Bundestag Elections And The Dax: Forecasting Market Behavior

Table of Contents

Historical Impact of Bundestag Elections on the DAX

Election Year Volatility

Historical data reveals a clear pattern: increased volatility in the DAX during German federal election years. This heightened uncertainty stems from the unknown policy directions of a new government and the potential for significant shifts in economic priorities.

-

Examples of past election years and their impact on DAX performance:

- 2017: The DAX experienced relatively modest fluctuations throughout the year, showing a slight positive trend after the election.

- 2013: The DAX saw increased volatility in the lead-up to the election, followed by a period of relative stability post-election.

- 2009: The global financial crisis overshadowed the election's immediate impact, leading to significant market declines. However, the subsequent coalition government's policies played a role in the recovery.

-

Potential reasons for increased volatility: The uncertainty surrounding election outcomes, potential policy changes (taxation, regulation), and shifts in investor sentiment contribute to increased volatility. Investors often adopt a "wait-and-see" approach, leading to more cautious trading and increased price fluctuations in the DAX.

Post-Election Market Reactions

The DAX's reaction to election outcomes is not uniform and depends heavily on the resulting coalition government and its policy agenda.

-

Examples of different coalition governments and their subsequent effects on the DAX:

- Grand Coalition (CDU/CSU and SPD): Typically associated with stability and predictable economic policies, leading to relatively stable DAX performance.

- Jamaica Coalition (CDU/CSU, FDP, and Grüne): Can lead to diverse market reactions depending on the specifics of the coalition agreement and its impact on different sectors.

- Red-Red-Green Coalition (SPD, Die Linke, and Grüne): Often viewed as more left-leaning, leading to potential market reactions depending on the specific economic policies implemented.

-

Impact of policy announcements and shifts in government priorities: Policy announcements regarding taxation, environmental regulations, and social spending can significantly impact specific sectors. For example, a focus on renewable energy might boost related stocks, while stricter automotive regulations could negatively affect the automotive sector's performance within the DAX.

Key Political Factors Influencing the DAX

Coalition Government Formation

The formation of a coalition government is a critical determinant of post-election market behavior. The composition of the coalition significantly impacts the economic policies that will be pursued.

-

Examples of potential coalitions and their likely economic platforms: The potential for a coalition between the CDU/CSU and FDP might suggest a more pro-business agenda, potentially boosting investor confidence. Conversely, a coalition including the Greens might prioritize environmental policies, impacting sectors like automotive and energy.

-

Impact on key sectors: Different coalitions will have varying impacts on sectors like automotive (regulations and subsidies), renewable energy (investment and incentives), and finance (taxation and regulation). Analyzing the economic platforms of potential coalition partners is crucial for forecasting sector-specific DAX performance.

Economic Policy Platforms

The economic policies advocated by the major parties differ significantly, leading to differing market expectations.

-

Key policy differences between major parties: Key areas of divergence include taxation (corporate tax rates, income tax brackets), regulation (environmental regulations, labor laws), and social spending (healthcare, pensions).

-

Influence on investor confidence and market sentiment: Investors closely watch these policy differences, as they directly impact their investment returns. Pro-business policies often lead to increased investor confidence and a positive impact on the DAX, while policies perceived as detrimental to business can result in decreased investor confidence and negative market reactions.

Forecasting Market Behavior: Tools and Techniques

Sentiment Analysis

Sentiment analysis of news articles, social media posts, and expert opinions can provide valuable insights into market expectations surrounding the Bundestag elections.

-

Examples of data sources and techniques for sentiment analysis: Natural language processing (NLP) techniques can be used to analyze vast quantities of textual data from various sources, including news outlets (Handelsblatt, Frankfurter Allgemeine Zeitung), social media platforms (Twitter, Facebook), and financial blogs.

-

Insights into market expectations: By tracking the sentiment surrounding key political issues and parties, investors can gauge the overall market expectation and potential impact on the DAX. Positive sentiment suggests increased confidence and potential for growth, whereas negative sentiment indicates uncertainty and potential for decline.

