Boeing Completes $5.6 Billion Sale Of Jeppesen To Thoma Bravo

Table of Contents

Details of the Jeppesen Sale

Sale Price and Terms

The finalized deal saw Boeing receive $5.6 billion for its subsidiary, Jeppesen. While specific details regarding the closing date and any contingencies remain largely undisclosed, the substantial price tag reflects Jeppesen's significant value within the aviation ecosystem. Further financial details regarding Jeppesen's EBITDA and net income prior to the sale would provide a more comprehensive understanding of the return on investment for Boeing.

Jeppesen's Business and Significance

Jeppesen is a globally recognized provider of crucial aviation data and software solutions. Its offerings encompass a wide range of services, including precise navigation data, sophisticated flight planning software, and comprehensive aviation training solutions. Jeppesen data is integral to the daily operations of countless airlines, pilots, and air navigation service providers worldwide. This reliance on accurate and up-to-date Jeppesen data underscores its vital role within the digital aviation landscape. The company's revenue streams have historically been robust, fueled by the continuous demand for reliable flight planning, navigation, and training resources.

Impact on Boeing's Portfolio

The sale of Jeppesen directly aligns with Boeing's strategic priorities of portfolio optimization and a renewed focus on its core business of aircraft manufacturing and related services. The substantial proceeds from this transaction will likely be reinvested in research and development, enhancing Boeing's capabilities in areas such as sustainable aviation technologies and next-generation aircraft design. This divestment allows Boeing to streamline its operations and concentrate resources on its core competencies.

- Key Facts about the Deal:

- Sale price: $5.6 billion

- Buyer: Thoma Bravo, a private equity firm specializing in software and technology.

- Seller: Boeing

- Jeppesen's primary offerings: Navigation data, flight planning software, and aviation training solutions.

- Boeing's stated goal: Portfolio optimization and focus on core business.

Thoma Bravo's Acquisition Strategy

Thoma Bravo's Expertise in Software and Technology

Thoma Bravo is a prominent private equity firm with a proven track record of successful investments in the software and technology sectors. Their acquisition of Jeppesen reflects their keen interest in companies operating in data-rich industries with significant growth potential. Their experience in scaling software businesses makes them a well-suited owner for Jeppesen.

Future Plans for Jeppesen

Thoma Bravo has indicated plans for significant investment in Jeppesen, focusing on expanding its product offerings, enhancing its technology infrastructure, and exploring new market opportunities. Potential synergies with other Thoma Bravo portfolio companies in related sectors could further accelerate Jeppesen's growth. The firm may also explore strategic partnerships to broaden Jeppesen's reach and influence within the digital aviation space.

- Thoma Bravo's likely plans for Jeppesen:

- Increased investment in research and development.

- Expansion into new aviation data and software markets.

- Potential integration with other portfolio companies.

- Enhancement of digital aviation technologies.

Industry Reactions and Analysis

Analyst Comments and Market Response

The Boeing Jeppesen sale has been met with a mixture of anticipation and analysis from industry experts. Some analysts see the move as a strategic advantage for Boeing, allowing them to focus on their core competencies. Others speculate on the long-term implications for competition within the aviation data and software markets. Early market reactions have been generally positive, though further observation is needed to assess the full impact on Boeing's stock price and the broader aviation sector.

Long-Term Implications for Aviation

The sale's long-term effects on the aviation industry remain to be seen. The potential for increased innovation within Jeppesen under Thoma Bravo's ownership is a key consideration. Changes in Jeppesen's data accessibility policies or pricing strategies could impact various stakeholders, from airlines to smaller aviation businesses. The implications for industry competition are also a significant factor to watch.

- Key Predictions:

- Increased investment in Jeppesen's technology and services.

- Potential shifts in the competitive landscape of aviation data providers.

- Long-term impact on data accessibility and pricing within the industry.

The Boeing-Jeppesen-Thoma Bravo Deal: Looking Ahead

The $5.6 billion sale of Jeppesen to Thoma Bravo marks a significant strategic shift for Boeing, allowing the company to streamline its operations and focus on its core strengths. The transaction also presents exciting possibilities for Jeppesen's future, with Thoma Bravo's expertise and resources poised to drive innovation and expansion. The long-term implications for the aviation industry are significant, promising changes in data management, competition, and the overall technological landscape. To stay informed about further developments regarding Boeing's divestment strategy and the future of Jeppesen, continue to follow industry news and updates.

Featured Posts

-

Amandine Gerard Relations Commerciales Europe Marches Une Analyse Critique

Apr 23, 2025

Amandine Gerard Relations Commerciales Europe Marches Une Analyse Critique

Apr 23, 2025 -

Tournee Minerale Et Dry January Un Marche Du Sans Alcool En Plein Essor

Apr 23, 2025

Tournee Minerale Et Dry January Un Marche Du Sans Alcool En Plein Essor

Apr 23, 2025 -

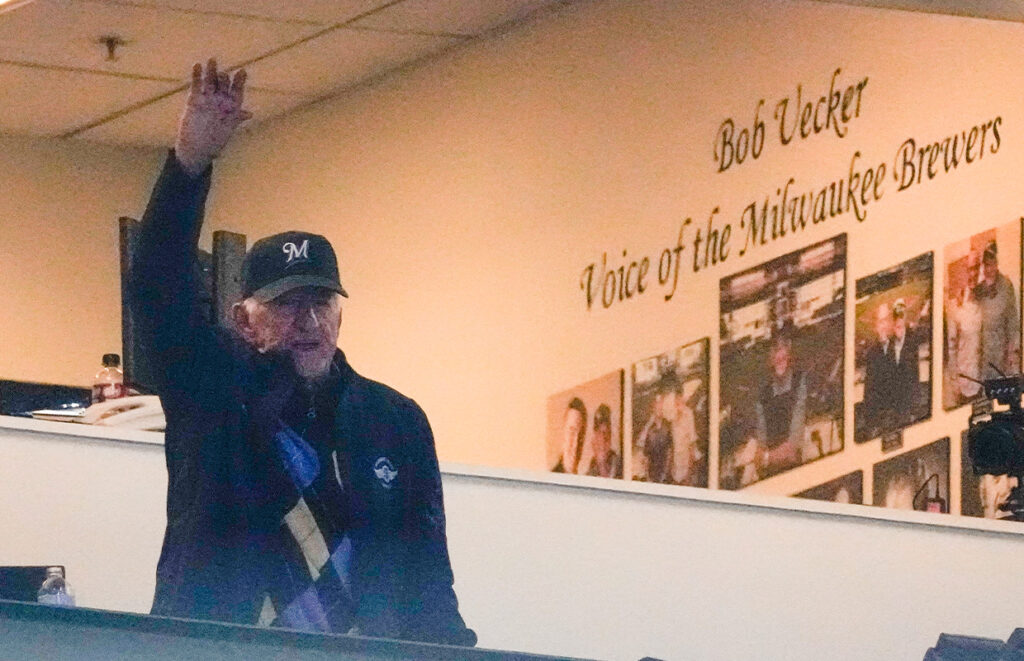

Remembering Bob Uecker Cory Provuss Heartfelt Tribute

Apr 23, 2025

Remembering Bob Uecker Cory Provuss Heartfelt Tribute

Apr 23, 2025 -

Pei Businesses Open And Closed On Easter Sunday And Monday

Apr 23, 2025

Pei Businesses Open And Closed On Easter Sunday And Monday

Apr 23, 2025 -

Hegseth Leaks Aim To Undermine Trumps Political Plans

Apr 23, 2025

Hegseth Leaks Aim To Undermine Trumps Political Plans

Apr 23, 2025