High Stock Market Valuations: A BofA Analyst's Perspective

Table of Contents

Factors Contributing to High Stock Market Valuations

Several interconnected factors have contributed to the current environment of high stock market valuations. Understanding these drivers is crucial for assessing the overall market risk and potential for future growth.

Low Interest Rates

Historically low interest rates have significantly impacted stock valuations. Currently, interest rates remain relatively low in many developed economies, influencing investor behavior and asset pricing. This low-interest-rate environment has several key effects:

- Lower borrowing costs: Reduced borrowing costs encourage corporate investment and expansion, leading to stronger earnings and higher stock prices. Companies can readily access capital for growth initiatives, fueling economic expansion.

- Increased attractiveness of stocks: Lower returns on bonds and other fixed-income instruments make stocks a relatively more attractive investment option, pushing up demand and driving valuations higher. Investors seek higher yields to compensate for inflation and the low returns offered by traditional safe haven assets.

- Impact on discounted cash flow valuations: Lower discount rates used in discounted cash flow (DCF) models, a common valuation method, result in higher present values of future cash flows, further inflating stock valuations.

Strong Corporate Earnings

Robust corporate profits have played a significant role in supporting high stock market valuations. Several sectors have experienced remarkable growth, contributing to overall market optimism.

- Strong earnings reports: Analysis of recent earnings reports from major corporations shows consistently strong results across many sectors, fueling positive market sentiment and driving investor confidence. This positive outlook is reflected in increasing stock prices.

- Supply chain improvements and increased consumer spending: Improvements in global supply chains, coupled with increased consumer spending (particularly in certain sectors), have boosted corporate revenues and profit margins. This positive feedback loop reinforces higher stock valuations.

- Future earnings growth potential: The potential for continued earnings growth in the coming quarters further supports current high valuations. Analysts' projections for future earnings often underpin investor confidence and willingness to pay higher prices for stocks.

Quantitative Easing and Monetary Policy

Central bank policies, particularly quantitative easing (QE), have significantly influenced market liquidity and asset prices. QE involves central banks injecting liquidity into the financial system by purchasing government bonds and other assets.

- Impact on investor behavior and risk appetite: QE has increased market liquidity, lowering borrowing costs and encouraging risk-taking behavior amongst investors. This increased risk appetite translates to higher demand for equities and higher stock valuations.

- Potential for future monetary policy shifts: Future shifts in monetary policy, such as interest rate hikes or a reduction in QE programs, could significantly impact market liquidity and asset prices, potentially leading to market corrections. Investors need to carefully monitor central bank announcements and assess the potential implications for their portfolios.

- Relationship between QE and inflation: The relationship between QE and inflation is complex. While QE can stimulate economic growth and inflation, excessive liquidity can also contribute to asset bubbles and inflationary pressures, potentially impacting stock valuations negatively.

Assessing the Risks of High Valuations

While high stock market valuations reflect positive economic indicators, it's crucial to acknowledge the associated risks.

