Dax: Bundestag Elections And Business Figures – A Market Analysis

Table of Contents

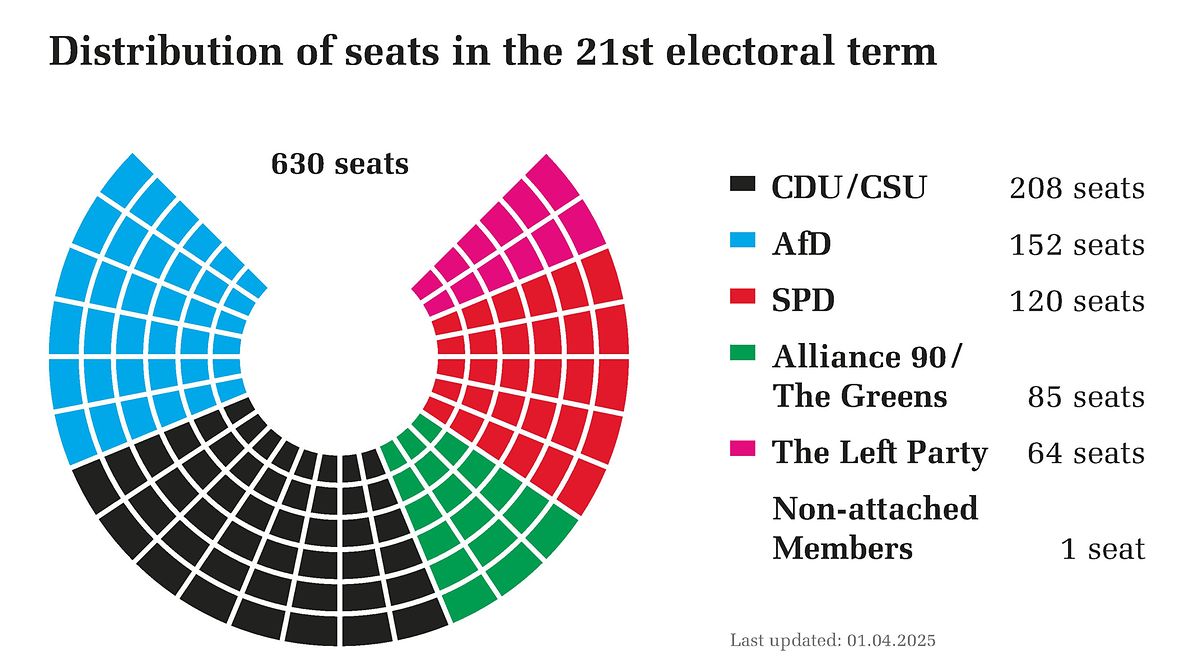

Historical Impact of Bundestag Elections on the Dax

Analyzing the historical performance of the DAX around previous Bundestag elections reveals a clear correlation between political events and market fluctuations. While the DAX doesn't always experience immediate, dramatic swings, the election cycle often precedes periods of either growth or contraction.

-

Analyze periods of economic growth and contraction following elections: For instance, the 2005 election, which saw Angela Merkel's CDU/CSU take power, was followed by a period of relative economic stability and DAX growth. Conversely, the aftermath of the 2009 election, amid the global financial crisis, saw a significant downturn.

-

Highlight specific policy changes and their effect on the DAX: Tax reforms introduced after certain elections have demonstrably impacted corporate profitability and, subsequently, the DAX. Similarly, environmental regulations, particularly those affecting the automotive sector, have led to both short-term market corrections and long-term shifts in investment patterns within the DAX.

-

Mention any major political shifts and their immediate and long-term impact on the market: The formation of unexpected coalition governments or significant shifts in political power can introduce uncertainty, leading to increased market volatility. The initial market reaction might be negative due to uncertainty, but long-term effects depend on the implemented policies.

[Insert chart or graph showing DAX performance around previous Bundestag elections]

Key Sectors Most Affected by Bundestag Election Outcomes

Several key sectors within the German economy, and thus heavily represented in the DAX, are particularly sensitive to changes in government policy following Bundestag elections.

- Bullet Points:

- Automotive Industry: Stringent emission regulations, incentives for electric vehicles, and trade policies significantly impact this sector, a major component of the DAX. Changes in government priorities concerning climate change directly influence the automotive sector's prospects.

