Dismissing Valuation Concerns: BofA's Argument For A Bullish Stock Market

Table of Contents

BofA's Key Arguments for a Bullish Market

BofA's bullish stance isn't based on blind optimism; it rests on several pillars supporting their projection of a positive market trajectory.

Strong Corporate Earnings Growth

BofA projects robust corporate earnings growth in the coming quarters. This anticipated growth is the cornerstone of their bullish prediction, suggesting that strong fundamentals will ultimately outweigh valuation concerns. They believe that this earnings growth will translate into significant stock price appreciation. Specific sectors expected to perform particularly well, according to BofA's analysis, include:

- Technology: Continued innovation and digital transformation are expected to fuel strong growth.

- Healthcare: Aging populations and advancements in medical technology are driving demand.

- Financials: A recovering economy and rising interest rates are anticipated to benefit financial institutions.

These sectors are poised to deliver substantial earnings growth, significantly contributing to overall stock price appreciation and bolstering corporate earnings figures. Positive sector performance in these key areas significantly strengthens BofA's bullish forecast.

Resilient Consumer Spending

Despite inflationary pressures and rising interest rates, BofA's analysis suggests that consumer spending remains surprisingly resilient. This strength in consumer spending indicates a healthy economy and mitigates recessionary fears. While consumer confidence may fluctuate, the sustained level of spending points to a continued positive economic outlook. Key data points supporting this assertion may include:

- Strong retail sales figures.

- Robust employment numbers.

- Continued growth in personal consumption expenditures.

This economic growth, fueled by resilient consumer spending, further underpins BofA's bullish prediction, challenging prevailing recessionary fears.

Positive Impact of Federal Reserve Policies (or potential shift in policy)

BofA's assessment of the Federal Reserve's monetary policy plays a significant role in their bullish outlook. While the Federal Reserve has implemented interest rate hikes to combat inflation, BofA believes that the impact on the market will be manageable and ultimately beneficial in the long term. They anticipate that the Federal Reserve will continue to monitor economic data closely and adjust its policies accordingly, striking a balance between curbing inflation and supporting economic growth. A potential pivot in policy, if inflation cools significantly, could further boost market sentiment. Understanding the Federal Reserve's actions and projected response to market volatility is therefore crucial in interpreting BofA's prediction.

Addressing Valuation Concerns: BofA's Counterarguments

The elephant in the room, of course, is the relatively high valuation multiples currently present in the market. BofA addresses these valuation concerns with several counterarguments.

Long-Term Growth Potential

BofA argues that current valuations are justified by the significant long-term growth potential embedded within the market. They highlight the transformative power of technological innovation and disruptive technologies as key drivers of future growth. The potential for paradigm shifts in various sectors justifies, in their view, the premium valuations currently assigned to many companies.

Comparative Valuation Analysis

BofA's comparative analysis of current valuations relative to historical valuations and other asset classes provides further context. They argue that while valuations appear high in absolute terms, they are not unprecedented in a historical context, and potentially more attractive when compared to the yields available in the bond market or other asset classes. This risk assessment and asset allocation perspective offers a more nuanced view of current valuation multiples.

Factors Driving Higher Valuations

Several macroeconomic factors, according to BofA, contribute to justifying the higher valuations. The sustained period of low interest rates prior to recent hikes, for example, encouraged investment and increased the present value of future earnings. Additionally, positive market sentiment and strong investor confidence, driven by factors outlined above, also play a role in supporting higher valuations. These macroeconomic factors are crucial components in understanding BofA's rationale.

Conclusion: Is a Bullish Stock Market Justified Despite Valuation Concerns? BofA's Perspective

BofA's bullish stock market outlook rests on a combination of projected strong corporate earnings growth, resilient consumer spending, and a considered view of the Federal Reserve's monetary policies. Their counterarguments to valuation concerns emphasize long-term growth potential, comparative valuation analysis, and the impact of broader macroeconomic factors. While high valuations are a valid consideration, BofA's arguments highlight the importance of considering the broader economic landscape and long-term growth prospects.

Ultimately, the question of whether a bullish stock market is justified remains a matter of individual assessment and risk tolerance. However, BofA's perspective offers a valuable framework for evaluating current valuation concerns and forming a well-informed investment strategy. We encourage you to conduct further research on the bullish stock market outlook and carefully consider your own risk tolerance before making any investment decisions. Remember to diversify your portfolio and consider consulting with a financial advisor for personalized guidance.

