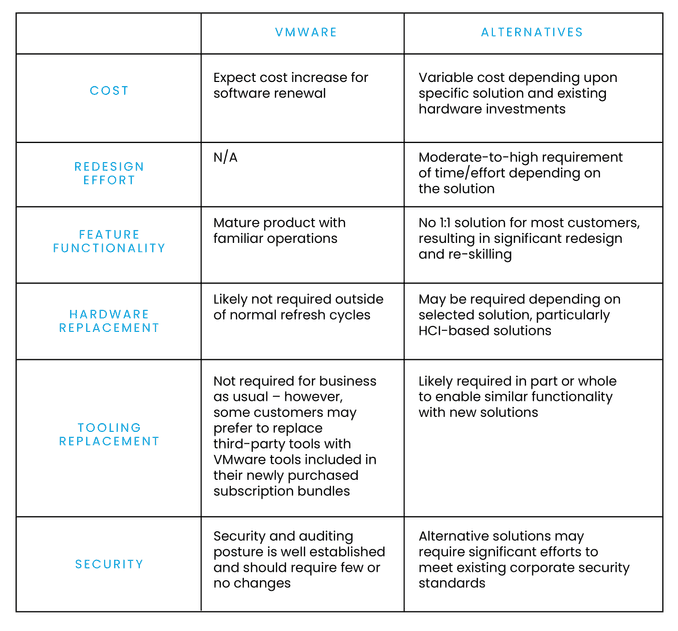

Broadcoms V Mware Acquisition A 1050 Price Hike Concerns At And T

Apr 23, 2025

Broadcoms V Mware Acquisition A 1050 Price Hike Concerns At And T

Apr 23, 2025 -

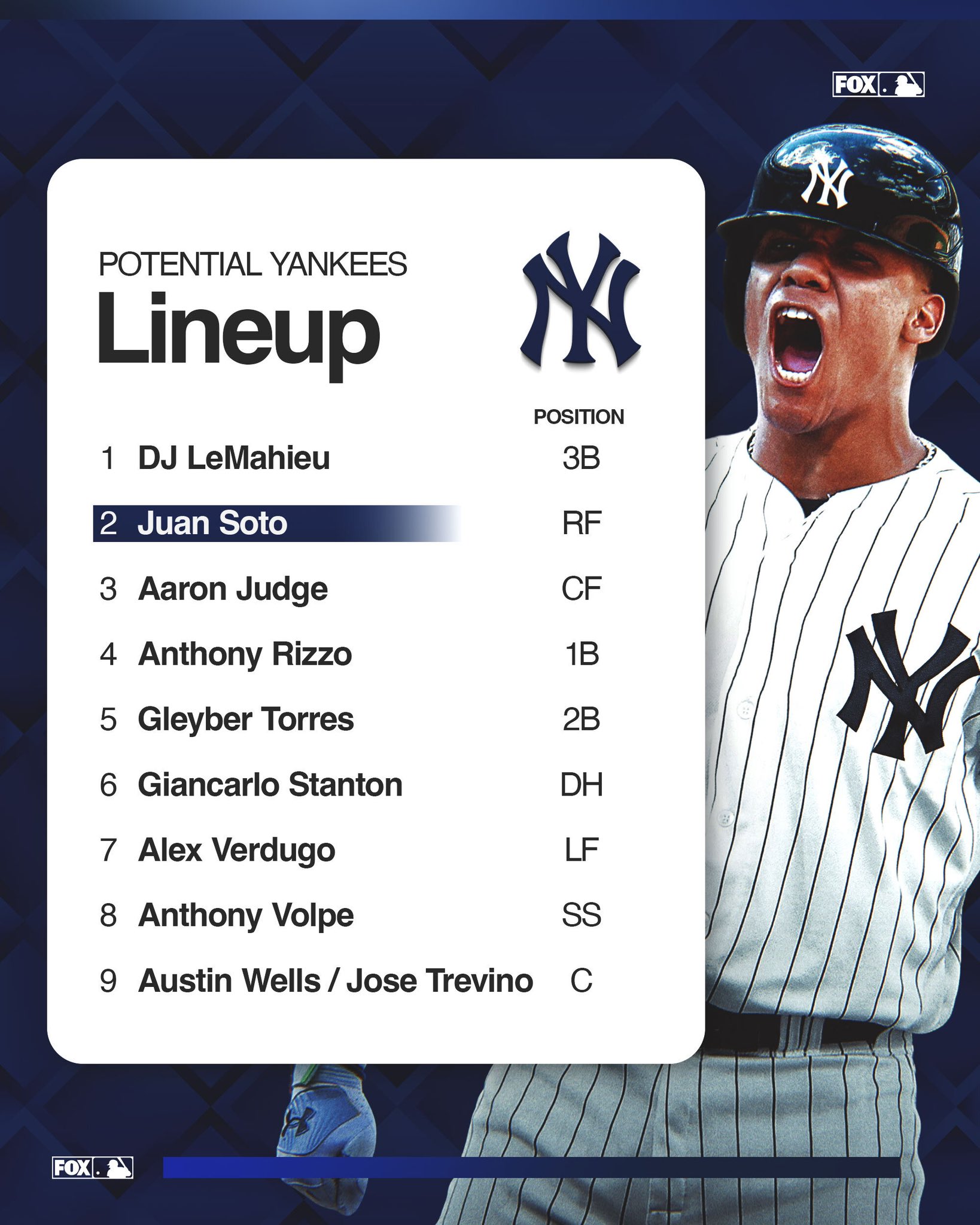

Nine Home Runs Power Yankees 2025 Season Debut Judges Triple Crown Performance

Apr 23, 2025

Nine Home Runs Power Yankees 2025 Season Debut Judges Triple Crown Performance

Apr 23, 2025 -

John Plassard Usa Today Perspectives Sur La Course Aux Armements Entre Les Usa Et La Russie

Apr 23, 2025

John Plassard Usa Today Perspectives Sur La Course Aux Armements Entre Les Usa Et La Russie

Apr 23, 2025 -

Is Betting On Wildfires The New Normal The Los Angeles Case

Apr 23, 2025

Is Betting On Wildfires The New Normal The Los Angeles Case

Apr 23, 2025