Dax Performance: Influence Of Bundestag Elections And Economic Indicators

Table of Contents

The Impact of Bundestag Elections on DAX Performance

Bundestag elections inject significant uncertainty into the German economy, creating ripples that inevitably affect DAX performance. This impact manifests itself both before and after the election.

Pre-Election Volatility

The period leading up to a Bundestag election is often marked by increased market volatility.

- Increased Uncertainty: The inherent uncertainty surrounding the outcome of the election and the subsequent formation of a government creates a climate of speculation. Investors tend to adopt a "wait-and-see" approach, potentially leading to decreased trading volume.

- Policy-Driven Price Adjustments: Market participants anticipate potential policy changes based on the platforms of different political parties. This can lead to price adjustments in specific sectors even before the election results are known. For example, a party advocating for stricter environmental regulations might cause a dip in the automotive sector, while a party promoting renewable energy could boost related stocks.

- Past Election Cycles: Analyzing past election cycles reveals a pattern of increased volatility in the months leading up to the vote. The 2017 election, for instance, saw significant fluctuations in the DAX in the final quarter before the vote.

- Party Platforms and Sectoral Impact:

- Green Party: Policies focused on renewable energy and environmental protection could positively affect related sectors while potentially impacting industries like fossil fuels.

- CDU/CSU: Historically more business-friendly, their policies generally have a positive impact on the overall market, although specific sectors might see targeted adjustments.

- SPD: Policies focusing on social welfare and labor rights can influence sectors like healthcare and social services.

Post-Election Market Reactions

The aftermath of a Bundestag election brings its own set of market reactions.

- Reaction to Results: The DAX's immediate reaction to election results depends heavily on the winning party or coalition and the market's perception of their economic policies. A decisive victory for a pro-business party might boost investor confidence, while a fractured coalition could lead to uncertainty.

- Coalition Negotiations: The formation of a coalition government is a crucial period. Prolonged negotiations can extend the period of uncertainty and volatility. The final composition of the coalition and its policy agenda significantly impact market sentiment.

- Winning and Losing Sectors: Once a new government is formed, specific sectors might experience gains or losses based on the new policy agenda. For instance, a government prioritizing infrastructure spending could benefit construction companies, while tax increases on certain industries could negatively affect their stock prices.

- Long-Term Effects: The long-term impact of a new government's policies can be substantial. Structural reforms, tax changes, and regulatory adjustments can have a profound and lasting effect on DAX companies and overall market performance.

Key Economic Indicators Affecting DAX Performance

Beyond the political landscape, several key economic indicators directly influence DAX performance.

GDP Growth

German GDP growth is strongly correlated with DAX performance.

- Investor Confidence: Strong GDP growth boosts investor confidence, leading to higher valuations and increased investment. Conversely, weak GDP growth can signal economic weakness and trigger market corrections.

- Historical Correlation: Examining periods of high and low GDP growth in Germany reveals a clear correlation with corresponding DAX performance. Periods of robust growth generally coincide with higher DAX values, while recessions are often reflected in lower DAX performance.

Inflation Rates

Inflation's impact on corporate profitability and investor sentiment is substantial.

- Corporate Profitability: High inflation erodes corporate profitability by increasing input costs. This can lead to decreased earnings and potentially lower stock valuations.

- Interest Rates: Central banks often respond to rising inflation by increasing interest rates. Higher interest rates increase borrowing costs for businesses, impacting investment and potentially slowing economic growth.

- Consumer Spending: Inflation reduces consumer purchasing power, impacting consumer spending and subsequently affecting the sales of DAX companies.

Interest Rates and Monetary Policy

The European Central Bank (ECB)'s monetary policy significantly influences the DAX.

- ECB Policies: ECB actions like interest rate adjustments and quantitative easing (QE) programs have a direct impact on market liquidity and borrowing costs.

- Impact on Borrowing Costs: Lower interest rates stimulate borrowing and investment, boosting economic activity and potentially benefiting DAX companies. Higher rates have the opposite effect.

- Quantitative Easing (QE): QE programs, where the ECB injects liquidity into the market by purchasing assets, can artificially inflate asset prices, including stocks listed on the DAX.

Analyzing the Combined Influence

Understanding the interplay between Bundestag elections and economic indicators is crucial for comprehending DAX performance.

- Synergistic Effects: A pro-growth government elected during a period of strong GDP growth can create a positive feedback loop, leading to strong DAX performance.

- Conflicting Influences: Conversely, a government with austerity measures might negatively impact DAX performance even during a period of economic expansion.

- Model Limitations: While a model attempting to quantify the combined influence could be developed, it's crucial to acknowledge the complexity and uncertainties involved. Simple cause-and-effect relationships often oversimplify the reality of market dynamics.

Conclusion

DAX performance is a multifaceted outcome influenced by a complex interplay of factors. Bundestag elections introduce significant uncertainty, affecting market volatility both before and after the vote. Simultaneously, key economic indicators like GDP growth, inflation, and interest rates—coupled with ECB monetary policy—directly impact corporate profitability and investor sentiment. Understanding this intricate relationship is vital for navigating the German stock market.

Call to Action: Stay informed about upcoming Bundestag elections and meticulously monitor key economic indicators to effectively analyze and predict future DAX performance. Mastering the relationship between these factors is paramount for devising successful DAX investment strategies.