Valuation Metrics and Their Implications

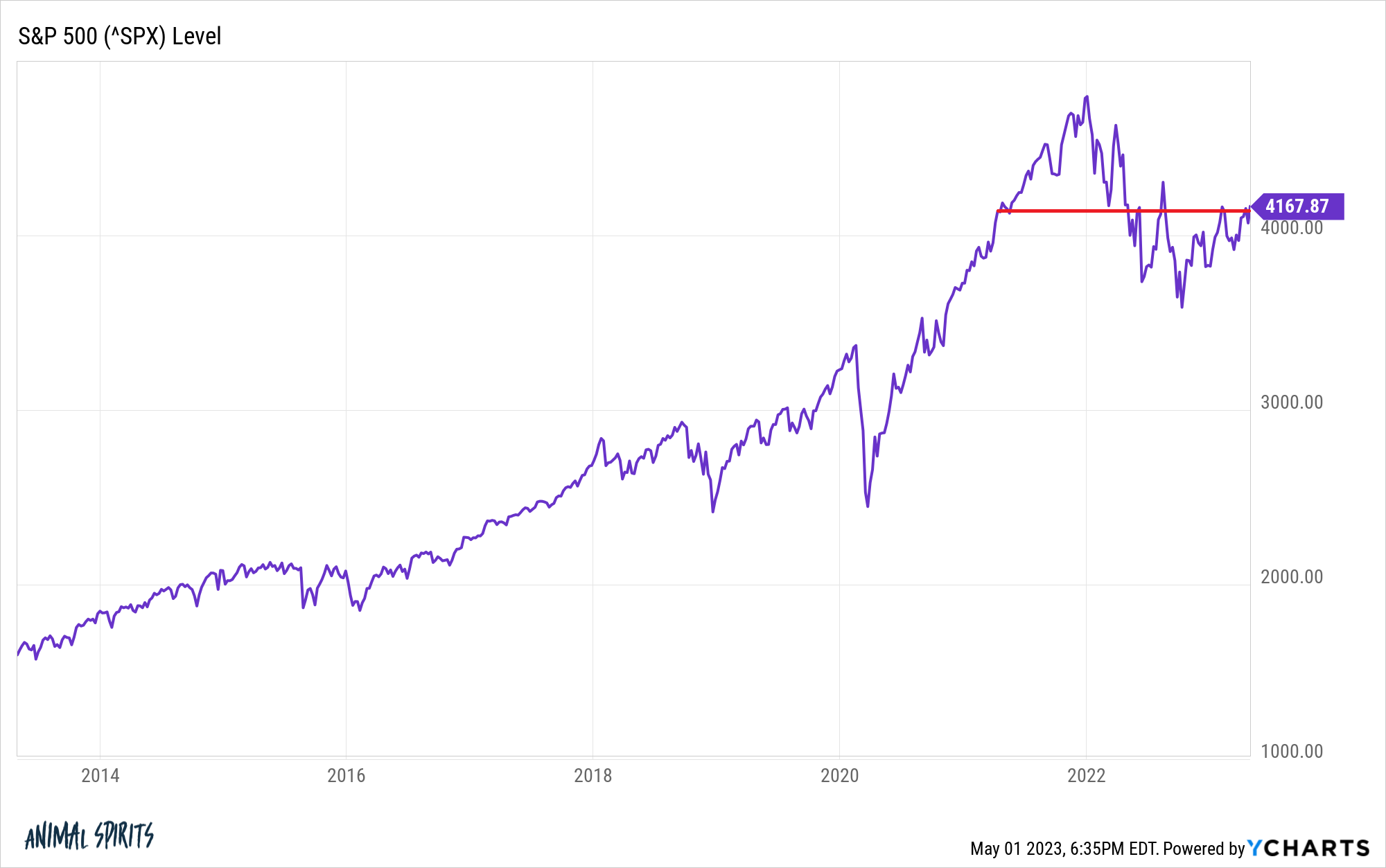

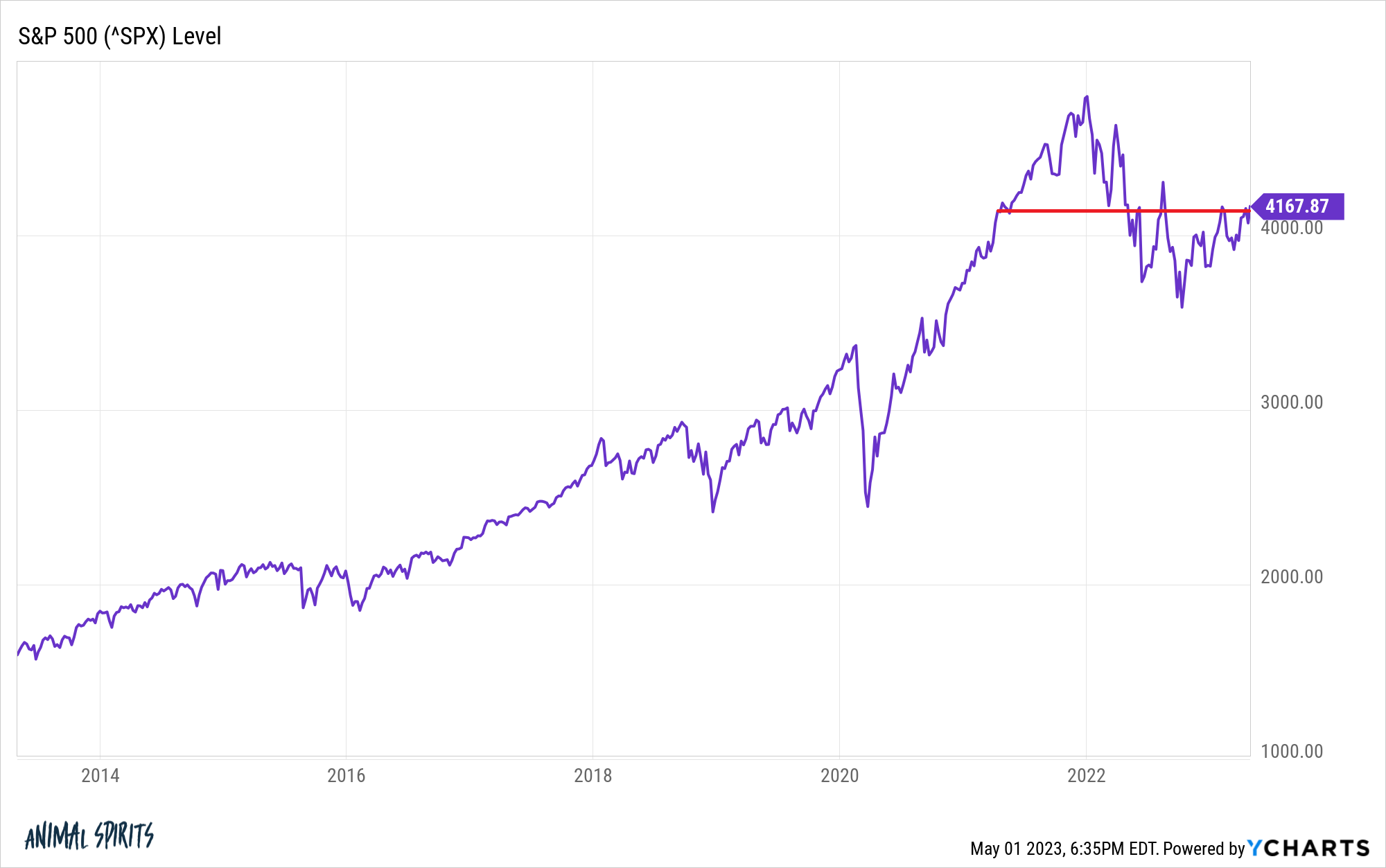

Several key valuation metrics provide insights into whether the market is overvalued. Analyzing these metrics in relation to historical averages is crucial for risk assessment.

- P/E ratio: The Price-to-Earnings (P/E) ratio is a widely used metric that compares a company's stock price to its earnings per share. High P/E ratios may indicate overvaluation.

- Shiller PE (CAPE): The cyclically adjusted price-to-earnings ratio (CAPE) smooths out earnings fluctuations over a longer period, providing a more robust measure of valuation. Comparing current CAPE to historical averages can offer valuable insights into potential overvaluation.

- Other valuation metrics: Other relevant metrics include Price-to-Sales (P/S), Price-to-Book (P/B), and Dividend Yield, each offering a unique perspective on market valuations. Comparing current levels to long-term averages is essential.

- Potential for market correction: High valuation metrics coupled with other economic headwinds increase the likelihood of a market correction. Investors must be prepared for potential volatility and adjust their investment strategies accordingly.

Potential Economic Headwinds

Several economic factors could negatively impact stock market valuations. These include:

- Inflation: High and persistent inflation erodes corporate profits and reduces consumer spending, negatively impacting stock prices. Central bank responses to combat inflation (like raising interest rates) can also impact market valuations.

- Rising interest rates: Rising interest rates increase borrowing costs for companies and reduce the attractiveness of equities relative to bonds, putting downward pressure on stock prices.

- Geopolitical risks: Geopolitical instability and uncertainty can trigger market volatility and negatively impact investor sentiment, leading to sell-offs and lower valuations.

BofA Analyst's Investment Strategy Recommendations

Given the current environment of high stock market valuations, a cautious and diversified investment approach is recommended.

Portfolio Diversification

Diversification is crucial for mitigating risk in a high-valuation market.

- Asset allocation: Diversify across different asset classes, including stocks, bonds, real estate, and other alternative investments, to reduce overall portfolio risk.

