BofA On Stock Market Valuations: A Reason For Investor Confidence

Table of Contents

BofA's Current Valuation Assessment

BofA's recent report on stock market valuations provides a detailed assessment of the current market landscape. While specific figures and data points may vary depending on the report's release date, the general thrust of the analysis is crucial for investors. The report utilizes a robust methodology, often incorporating a combination of discounted cash flow (DCF) analysis, price-to-earnings ratios (P/E), and other key valuation metrics to arrive at its conclusions.

- Summary of BofA's Key Findings: BofA's assessment of stock market valuations often falls into one of three categories: undervalued, fairly valued, or overvalued. The specific categorization can change based on market conditions and the timing of the report. It's crucial to consult the most up-to-date report for their current stance.

- Sectors Analyzed: The BofA analysis typically covers a broad range of sectors, including technology, healthcare, financials, consumer staples, and energy. The report usually delves into the valuation of specific indices (like the S&P 500) and individual companies within these sectors.

- Methodology: BofA employs sophisticated quantitative and qualitative methods in its stock market valuation analysis. This often includes considering macroeconomic factors, industry trends, and company-specific financial performance. Understanding the methodology strengthens the interpretation of their findings.

Factors Contributing to BofA's Positive Outlook

BofA's positive outlook on stock market valuations is often supported by several key factors. These factors are constantly evolving and need to be considered within the context of the most recent report.

- Strong Corporate Earnings Growth: Robust corporate earnings growth frequently underpins BofA's positive assessment. Specific examples of high-performing sectors and companies are often highlighted in their reports. This strong performance can help to justify current valuations or suggest undervaluation in some cases.

- Low Interest Rates (or Anticipated Changes): Low interest rates, or the expectation of low interest rates, can significantly impact stock valuations. Lower borrowing costs make it cheaper for companies to invest and grow, ultimately boosting stock prices. Conversely, anticipated interest rate hikes can have an opposite effect.

- Positive Economic Indicators: Positive economic indicators like GDP growth, low unemployment rates, and consumer confidence often contribute to BofA's positive outlook. These indicators reflect a healthy economy, supporting higher valuations.

- Geopolitical Factors: Geopolitical stability and positive global economic developments can also influence BofA's assessment. However, increased geopolitical uncertainty can significantly impact market valuations, leading to a more cautious outlook.

Potential Risks and Cautions Highlighted by BofA

While BofA may present a generally positive outlook, their reports always include important caveats and potential risks. It is vital to consider these carefully.

- Inflationary Pressures: Rising inflation can erode corporate profits and lead to higher interest rates, negatively affecting stock valuations. This is a key risk often emphasized in BofA's reports.

- Geopolitical Uncertainties: Geopolitical events can create market volatility and uncertainty, leading to potential market downturns. This is a significant factor influencing BofA's cautions.

- Potential for Interest Rate Hikes: Unexpected interest rate hikes by central banks can significantly impact stock prices, particularly in sectors sensitive to interest rate changes. BofA frequently highlights this as a key risk.

- Sector-Specific Risks: BofA's reports often identify specific sector risks. For example, they might highlight potential overvaluation in certain sectors or point out vulnerabilities within specific industries.

How Investors Can Respond to BofA's Analysis

BofA's analysis provides valuable insights, but investors must make informed decisions based on their own risk tolerance and financial goals.

- Diversification Strategies: BofA's sector-specific assessments can inform your diversification strategy. By considering their analysis, investors can create a diversified portfolio that aligns with their risk profile.

- Risk Management Techniques: Understanding the potential risks highlighted by BofA is crucial for effective risk management. Investors can utilize strategies like stop-loss orders and diversification to mitigate potential losses.

- Long-Term vs. Short-Term Strategies: BofA's long-term outlook on valuations can help investors make informed decisions about their investment timeline. Long-term investors might be less affected by short-term market fluctuations.

- Importance of Individual Due Diligence: While BofA's research is valuable, individual due diligence is essential. Investors should conduct their own research and consult financial advisors before making investment decisions.

BofA on Stock Market Valuations: A Call to Action for Informed Investors

In conclusion, BofA's analysis of stock market valuations provides a valuable framework for investors. However, it's crucial to remember that market conditions are dynamic, and BofA's perspective is just one piece of the puzzle. By carefully considering BofA's analysis of stock market valuations and conducting your own thorough due diligence, you can make informed investment decisions, build investor confidence, and work towards achieving your financial goals. Remember to consult the latest BofA reports and seek professional financial advice when necessary. Understanding stock market valuations is key to successful investing – make informed decisions based on credible research and expert insights.

