German Dax: How Elections And Business Data Shape Market Trends

Table of Contents

The Impact of German Elections on the German Dax

Political Uncertainty and Market Volatility

Elections introduce a period of uncertainty, significantly impacting investor confidence. Changes in government can lead to substantial shifts in fiscal and monetary policies, directly influencing company profits and overall market sentiment. This uncertainty often translates into increased market volatility in the lead-up to and immediately following an election.

- Potential changes in tax policies: A new government might implement different tax rates for corporations, impacting profitability and investor returns. This uncertainty can cause hesitation among investors.

- Shifts in regulations affecting specific sectors (e.g., automotive, energy): Changes in environmental regulations or industrial policies can disproportionately affect certain sectors, leading to significant price movements within the Dax. The automotive industry, for example, is highly sensitive to such changes.

- Uncertainty regarding trade agreements and international relations: A shift in government could alter Germany's stance on international trade agreements, impacting export-oriented companies listed on the Dax. This uncertainty can create volatility.

- Impact of coalition negotiations on market stability: The formation of a coalition government after an election can be a protracted process, further extending the period of uncertainty and impacting market stability. Lengthy negotiations can heighten volatility.

Analyzing Past Election Cycles and Dax Performance

Historical data provides valuable insights into the correlation between election outcomes and subsequent Dax movements. Studying past trends allows investors to anticipate potential market reactions to future elections more effectively.

- Case studies of previous elections and their impact on specific sectors: Analyzing past election cycles reveals how different sectors reacted to policy changes implemented by various governments. This analysis helps identify sector-specific sensitivities.

- Analysis of market volatility before, during, and after election periods: Examining historical data helps determine the typical duration and magnitude of market volatility surrounding German elections. This allows investors to better manage risk.

- Identification of predictable market responses to certain election results: Identifying patterns in market reactions to specific election outcomes—such as a clear victory versus a close contest—can help investors anticipate market movements and adjust their strategies accordingly.

Key Business Data and its Influence on the German Dax

Inflation Data and its Effect

Inflation figures significantly impact investor expectations and central bank policy. High inflation can prompt the European Central Bank (ECB) to raise interest rates, potentially slowing economic growth and negatively impacting the Dax. Conversely, low inflation might lead to lower interest rates, potentially stimulating the economy.

- Explanation of how inflation affects consumer spending and business investment: High inflation erodes purchasing power, impacting consumer spending and impacting business investment decisions, thus affecting corporate profits.

- The role of the European Central Bank (ECB) in managing inflation: The ECB's actions to control inflation, such as adjusting interest rates, directly influence borrowing costs and investment decisions.

- Impact of inflation expectations on bond yields and stock valuations: Anticipations of future inflation affect bond yields and ultimately impact stock valuations, influencing the overall performance of the Dax.

GDP Growth and its Correlation with the German Dax

Gross Domestic Product (GDP) growth is a primary indicator of the German economy's health. Strong GDP growth generally translates to positive performance for the Dax, as it signals increased corporate earnings and economic prosperity.

- Explanation of the relationship between GDP growth and corporate earnings: Strong GDP growth usually boosts corporate earnings, leading to higher stock prices.

- Analysis of sector-specific sensitivities to GDP fluctuations: Some sectors are more sensitive to GDP fluctuations than others. Understanding these sensitivities helps investors diversify their portfolios effectively.

- The impact of global economic conditions on German GDP growth and the Dax: Global economic factors, such as international trade and geopolitical events, can significantly influence German GDP growth and the Dax's performance.

Unemployment Rates and Consumer Confidence

Unemployment figures and consumer confidence indices provide crucial insights into overall economic sentiment. High unemployment and low consumer confidence often negatively affect the Dax, as they reflect weaker consumer spending and decreased business investment.

- How unemployment affects consumer spending and business investment: High unemployment reduces consumer spending and business investment, impacting overall economic growth and Dax performance.

- The relationship between consumer confidence and stock market performance: Consumer confidence is a leading indicator of future economic activity and is closely correlated with stock market performance.

- The use of leading indicators to predict future economic trends: Monitoring leading indicators, such as consumer confidence and unemployment rates, can help investors anticipate future economic trends and adjust their investment strategies accordingly.

Conclusion

The German Dax is a dynamic index influenced by numerous factors, but political elections and key business data releases are significant drivers. Understanding how these factors interact allows for more informed investment strategies. By carefully analyzing election cycles, inflation data, GDP growth, and unemployment figures, investors can better anticipate market trends and position themselves for success. Stay informed about upcoming elections and crucial economic data releases to effectively navigate the complexities of the German Dax and optimize your investment decisions. Continuously monitoring the German Dax and its key influencing factors is crucial for long-term success in the German stock market.

Featured Posts

-

Pre 2025 Grand National Assessing The History Of Horse Deaths

Apr 27, 2025

Pre 2025 Grand National Assessing The History Of Horse Deaths

Apr 27, 2025 -

Analysis Of Vaccine Studies Hhss Choice Of David Geier Sparks Debate

Apr 27, 2025

Analysis Of Vaccine Studies Hhss Choice Of David Geier Sparks Debate

Apr 27, 2025 -

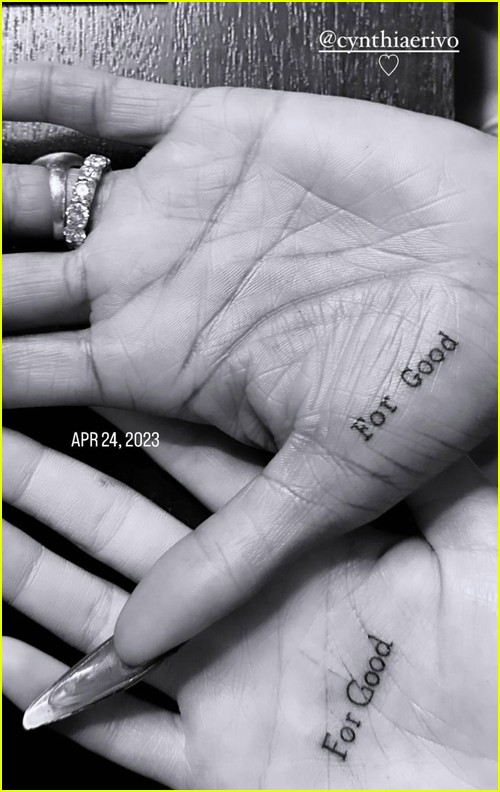

The Psychology Of Image Ariana Grande Tattoos And Hair Changes

Apr 27, 2025

The Psychology Of Image Ariana Grande Tattoos And Hair Changes

Apr 27, 2025 -

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025 -

Navigating The Chinese Market The Hurdles Faced By Bmw Porsche And Other Automakers

Apr 27, 2025

Navigating The Chinese Market The Hurdles Faced By Bmw Porsche And Other Automakers

Apr 27, 2025