Crack The Code: 5 Do's And Don'ts To Land Your Dream Private Credit Job

Table of Contents

5 Do's to Secure Your Dream Private Credit Job

Do 1: Network Strategically

Networking is paramount in the private credit industry. Building strong relationships can open doors to unadvertised private credit job opportunities and provide invaluable insights. Attend industry events, join professional organizations like the CFA Institute or Private Equity International, and actively engage on LinkedIn.

- Informational interviews: Reach out to professionals in private credit for informational interviews to learn about their career paths and gain valuable advice.

- Industry conferences: Attend conferences like SuperReturn or the PEI events to network with potential employers and learn about the latest trends in private credit.

- LinkedIn: Optimize your LinkedIn profile with relevant keywords like "private credit networking" and "private credit industry events," and actively engage in industry groups and discussions.

Do 2: Showcase Relevant Skills & Experience

Tailor your resume and cover letter to each specific private credit job description. Highlight quantifiable achievements demonstrating your mastery of key skills.

- Financial modeling: Showcase your expertise in building and interpreting financial models, crucial for credit analysis and valuation.

- Credit analysis: Demonstrate your ability to assess creditworthiness, using keywords like "credit underwriting" and "debt financing."

- Due diligence: Highlight experience in conducting thorough due diligence on potential investments, including leveraged buyouts.

- Portfolio management: Show your experience in managing a portfolio of private credit investments.

Quantifiable achievements: Instead of simply listing responsibilities, quantify your accomplishments. For example, instead of saying "Managed a portfolio," say "Managed a $100 million portfolio, resulting in a 15% annual return."

Do 3: Master the Interview Process

Prepare for a multifaceted interview process that will likely include behavioral, technical, and potentially case study interviews specific to private credit.

- Behavioral questions: Practice answering common behavioral questions like "Tell me about a time you failed" using the STAR method (Situation, Task, Action, Result).

- Technical questions: Prepare for technical questions on financial modeling, credit analysis, and industry trends. Knowing the intricacies of "private credit investment strategies" is key.

- Case study interviews: Practice case studies that assess your analytical and problem-solving abilities, relating them to real-world private credit scenarios.

- Company research: Thoroughly research the firm and the interviewer beforehand to demonstrate your genuine interest.

Do 4: Understand the Private Credit Landscape

Demonstrate a deep understanding of the private credit market, including current trends, regulations, and investment strategies. Stay updated on market news through reputable sources.

- Market trends: Follow key trends in private credit, such as the increasing use of technology and the growing importance of ESG factors.

- Regulations: Stay informed about relevant regulations, such as those related to lending and compliance.

- Industry publications: Read industry publications like Private Debt Investor or Debtwire to stay abreast of the latest developments. Demonstrate understanding of "private credit market" dynamics.

Do 5: Follow Up Effectively

Send thank-you notes after each interview, expressing your continued interest in the private credit job and reiterating your key qualifications.

- Thank-you emails: Craft personalized thank-you emails within 24 hours of each interview.

- LinkedIn connections: Maintain connections with recruiters and interviewers on LinkedIn.

- Follow-up calls/emails: A well-timed follow-up call or email can reiterate your enthusiasm and keep your application top-of-mind.

5 Don'ts to Avoid When Searching for a Private Credit Job

Don't 1: Neglect Your Online Presence

A professional online presence, especially on LinkedIn, is crucial. Optimize your profile with relevant keywords related to private credit.

- Keyword optimization: Use keywords like "private credit analyst," "private credit associate," and "private credit portfolio manager" throughout your profile.

- Compelling summary: Write a concise and compelling summary highlighting your skills and experience.

- Professional photo: Include a professional headshot.

Don't 2: Submit Generic Applications

Tailor each application to the specific job description. Generic applications demonstrate a lack of interest and preparation.

- Personalized cover letters: Craft unique cover letters that address the specific requirements and responsibilities of each role.

- Keyword targeting: Use keywords from the job description in your resume and cover letter.

Don't 3: Underestimate the Importance of Research

Thoroughly research potential employers and the specific private credit roles you apply for. Demonstrating knowledge shows initiative and interest.

- Company websites: Review company websites to understand their investment strategies, portfolio companies, and culture.

- News articles: Read news articles and press releases to understand recent company developments. Understand "private credit company research" methodology.

Don't 4: Ignore Feedback

Actively seek and learn from feedback received during the job search process. Use feedback to improve future applications and interviews.

- Request feedback: Ask interviewers for feedback, even if you don't get the job.

- Self-reflection: Reflect on your performance and identify areas for improvement.

Don't 5: Be Unprepared for Salary Negotiations

Research salary ranges for private credit jobs in your area and have a clear idea of your desired compensation. Being unprepared can hurt your chances.

- Salary research: Use online resources like Glassdoor and Salary.com to research salary ranges.

- Know your worth: Understand your skills and experience and their value in the market. Understand the "private credit salary" expectations.

Conclusion

Landing your dream private credit job requires a strategic and proactive approach. By following these "do's" and "don'ts," you'll significantly increase your chances of success. Remember to network strategically, showcase your relevant skills, master the interview process, understand the private credit landscape, and follow up effectively. Avoid neglecting your online presence, submitting generic applications, underestimating research, ignoring feedback, and being unprepared for salary negotiations. By applying this advice, you'll significantly increase your chances of cracking the code and landing your dream private credit career. Start your search today and unlock your private credit opportunities!

