Concerns Over Musk's Focus: State Treasurers Challenge Tesla Board

Table of Contents

The Diversification Dilemma: Musk's Multiple Ventures

Elon Musk's entrepreneurial spirit is undeniable. He simultaneously leads Tesla, SpaceX, and now X (formerly Twitter), a level of diversification that raises significant concerns about potential conflicts of interest and the allocation of his time and resources. This "diversification dilemma" fuels anxieties about whether Tesla receives the undivided attention it needs to maintain its competitive edge and deliver sustained growth.

-

Examples of Divided Attention: The tumultuous Twitter/X acquisition, requiring substantial financial and managerial resources, undeniably diverted Musk's attention from Tesla. Simultaneously managing major SpaceX launches and crucial Tesla development phases presents inherent challenges.

-

Impact on Tesla Stock and Investor Confidence: The volatility in Tesla's stock price often correlates with significant events at Musk's other companies. Periods of intense focus on Twitter/X have often coincided with dips in Tesla's valuation, eroding investor confidence. This uncertainty creates a risk premium for investors.

-

Expert Opinions: Financial analysts and corporate governance experts have openly voiced concerns. They highlight the inherent risks of a CEO juggling multiple, demanding leadership roles, potentially compromising strategic decision-making and operational efficiency at each company. The lack of clear prioritization fuels these concerns.

State Treasurers' Actions and Their Significance

The concerns aren't merely whispers amongst analysts; they've reached the highest levels of state-sponsored investment. Several state treasurers, responsible for managing billions of dollars in public pension funds – many of which hold significant Tesla stock – have taken concrete actions to express their dissatisfaction with Musk’s leadership. These actions represent a powerful voice demanding greater accountability and transparency.

-

Specific Actions: Some state treasurers have issued public statements expressing their concerns, while others have filed shareholder proposals calling for improved corporate governance at Tesla. These actions directly challenge the Tesla board's oversight of Musk's performance and potentially conflicting interests.

-

Fiduciary Duty: The state treasurers' actions stem from their fiduciary duty to protect the public pension funds under their management. Investing in Tesla is a significant undertaking, and concerns over Musk's focus directly impact the value of those investments, representing a substantial risk to the retirement savings of countless citizens.

-

Legal and Financial Implications: While the direct legal repercussions are uncertain, the actions of state treasurers could lead to increased regulatory scrutiny of Tesla's corporate governance and potentially influence future board decisions. This increased pressure could impact Tesla's valuation and long-term strategic planning.

Tesla's Board Response and Future Implications

Tesla's board has responded to the mounting pressure, although the effectiveness of their response remains to be seen. The board's statements have generally reiterated their commitment to shareholder value and sound corporate governance.

-

Board Statements: Public statements have emphasized the board's ongoing efforts to oversee Tesla's operations and ensure its long-term success. However, concrete actions to mitigate concerns remain limited.

-

Potential Structural Changes: The current situation could prompt changes in Tesla's organizational structure or the allocation of responsibilities within the leadership team. However, specifics are still largely absent.

-

Consequences for Tesla's Future: The ultimate outcome will significantly shape Tesla's trajectory. A failure to address the concerns effectively could lead to further investor unrest, impacting stock performance and potentially attracting further regulatory scrutiny. Conversely, proactive measures could enhance investor confidence and fortify the company's long-term prospects.

-

Changes to Musk's Role: Although unlikely at this point, significant pressure could lead to a modification of Musk’s role and responsibilities within Tesla.

The Impact on Tesla's Stock Performance and Investor Sentiment

The correlation between Musk's actions and Tesla's stock price fluctuations is undeniable. Periods of heightened concern over his focus often coincide with periods of increased stock volatility.

-

Stock Performance Statistics: Detailed analysis of Tesla's stock performance during key events—such as the Twitter/X acquisition—clearly shows periods of significant drops followed by attempts at recovery.

-

Analyst Quotes: Financial analysts have expressed varied opinions, ranging from cautious optimism to more pessimistic forecasts about Tesla's long-term performance under the current leadership structure. Long-term investor confidence is a significant factor influencing their predictions.

-

Investor Strategies: The situation forces investors to re-evaluate their strategies. Some might choose to hold onto their Tesla stock, anticipating a future recovery. Others may opt to sell, cutting their losses and reducing their exposure to the inherent risks associated with the current situation.

Concerns Over Musk's Focus: A Call for Transparency and Accountability

The actions of state treasurers highlight the critical need for increased transparency and accountability within Tesla’s leadership. The concerns over Musk's focus are not merely about the performance of one company; they raise broader questions about corporate governance and the responsibilities of CEOs leading multiple large-scale enterprises. The situation warrants ongoing monitoring.

To stay informed about the evolving dynamics surrounding "Concerns Over Musk's Focus," actively seek out reputable news sources and financial analysis. Engage in responsible investing practices, carefully evaluating your risk tolerance and diversification strategies before making any investment decisions. For further reading on corporate governance, Tesla, or Elon Musk's leadership, consult resources from reputable financial news outlets and academic institutions. The future of Tesla, and the broader implications for corporate leadership, depend on continued scrutiny and engagement.