Featured Posts

-

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 28, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 28, 2025 -

Trumps Impact On Higher Education Examining The Fallout Beyond Ivy League Institutions

Apr 28, 2025

Trumps Impact On Higher Education Examining The Fallout Beyond Ivy League Institutions

Apr 28, 2025 -

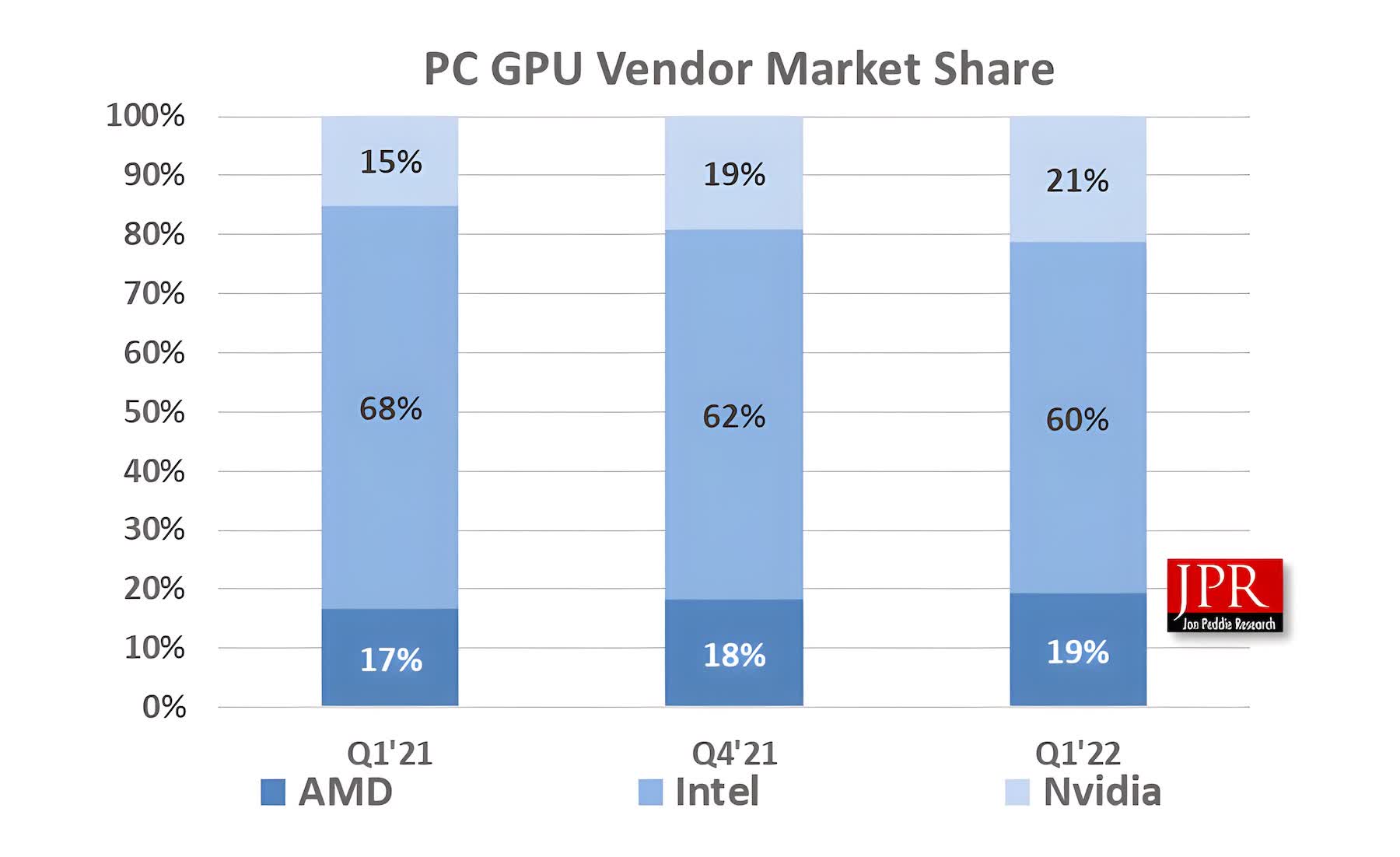

Are Gpu Prices Out Of Control Again Analyzing The Market Volatility

Apr 28, 2025

Are Gpu Prices Out Of Control Again Analyzing The Market Volatility

Apr 28, 2025 -

Florida Keys Highway A Drive From Railroad To Ocean

Apr 28, 2025

Florida Keys Highway A Drive From Railroad To Ocean

Apr 28, 2025 -

Eva Longoria Impressed By Worlds Most Influential Chefs Fishermans Stew

Apr 28, 2025

Eva Longoria Impressed By Worlds Most Influential Chefs Fishermans Stew

Apr 28, 2025

Latest Posts

-

Millions Stolen Through Office365 Breaches Inside The Cybercrime Ring

Apr 28, 2025

Millions Stolen Through Office365 Breaches Inside The Cybercrime Ring

Apr 28, 2025 -

Federal Charges Man Made Millions Targeting Executive Office365 Inboxes

Apr 28, 2025

Federal Charges Man Made Millions Targeting Executive Office365 Inboxes

Apr 28, 2025 -

Execs Office365 Accounts Breached Millions Stolen Suspect Arrested

Apr 28, 2025

Execs Office365 Accounts Breached Millions Stolen Suspect Arrested

Apr 28, 2025 -

Office365 Hackers Multi Million Dollar Scheme Fbi Investigation Details

Apr 28, 2025

Office365 Hackers Multi Million Dollar Scheme Fbi Investigation Details

Apr 28, 2025 -

Ohio Train Derailment The Prolonged Presence Of Toxic Chemicals In Buildings

Apr 28, 2025

Ohio Train Derailment The Prolonged Presence Of Toxic Chemicals In Buildings

Apr 28, 2025