Graphics Card Prices: The Latest Trends And Predictions

Table of Contents

Current Market Conditions for Graphics Cards

The current graphics card market is showing signs of stabilization after years of volatility. While prices are still higher than pre-pandemic levels for some models, the extreme scarcity and inflated prices seen in 2020-2022 are easing. However, it's not a uniform picture across all segments.

-

Specific Card Examples and Price Ranges: High-end cards like the Nvidia RTX 4090 and AMD Radeon RX 7900 XTX remain relatively expensive, often exceeding $1000, though prices are slowly decreasing. Budget-friendly options, such as the Nvidia RTX 3050 and AMD Radeon RX 6500 XT, are more readily available and priced in the $200-$300 range.

-

Availability of Graphics Cards: The availability of graphics cards has significantly improved. While certain high-demand models might still experience occasional stock shortages, most cards are generally easier to find than they were a few years ago. This increased availability is contributing to price normalization.

-

Impact of Cryptocurrency Mining: The cryptocurrency mining boom significantly impacted GPU prices. The reduced profitability of mining many cryptocurrencies has lessened the demand from miners, freeing up more cards for the consumer market and easing price pressure.

-

Recent Price Changes: We've seen a gradual decrease in GPU prices over the past year. For instance, some mid-range cards have dropped by 20-30% from their peak prices, reflecting the improved supply and reduced demand.

-

Market Share: Nvidia and AMD continue to dominate the graphics card market, with Nvidia holding a larger market share in the high-end segment, while AMD often competes strongly in the mid-range and budget categories. The exact market share fluctuates depending on product launches and availability.

Factors Influencing Graphics Card Prices

Several interconnected factors influence the price fluctuations in the graphics card market. Understanding these factors is key to predicting future trends.

-

Supply Chain Issues: Global chip shortages and logistical challenges continue to impact GPU production and availability, although the situation is improving. Delays in manufacturing and transportation still affect pricing and lead times.

-

Demand: The demand for graphics cards is driven by various factors, including the growth of the gaming industry, the increasing popularity of cryptocurrency mining (though less impactful now than previously), and the need for powerful GPUs in professional applications like AI and machine learning.

-

Manufacturing Costs: The cost of raw materials, such as silicon wafers and other components, directly influences the manufacturing cost of GPUs. These costs can fluctuate based on global market conditions. Furthermore, advanced manufacturing processes add to the overall cost.

-

Technological Advancements: New GPU architectures and features, such as ray tracing and DLSS, increase manufacturing complexity and contribute to higher prices for cutting-edge cards. However, these advancements also drive demand and create a cycle of price changes.

-

Currency Fluctuations: Global currency exchange rates affect the price of GPUs, particularly when manufacturing or sourcing components from different countries. Fluctuations in the US dollar, for instance, impact pricing across the board.

Predictions for Future Graphics Card Prices

Predicting future GPU prices requires considering several intertwined factors.

-

Resolution of Supply Chain Issues: While supply chain challenges are easing, some disruptions may persist. This means that some price volatility is still expected, but likely less extreme than in previous years.

-

Impact of New GPU Generations: The release of new GPU generations, such as the next series of RTX cards from Nvidia and competing offerings from AMD, will influence pricing. Generally, newer generation cards are initially expensive and then the price decreases over time as newer models are released.

-

Continued Cryptocurrency Market Volatility: Although less impactful than before, sudden changes in the cryptocurrency market could still create minor ripples in GPU demand and pricing.

-

Potential Economic Downturns: A significant economic downturn could reduce consumer spending on discretionary items like high-end graphics cards, potentially leading to price adjustments.

-

Expected Price Changes for Different Segments: We anticipate a continued, gradual decline in prices for most graphics card segments over the next 2-3 years. The high-end segment will likely see a slower decrease compared to the mid-range and budget segments.