Featured Posts

-

El Secreto Del Gol La Garantia De Alberto Ardila Olivares While This Uses Secreto It Avoids Secrets In English And Focuses On The Keyword

Apr 27, 2025

El Secreto Del Gol La Garantia De Alberto Ardila Olivares While This Uses Secreto It Avoids Secrets In English And Focuses On The Keyword

Apr 27, 2025 -

Sinner Settles Doping Allegations A Full Report

Apr 27, 2025

Sinner Settles Doping Allegations A Full Report

Apr 27, 2025 -

Hhs Under Fire Anti Vaccine Activist Review Of Debunked Autism Vaccine Connection

Apr 27, 2025

Hhs Under Fire Anti Vaccine Activist Review Of Debunked Autism Vaccine Connection

Apr 27, 2025 -

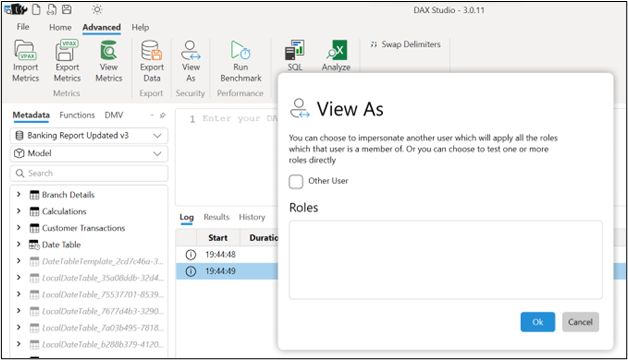

Analyzing The Dax The Interplay Of Politics And Economics In Germany

Apr 27, 2025

Analyzing The Dax The Interplay Of Politics And Economics In Germany

Apr 27, 2025 -

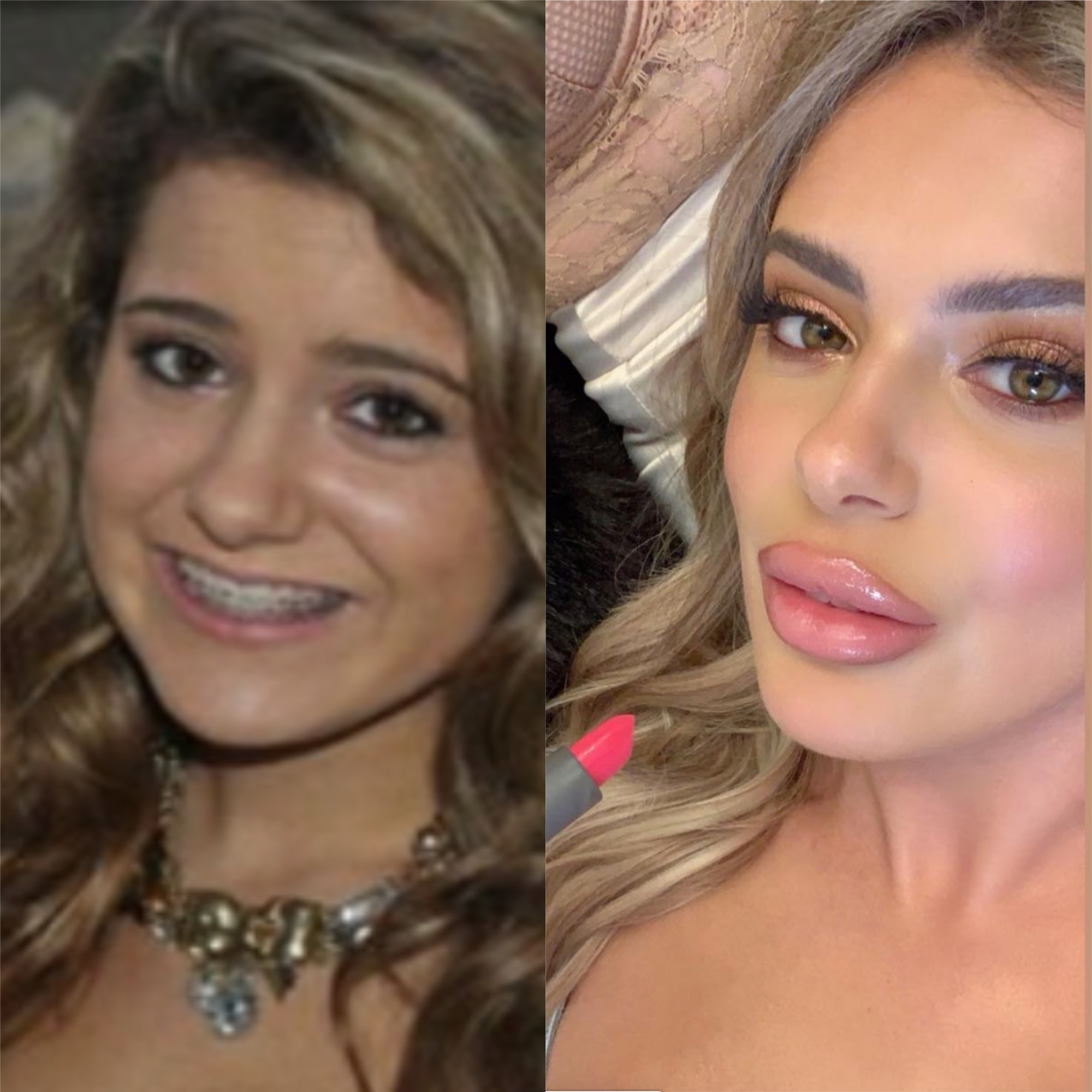

Couples Getaway Ariana Biermann In Alaska

Apr 27, 2025

Couples Getaway Ariana Biermann In Alaska

Apr 27, 2025