GPU Market Update: High Prices Persist, What To Expect Next

Table of Contents

Persistent High GPU Prices: A Deeper Dive

The persistently high GPU prices we're seeing today are a result of a confluence of factors, none of which have been easily resolved. Let's break down the key contributors.

The Legacy of the Cryptocurrency Boom

The cryptocurrency mining boom significantly impacted the GPU market. Cryptocurrencies like Ethereum, which relied heavily on GPU mining for transaction validation, created an insatiable demand for graphics cards. Miners often purchased GPUs in bulk, outcompeting gamers and driving prices to unprecedented levels.

- Increased demand from miners drove up prices. Miners were willing to pay a premium for high-performance GPUs, creating a bidding war that squeezed out casual consumers.

- Miners often purchased GPUs in bulk, further limiting availability for gamers. This created artificial scarcity, pushing prices even higher.

- The crash of the crypto market didn't immediately translate to lower GPU prices. While mining profitability decreased, the existing inventory was already depleted, and supply chain issues continued to restrict the flow of new GPUs.

Ongoing Supply Chain Issues

The global supply chain continues to be a major bottleneck. Factory closures due to the pandemic, logistical bottlenecks, and component shortages have all contributed to a constrained supply of GPUs. Geopolitical instability, including the war in Ukraine, has further exacerbated these issues.

- Chip shortages continue to affect GPU production. The semiconductor industry is facing a global chip shortage, impacting the production of various electronic components, including GPUs.

- Transportation delays increase costs and lead times. Shipping delays and increased freight costs add to the overall price of GPUs.

- The war in Ukraine has further disrupted the global supply chain. The conflict has disrupted the supply of crucial materials and components, impacting manufacturing and distribution.

Increased Demand for High-End GPUs

Beyond cryptocurrency mining, demand for high-performance GPUs remains robust. The gaming industry's push for higher resolutions, ray tracing, and advanced graphical effects, coupled with the growing needs of AI, machine learning, and professional applications, fuels the demand for top-tier GPUs.

- High-resolution gaming and ray tracing drive demand for powerful GPUs. These technologies are graphically intensive, requiring significant processing power.

- AI and machine learning applications require high-performance computing. Training complex AI models demands immense computational resources, making high-end GPUs essential.

- Professional industries like VFX and CAD rely on powerful GPUs. These sectors depend on powerful GPUs for rendering, simulations, and other computationally intensive tasks.

What to Expect in the Coming Months

While the situation remains challenging, there are some potential developments to watch for in the coming months.

Potential Price Decreases

Several factors suggest that GPU prices may eventually decrease. Increased production capacity, a potential softening in demand (especially with the decline in cryptocurrency mining), and the release of new GPUs could all contribute to lower prices.

- Increased production capacity may lead to lower prices. As supply chain issues ease, manufacturers may be able to produce more GPUs, increasing availability.

- A softening in demand could also contribute to price reductions. While demand remains high, a leveling off could ease price pressures.

- New GPU releases from major manufacturers could impact pricing. New releases often cause a price drop for older models.

New GPU Releases and Technological Advancements

The launch of next-generation GPUs is always a significant event in the market. These new releases often introduce significant performance improvements and can influence pricing dynamics. Expect continued advancements in GPU architecture, potentially leading to better performance and energy efficiency.

- Next-generation GPUs often command high prices initially. Early adopters often pay a premium for the latest technology.

- Technological advancements can increase performance while potentially lowering costs over time. As manufacturing processes improve, the cost of producing advanced GPUs may decrease.

- New architectural improvements are constantly being developed. This continuous innovation drives performance increases and efficiency gains.

Strategies for Smart GPU Purchases

Finding the best deal on a GPU requires patience and research. Here are some strategies:

- Monitor online retailers for price drops and sales. Regularly check major online retailers for discounts and special offers.

- Compare prices from different vendors. Don't settle for the first price you see; shop around to compare offers.

- Consider buying a slightly older generation GPU for better value. Older-generation GPUs often offer excellent performance at a lower price.