Featured Posts

-

Hollywood At A Standstill The Writers And Actors Joint Strike

Apr 28, 2025

Hollywood At A Standstill The Writers And Actors Joint Strike

Apr 28, 2025 -

Red Sox Roster Update Lineup Restructure Outfielder Returns Casas Position Shift

Apr 28, 2025

Red Sox Roster Update Lineup Restructure Outfielder Returns Casas Position Shift

Apr 28, 2025 -

Boston Red Sox Lineup Minor Changes By Cora For Doubleheader

Apr 28, 2025

Boston Red Sox Lineup Minor Changes By Cora For Doubleheader

Apr 28, 2025 -

Le Bron James On Richard Jeffersons Espn Comments

Apr 28, 2025

Le Bron James On Richard Jeffersons Espn Comments

Apr 28, 2025 -

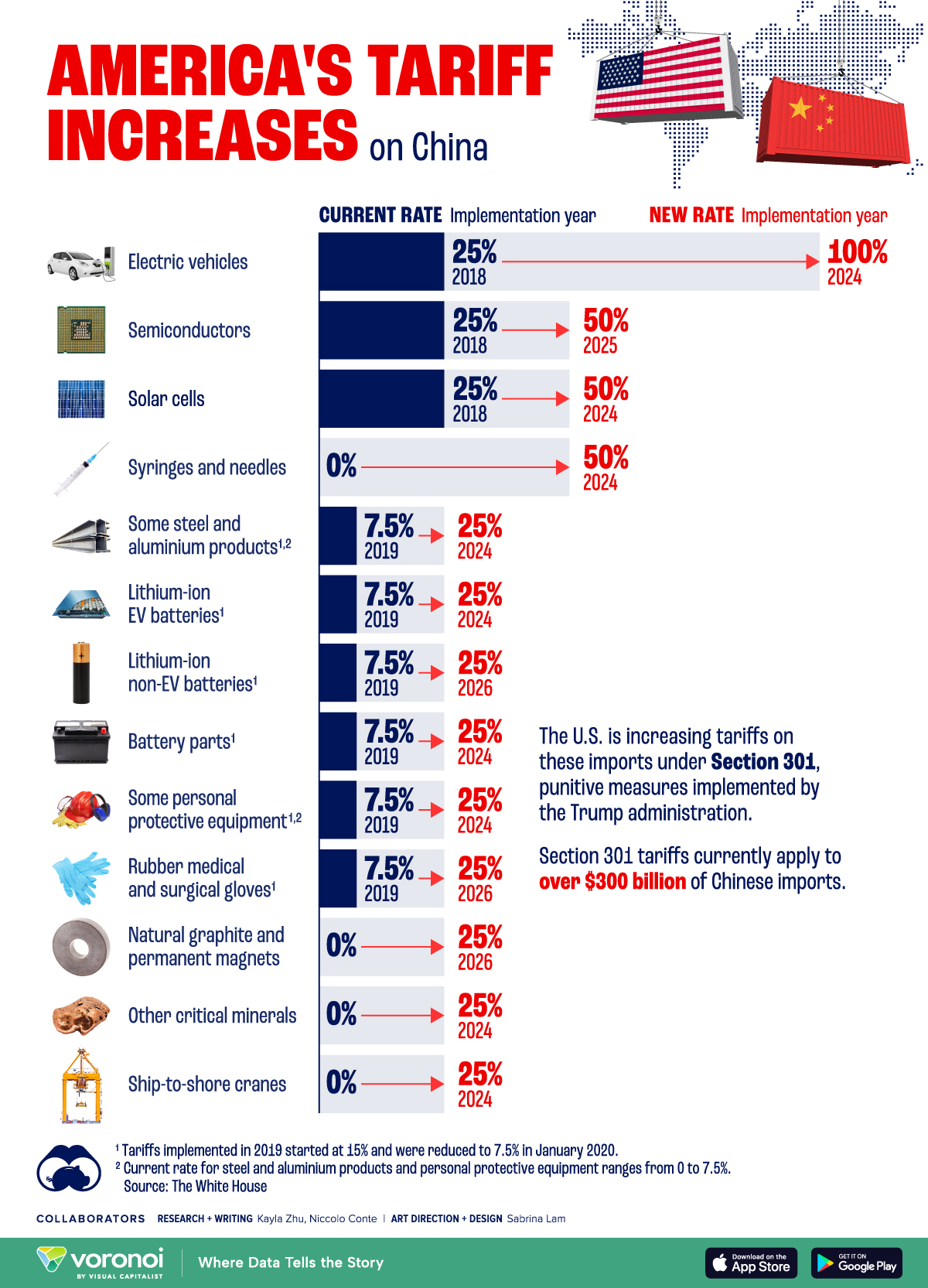

Us China Trade War Partial Tariff Relief For American Products

Apr 28, 2025

Us China Trade War Partial Tariff Relief For American Products

Apr 28, 2025