Economic Modeling

Economic models can help predict DAX performance based on different election outcomes and subsequent policy changes.

-

Different economic modeling techniques: Various econometric models, including time series analysis and vector autoregression (VAR) models, can be employed. These models incorporate various economic indicators and political variables to forecast DAX performance under different scenarios.

-

Limitations and potential biases in economic forecasting models: It's crucial to remember that economic models are simplifications of complex realities. Unforeseen events and inherent biases in model assumptions can impact forecast accuracy. Therefore, these models should be used in conjunction with other forecasting methods, like sentiment analysis.

Conclusion

The relationship between Bundestag elections and the DAX is complex and influenced by numerous factors. Historical data shows increased volatility during election years, with post-election market reactions depending heavily on the resulting coalition government and its economic platform. By analyzing historical trends, considering key political factors, and employing forecasting tools like sentiment analysis and economic modeling, investors can gain valuable insights into potential market behavior. Staying informed about the evolving political landscape and its potential impact on economic policy is vital for successfully navigating the uncertainties surrounding Bundestag elections and the Dax. Understanding the interplay between Bundestag Elections and the Dax is crucial for making informed investment decisions. Therefore, continuous monitoring of political developments and economic indicators is highly recommended.

Featured Posts

-

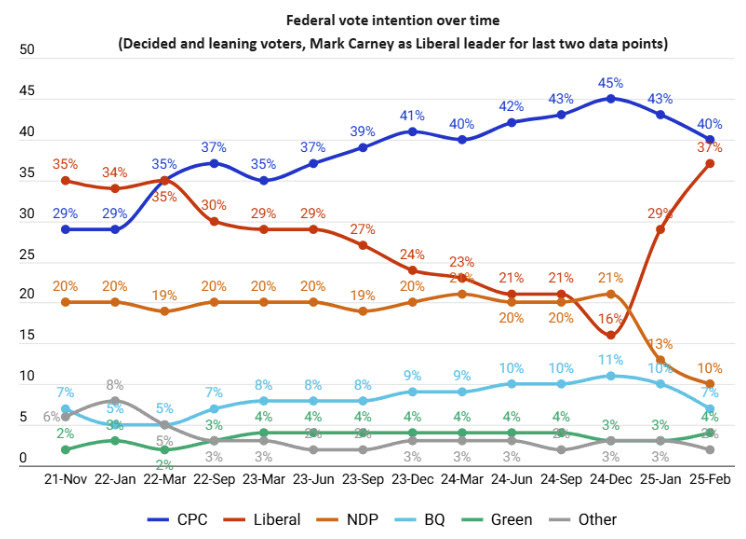

Upcoming Canadian Election Carney Highlights Trumps Trade Concessions

Apr 27, 2025

Upcoming Canadian Election Carney Highlights Trumps Trade Concessions

Apr 27, 2025 -

Indian Wells 2024 Eliminacion Inesperada De Una Pre Clasificada

Apr 27, 2025

Indian Wells 2024 Eliminacion Inesperada De Una Pre Clasificada

Apr 27, 2025 -

Novak Djokovics Early Exit From Monte Carlo Masters 2025 Straight Sets Loss Against Tabilo

Apr 27, 2025

Novak Djokovics Early Exit From Monte Carlo Masters 2025 Straight Sets Loss Against Tabilo

Apr 27, 2025 -

Sources Reveal Hhss Appointment Of Anti Vaccine Advocate To Investigate Autism Vaccine Theories

Apr 27, 2025

Sources Reveal Hhss Appointment Of Anti Vaccine Advocate To Investigate Autism Vaccine Theories

Apr 27, 2025 -

Posthaste How A Canadian Travel Boycott Affects The American Economy

Apr 27, 2025

Posthaste How A Canadian Travel Boycott Affects The American Economy

Apr 27, 2025