Conclusion

The graphics card market is stabilizing after a period of intense price volatility. While current prices are still elevated compared to pre-pandemic levels for some high-end models, increased availability and reduced demand from cryptocurrency mining are leading to a more normalized market. Supply chain issues, technological advancements, and overall demand continue to be key factors influencing prices. Our prediction for the future points to a gradual decrease in graphics card prices across all segments, although certain high-end models may remain expensive. Staying informed about graphics card price trends is essential before making a purchase. Regularly check reliable sources for updates on current graphics card prices and stay informed about the latest trends to get the best deal on your next graphics card purchase. Keep an eye on our website for future updates on graphics card prices.

Featured Posts

-

New Partnership Announced For Bubba Wallace And 23 Xi Racing

Apr 28, 2025

New Partnership Announced For Bubba Wallace And 23 Xi Racing

Apr 28, 2025 -

Perplexitys Ceo On The Ai Browser War Taking On Google

Apr 28, 2025

Perplexitys Ceo On The Ai Browser War Taking On Google

Apr 28, 2025 -

Denny Hamlins Martinsville Victory Ending A Dry Spell

Apr 28, 2025

Denny Hamlins Martinsville Victory Ending A Dry Spell

Apr 28, 2025 -

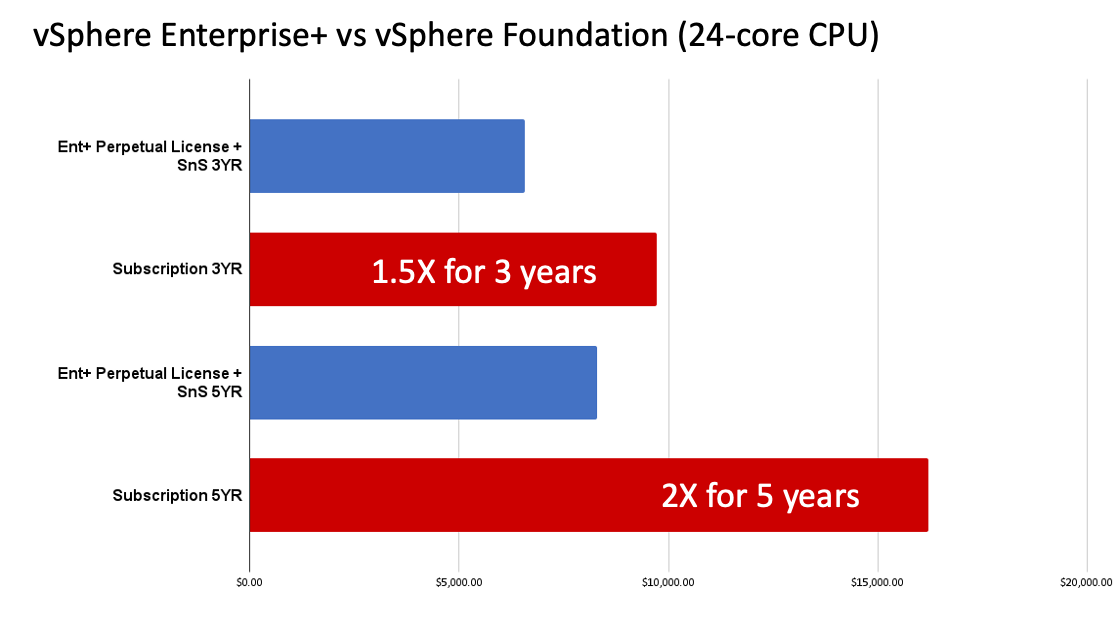

Extreme V Mware Price Increase At And T Highlights 1050 Jump Proposed By Broadcom

Apr 28, 2025

Extreme V Mware Price Increase At And T Highlights 1050 Jump Proposed By Broadcom

Apr 28, 2025 -

Breakout Season Could A Red Sox Underdog Be The Next Big Star

Apr 28, 2025

Breakout Season Could A Red Sox Underdog Be The Next Big Star

Apr 28, 2025