- Risk management strategies: Implement strategies such as hedging or using stop-loss orders to limit potential losses in a volatile market.

- Long-term investment horizon: Maintain a long-term investment horizon to weather short-term market fluctuations.

Sector-Specific Opportunities

While overall market valuations may be high, specific sectors may offer better value or growth potential.

- Fundamental analysis: Focus on fundamental analysis to identify companies with strong earnings growth potential and sustainable competitive advantages, even within high-valuation sectors.

- Undervalued sectors: Investigate sectors that may be undervalued relative to their growth prospects. This requires careful research and a thorough understanding of market dynamics.

- Value investing strategies: Employ value investing strategies to identify companies trading below their intrinsic value, offering potential for higher returns.

Conclusion

High stock market valuations present both opportunities and challenges. While strong corporate earnings and low interest rates have fueled the current environment, the BofA analyst's perspective underscores the importance of a prudent approach. Diversification, thorough risk assessment, and a long-term investment horizon are vital for navigating this market. Understanding the factors driving high stock market valuations is crucial for making informed investment decisions. Continue your research, stay informed on market trends, and adjust your strategy accordingly to effectively manage your portfolio in this dynamic environment.

Featured Posts

-

Chinas Targeted Tariff Exemptions For Us Imports

Apr 28, 2025

Chinas Targeted Tariff Exemptions For Us Imports

Apr 28, 2025 -

Boston Red Sox Injury Update Crawford Bello Abreu And Rafaela Status

Apr 28, 2025

Boston Red Sox Injury Update Crawford Bello Abreu And Rafaela Status

Apr 28, 2025 -

Tesla And Tech Power Us Stock Market Surge

Apr 28, 2025

Tesla And Tech Power Us Stock Market Surge

Apr 28, 2025 -

Max Frieds Yankee Debut A Success Offense Powers 12 3 Win Against Pittsburgh

Apr 28, 2025

Max Frieds Yankee Debut A Success Offense Powers 12 3 Win Against Pittsburgh

Apr 28, 2025 -

Aaron Judge And Samantha Bracksieck Welcome First Child

Apr 28, 2025

Aaron Judge And Samantha Bracksieck Welcome First Child

Apr 28, 2025