Conclusion

The GPU market remains dynamic, with high prices still impacting consumers. While several factors contribute to this ongoing situation, there are positive signs pointing towards potential price decreases in the near future. By staying informed about upcoming GPU releases, supply chain developments, and market trends, consumers can make informed purchasing decisions and find the best value for their needs. Keep checking back for updates on the GPU market and learn how to navigate these fluctuating GPU prices. Remember to follow us for the latest news on graphics card prices and GPU availability.

Featured Posts

-

Post Roe America How Over The Counter Birth Control Reshapes Family Planning

Apr 28, 2025

Post Roe America How Over The Counter Birth Control Reshapes Family Planning

Apr 28, 2025 -

Cairo Ceasefire Talks Hamas Leaders Meet Amidst Trumps Gaza Policy

Apr 28, 2025

Cairo Ceasefire Talks Hamas Leaders Meet Amidst Trumps Gaza Policy

Apr 28, 2025 -

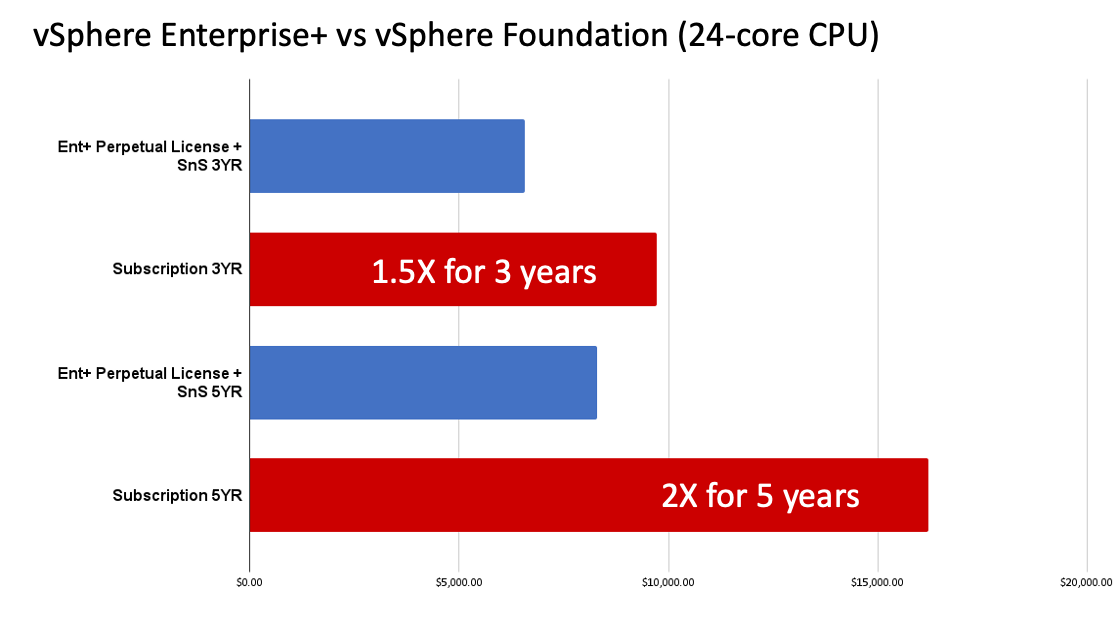

Extreme V Mware Price Increase At And T Highlights 1050 Jump Proposed By Broadcom

Apr 28, 2025

Extreme V Mware Price Increase At And T Highlights 1050 Jump Proposed By Broadcom

Apr 28, 2025 -

Rhlat Tyran Alerbyt Mn Abwzby Ila Kazakhstan Dlyl Shaml

Apr 28, 2025

Rhlat Tyran Alerbyt Mn Abwzby Ila Kazakhstan Dlyl Shaml

Apr 28, 2025 -

Coras Strategic Lineup Changes For Boston Red Sox Doubleheader Game 1

Apr 28, 2025

Coras Strategic Lineup Changes For Boston Red Sox Doubleheader Game 1

Apr 28, 2025