Boeing's Jeppesen Division Sold To Thoma Bravo In $5.6 Billion Deal

Table of Contents

Jeppesen's Key Businesses and Market Position

Jeppesen's core offerings have solidified its position as a dominant force in the aviation industry. Its services span several critical areas, including:

- Flight Planning: Jeppesen's flight planning software is used by airlines and general aviation pilots worldwide, optimizing routes and fuel efficiency. This critical component of flight operations relies on accurate and up-to-date aviation data solutions.

- Navigation Databases (Jeppesen Charts): Jeppesen is the market leader in digital aviation charts, providing pilots with essential navigational information for safe and efficient flight. These digital charts are crucial for flight operations across all sectors of aviation.

- Air Traffic Management Solutions: Jeppesen offers solutions that support air traffic control, contributing to safer and more efficient air traffic management.

- Pilot Training: Jeppesen provides comprehensive pilot training programs and software, ensuring that pilots are equipped with the latest knowledge and skills. Its pilot training software is highly regarded in the industry.

Jeppesen's market share within the aviation data and navigation sector is substantial, reflecting decades of expertise and a commitment to delivering high-quality products and services. Its dominance is built on its reputation for reliability, accuracy, and comprehensive offerings.

- Market leader in digital aviation charts.

- Widely used flight planning software by airlines and general aviation.

- Significant presence in pilot training and aviation safety services.

Thoma Bravo's Acquisition Strategy and Aviation Investments

Thoma Bravo focuses its investments on software and technology companies, exhibiting a keen understanding of the software acquisition process and the potential for growth in the technology sector. While not heavily invested in the aviation sector specifically, Thoma Bravo’s expertise in scaling software businesses makes Jeppesen an attractive acquisition target. Their investment strategy often involves identifying companies with strong market positions and significant growth potential.

The acquisition of Jeppesen aligns with Thoma Bravo's history of investing in technology companies with strong recurring revenue streams and opportunities for technological enhancement.

- Thoma Bravo's expertise in scaling software businesses.

- Potential synergies with other Thoma Bravo portfolio companies.

- Focus on improving Jeppesen's technology and market reach.

Boeing's Rationale for the Sale and Future Strategy

Boeing's decision to divest Jeppesen reflects a strategic realignment. By selling Jeppesen, Boeing can focus on its core competencies in aerospace manufacturing and engineering. This strategic divestment frees up capital that can be reinvested in core aerospace businesses, driving future growth and innovation in those areas. The move streamlines operations, improving overall efficiency and allowing Boeing to concentrate its resources on its primary goals.

- Freeing up capital for investment in core aerospace businesses.

- Streamlining operations and improving efficiency.

- Allowing Jeppesen to grow under a different ownership structure.

The Impact of the Sale on the Aviation Industry

The sale of Jeppesen to Thoma Bravo will undoubtedly have a ripple effect across the aviation industry. Given Jeppesen's significant market share and widespread use, changes are likely, though their nature remains to be seen. The potential impact ranges from adjustments in pricing strategies to the introduction of new and enhanced products and services. Increased competition within the flight planning software market is also a possibility.

- Potential for increased innovation in aviation data services.

- Impact on competition within the flight planning software market.

- Potential for changes in pricing and accessibility of Jeppesen products.

Conclusion: The Future of Jeppesen Under New Ownership

The Boeing-Jeppesen-Thoma Bravo deal marks a significant turning point for Jeppesen and the wider aviation industry. Boeing's strategic divestment allows it to refocus on its core business, while Thoma Bravo brings expertise in scaling software businesses that could significantly enhance Jeppesen's offerings. The future of Jeppesen under Thoma Bravo's ownership is likely to involve significant investment in technology and product development, potentially leading to increased innovation in aviation data and flight planning solutions.

Stay informed about the latest developments in the aviation industry and the evolving landscape of navigation data and flight planning solutions by following our updates on [Your Website/Platform].

Featured Posts

-

Dates Des Vacances Scolaires 2025 Federation Wallonie Bruxelles

Apr 23, 2025

Dates Des Vacances Scolaires 2025 Federation Wallonie Bruxelles

Apr 23, 2025 -

Brewers Lineup Changes A Response To Inconsistent Hitting

Apr 23, 2025

Brewers Lineup Changes A Response To Inconsistent Hitting

Apr 23, 2025 -

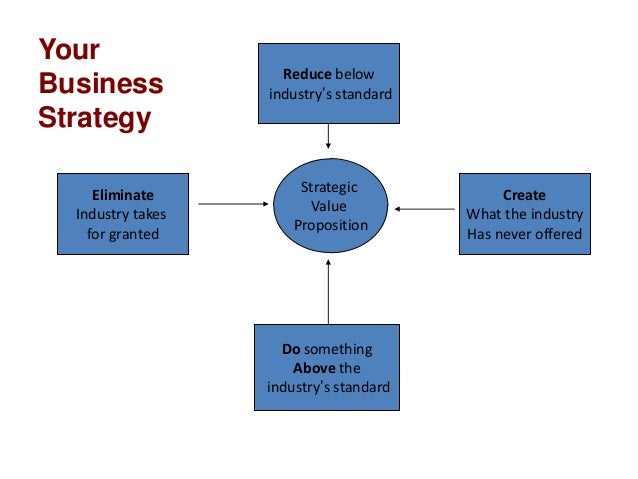

The Value Proposition Of Middle Management A Strategic Asset For Organizations

Apr 23, 2025

The Value Proposition Of Middle Management A Strategic Asset For Organizations

Apr 23, 2025 -

Resultats Fdj Du 17 Fevrier Hausse En Bourse Et Perspectives

Apr 23, 2025

Resultats Fdj Du 17 Fevrier Hausse En Bourse Et Perspectives

Apr 23, 2025 -

Asear Aldhhb Alywm Balsaght Ahdth Althdythat Walthlylat

Apr 23, 2025

Asear Aldhhb Alywm Balsaght Ahdth Althdythat Walthlylat

Apr 23, 2025