Featured Posts

-

Pazartesi Aksami Dizi Rehberi 7 Nisan

Apr 23, 2025

Pazartesi Aksami Dizi Rehberi 7 Nisan

Apr 23, 2025 -

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

Apr 23, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

Apr 23, 2025 -

Reds Three Game Losing Streak Analysis Of 1 0 Losses

Apr 23, 2025

Reds Three Game Losing Streak Analysis Of 1 0 Losses

Apr 23, 2025 -

Tigers Lose Series Finale To Brewers Keider Monteros Performance

Apr 23, 2025

Tigers Lose Series Finale To Brewers Keider Monteros Performance

Apr 23, 2025 -

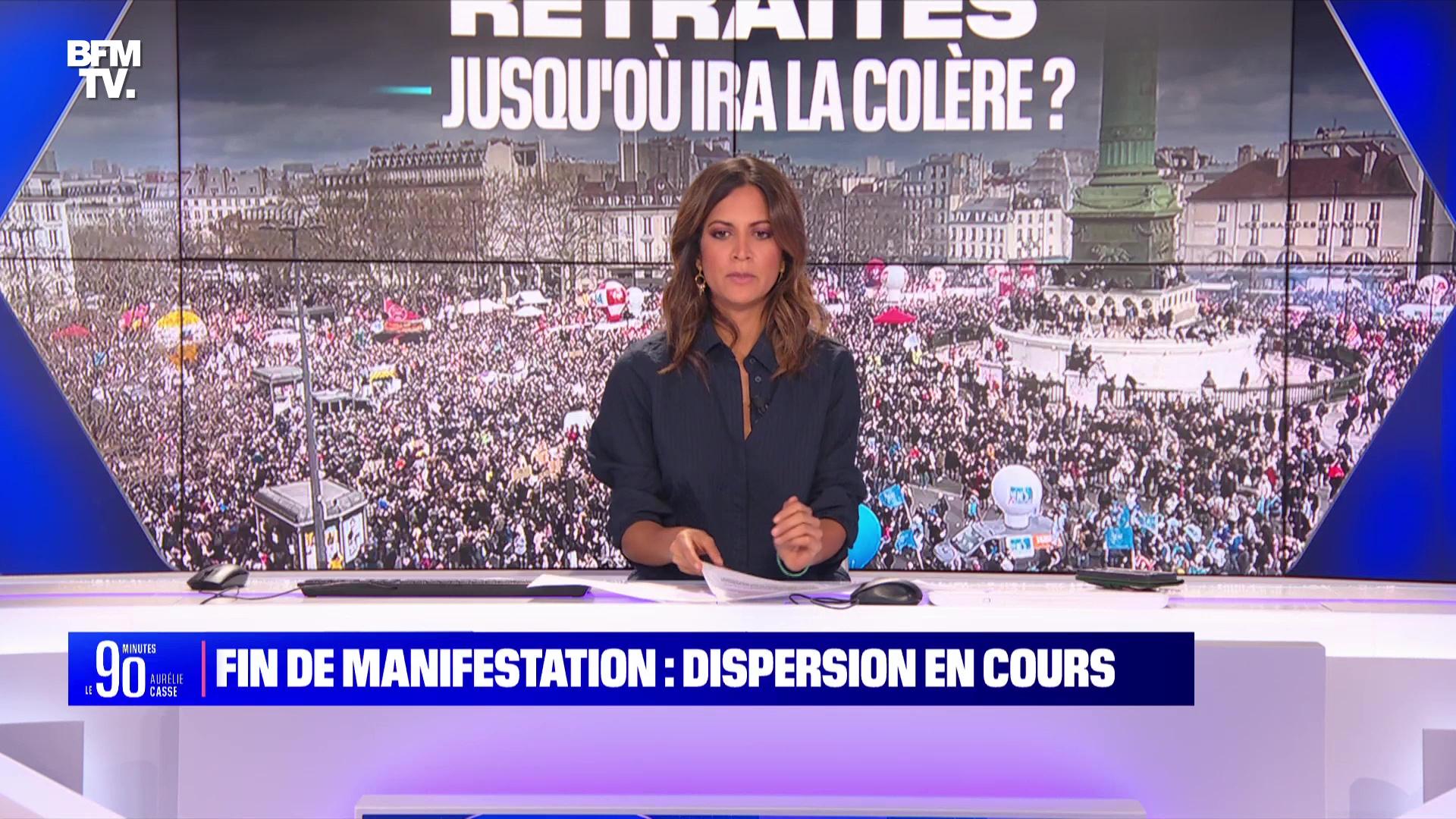

L Integrale Bfm Bourse Edition Speciale Du Lundi 24 Fevrier

Apr 23, 2025

L Integrale Bfm Bourse Edition Speciale Du Lundi 24 Fevrier

Apr 23, 2025