AT&T Sounds The Alarm: Broadcom's VMware Deal Could Increase Costs By 1,050%

Table of Contents

AT&T's Concerns and the 1050% Figure

AT&T's alarming 1050% cost increase projection stems from their assessment of how Broadcom's acquisition of VMware will affect their licensing fees and overall business operations. This isn't a random number; it's based on their analysis of anticipated price hikes across various VMware products and services.

Detailed Breakdown of the Claimed Cost Increase

AT&T's justification for this dramatic figure hinges on several key factors:

-

Increased licensing fees for VMware products: The acquisition could give Broadcom significant leverage to drastically increase licensing fees for essential VMware products, impacting AT&T's substantial investment in VMware's virtualization infrastructure. This price hike could affect everything from vSphere to vSAN.

-

Potential for reduced competition leading to higher prices: With Broadcom controlling a significant portion of the market, concerns exist about reduced competition and the potential for monopolistic pricing practices. This lack of alternative vendors could force companies like AT&T to accept significantly higher prices.

-

Impact on existing contracts and potential renegotiation challenges: Current contracts might become less favorable under Broadcom's ownership, leading to difficult renegotiations and potentially even higher costs than initially projected.

-

Loss of negotiating leverage due to Broadcom's market dominance: The merger dramatically shifts the power dynamic, leaving AT&T and other large companies with significantly less leverage during contract negotiations. This reduced negotiating power could directly translate into substantial cost increases.

Broadcom's Response and Arguments

Broadcom has naturally refuted AT&T's claims, offering its own perspective on the potential impact of the acquisition.

Broadcom's Stance on Cost Increases

Broadcom maintains that the 1050% figure is exaggerated and misleading. Their official statements emphasize continued investment in innovation and service improvements, promising no significant price increases for existing customers.

-

Broadcom's arguments against the 1050% claim: Broadcom highlights the potential for cost savings through synergies and economies of scale, arguing these savings will offset any potential price increases.

-

Promises of continued innovation and service improvements: The company emphasizes its commitment to developing and enhancing VMware's product portfolio, ensuring continued value for its customers.

-

Claims of potential cost savings through synergies and economies of scale: Broadcom argues that integrating VMware's operations with its own will lead to efficiencies and ultimately lower costs for customers in the long run.

Regulatory Scrutiny and Potential Outcomes

The Broadcom-VMware deal is facing intense regulatory scrutiny from antitrust authorities worldwide. The potential impact on competition within the networking and virtualization markets is a primary concern.

Antitrust Concerns and Investigations

Several regulatory bodies are currently investigating the proposed merger, assessing its potential impact on competition. These investigations could result in several outcomes:

-

Potential for the deal to be blocked or modified by regulators: If regulators find the merger significantly reduces competition, they could block it altogether or demand significant modifications to ensure a competitive marketplace.

-

Impact of the deal on competition in the networking and virtualization markets: The merger’s potential to stifle innovation and increase prices for essential virtualization technologies is a major area of concern for regulators.

-

The role of public opinion and lobbying efforts in influencing regulatory decisions: Public opinion and lobbying efforts from companies like AT&T could significantly influence regulatory decisions regarding the deal's approval.

The Wider Implications for the Tech Industry

The potential impact of the Broadcom-VMware deal extends far beyond AT&T, potentially affecting businesses and consumers across numerous sectors.

Impact on Businesses and Consumers

The merger could have significant repercussions for the broader tech landscape:

-

Increased software costs across various industries: If Broadcom increases prices, businesses reliant on VMware's virtualization solutions will likely experience significant cost increases.

-

Potential for innovation stagnation due to reduced competition: A less competitive market could stifle innovation and lead to slower advancements in virtualization technology.

-

The long-term implications for cloud computing and data center management: The merger could reshape the cloud computing landscape, potentially impacting pricing and the availability of competitive solutions for data center management.

Conclusion

AT&T's concerns about a potential 1050% cost increase following Broadcom's acquisition of VMware highlight the significant implications of this merger. While Broadcom refutes these claims, the potential for increased prices, reduced competition, and regulatory intervention remains a substantial concern. The deal's impact will likely be felt across various industries, influencing software costs, innovation, and the future of cloud computing. Stay updated on the Broadcom VMware acquisition and its potential cost implications for your business. Understanding the potential consequences is crucial for strategic planning and navigating the evolving technological landscape.