Featured Posts

-

Harvards Challenges A Conservative Professors Analysis And Solutions

Apr 26, 2025

Harvards Challenges A Conservative Professors Analysis And Solutions

Apr 26, 2025 -

Pentagon Chaos Exclusive Report On Hegseths Reaction To Leaks And Infighting

Apr 26, 2025

Pentagon Chaos Exclusive Report On Hegseths Reaction To Leaks And Infighting

Apr 26, 2025 -

Ftc Appeals Activision Blizzard Acquisition Whats Next For Microsoft

Apr 26, 2025

Ftc Appeals Activision Blizzard Acquisition Whats Next For Microsoft

Apr 26, 2025 -

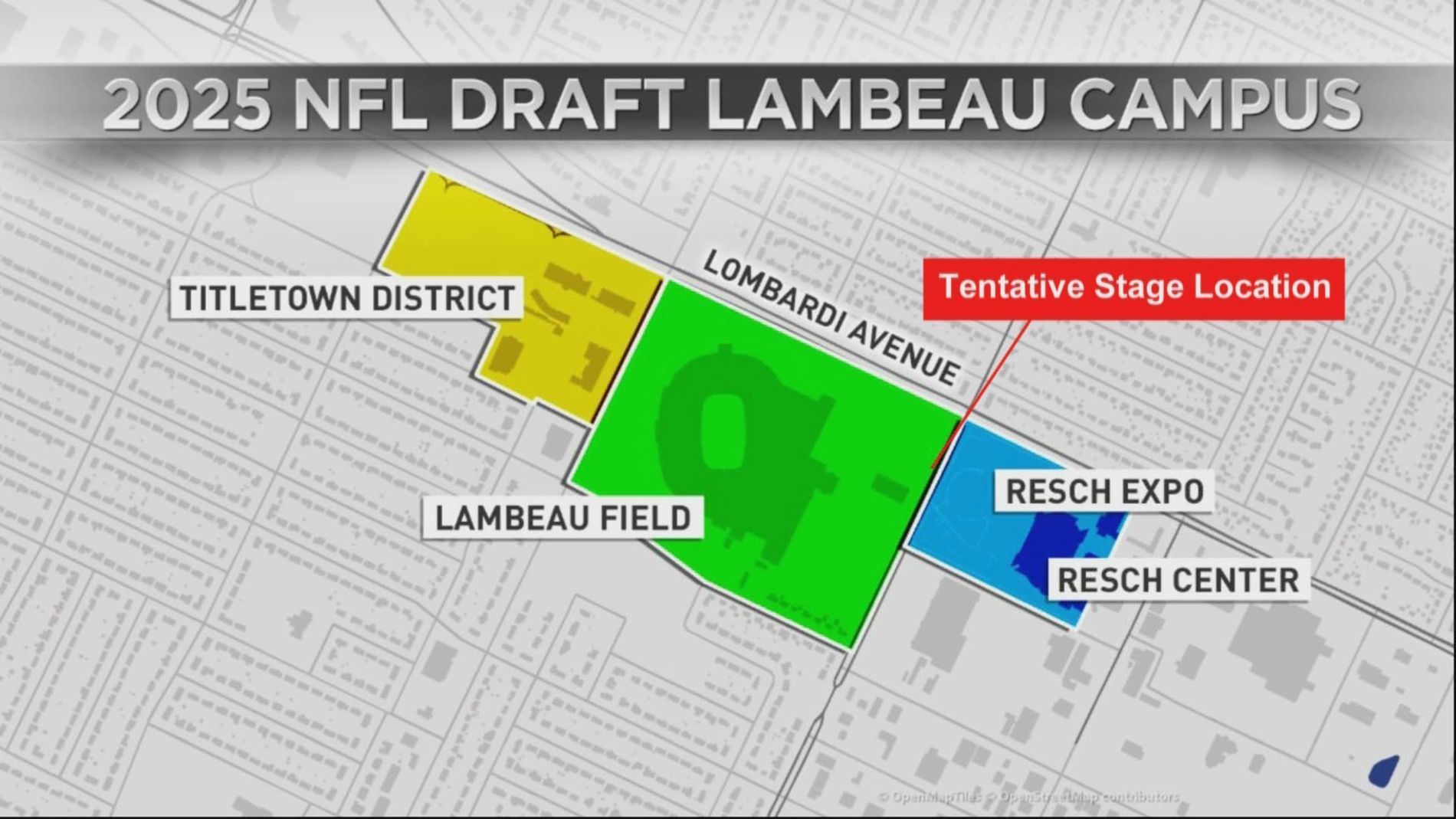

2024 Nfl Draft Green Bays Opening Night

Apr 26, 2025

2024 Nfl Draft Green Bays Opening Night

Apr 26, 2025 -

Sinners How Cinematography Showcases The Mississippi Deltas Expansive Landscape

Apr 26, 2025

Sinners How Cinematography Showcases The Mississippi Deltas Expansive Landscape

Apr 26, 2025