- Renewable Energy Sector: The level of commitment to green initiatives varies among parties, leading to differing levels of investment and support for the renewable energy sector. A strong green agenda generally translates to positive growth for related DAX-listed companies.

- Financial Services: Regulatory changes in the financial sector can impact the performance of banks and insurance companies listed on the DAX. Government stability and economic policy often play a crucial role in investor confidence in this sector.

The Automotive Industry and its Dax Representation

The automotive industry's vulnerability to policy shifts is undeniable. Emission standards, particularly concerning CO2 emissions, have consistently impacted manufacturers' profitability. Furthermore, government incentives for electric vehicles and the development of charging infrastructure directly influence the investment landscape for car manufacturers listed on the DAX. The success or failure of Germany’s transition to electric mobility will directly impact their stock prices.

The Renewable Energy Sector and the Green Agenda

The renewable energy sector’s fortunes are directly tied to the political commitment to climate action. Parties with ambitious green agendas usually translate this into supportive policies, such as subsidies and investment incentives for renewable energy companies. Conversely, a less environmentally focused government could lead to reduced support and potentially negative impacts on this growing sector within the DAX.

Predicting Dax Performance Post-Election: Analyzing the Current Political Landscape

Analyzing the manifestos of major parties participating in the upcoming Bundestag election is crucial for predicting potential economic implications for the DAX.

- Bullet Points:

- Impact of Coalition Negotiations on Market Uncertainty: The formation of a coalition government can introduce a period of uncertainty as different parties negotiate their policy priorities. This can lead to increased market volatility in the short term.

- Potential Scenarios and their Effects on the Dax: Based on the potential coalition outcomes, investors can model various scenarios – ranging from strong pro-business policies supporting the DAX to potentially disruptive policies that could negatively affect specific sectors.

- Expert Opinions and Forecasts: Consulting with financial analysts and economists specializing in the German market can provide valuable insight into potential post-election DAX performance.

Developing an Effective Investment Strategy in Light of the Bundestag Elections

Navigating the uncertainty surrounding Bundestag elections requires a proactive investment strategy.

- Bullet Points:

- Risk Mitigation Strategies: Diversification across different sectors and asset classes is key to mitigating the potential risks associated with election outcomes. Hedging strategies can also help protect investments against potential market downturns.

- Investment Opportunities based on Potential Election Outcomes: By anticipating potential policy changes, investors can identify sectors and companies likely to benefit from the winning party’s agenda. For example, a green-focused government may present opportunities in renewable energy stocks.

- Importance of Fundamental Analysis and Long-Term Strategies: Focusing on fundamental analysis, understanding the underlying financial health of companies, and employing long-term investment strategies can help investors weather short-term market fluctuations resulting from the elections.

Conclusion

Bundestag elections significantly influence the DAX and the broader German economy. Understanding the potential economic implications of different political outcomes is vital for investors seeking to navigate the German stock market effectively. The historical impact of past elections, the sensitivity of key sectors to policy changes, and the current political landscape all contribute to the need for informed investment decisions.

Call to Action: Stay informed about the upcoming Bundestag elections and their potential impact on the Dax. Conduct thorough research and develop a robust investment strategy to navigate the market volatility associated with these critical political events. Continue following our analysis for updates on the Dax and Bundestag elections. Learn more about effective Dax investment strategies through [link to relevant resource/further reading].

Featured Posts

-

Private Credits Widening Cracks A Closer Look At The Markets Instability

Apr 27, 2025

Private Credits Widening Cracks A Closer Look At The Markets Instability

Apr 27, 2025 -

Grand National Horse Deaths A Look At The Statistics Before 2025

Apr 27, 2025

Grand National Horse Deaths A Look At The Statistics Before 2025

Apr 27, 2025 -

Effective Middle Management The Foundation For A Thriving Organization

Apr 27, 2025

Effective Middle Management The Foundation For A Thriving Organization

Apr 27, 2025 -

Bencic Triumphs First Wta Tournament Win Since Becoming A Mother

Apr 27, 2025

Bencic Triumphs First Wta Tournament Win Since Becoming A Mother

Apr 27, 2025 -

Assessing The Probability Of A Fifth Champions League Place For The Premier League

Apr 27, 2025

Assessing The Probability Of A Fifth Champions League Place For The Premier League

Apr 27, 2025