Featured Posts

-

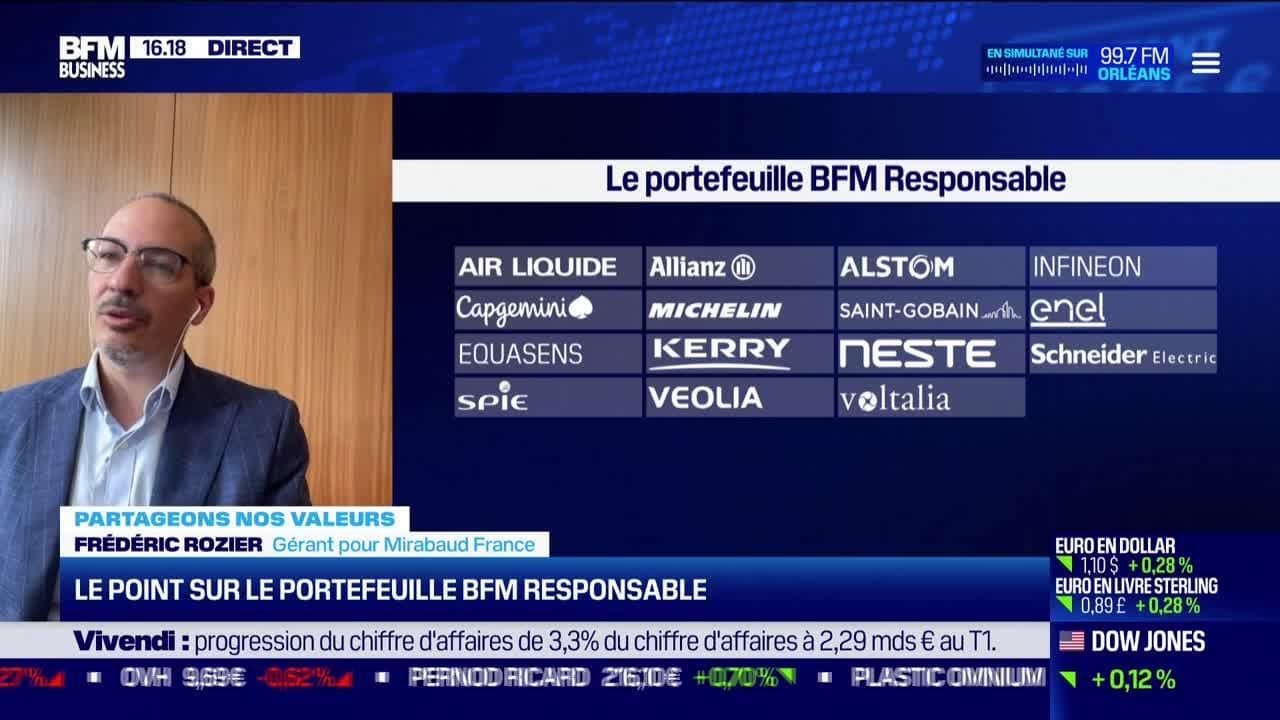

Portefeuille Bfm Revue Hebdomadaire De L Arbitrage 17 02

Apr 23, 2025

Portefeuille Bfm Revue Hebdomadaire De L Arbitrage 17 02

Apr 23, 2025 -

Brewers Nine Base Steal Spree Fuels Blowout Win Over As

Apr 23, 2025

Brewers Nine Base Steal Spree Fuels Blowout Win Over As

Apr 23, 2025 -

Windy City Showdown Brewers Defeat Cubs 9 7

Apr 23, 2025

Windy City Showdown Brewers Defeat Cubs 9 7

Apr 23, 2025 -

50 Staffel 2 2025 Wer Ist Raus Alle Infos Zu Teilnehmern And Streaming

Apr 23, 2025

50 Staffel 2 2025 Wer Ist Raus Alle Infos Zu Teilnehmern And Streaming

Apr 23, 2025 -

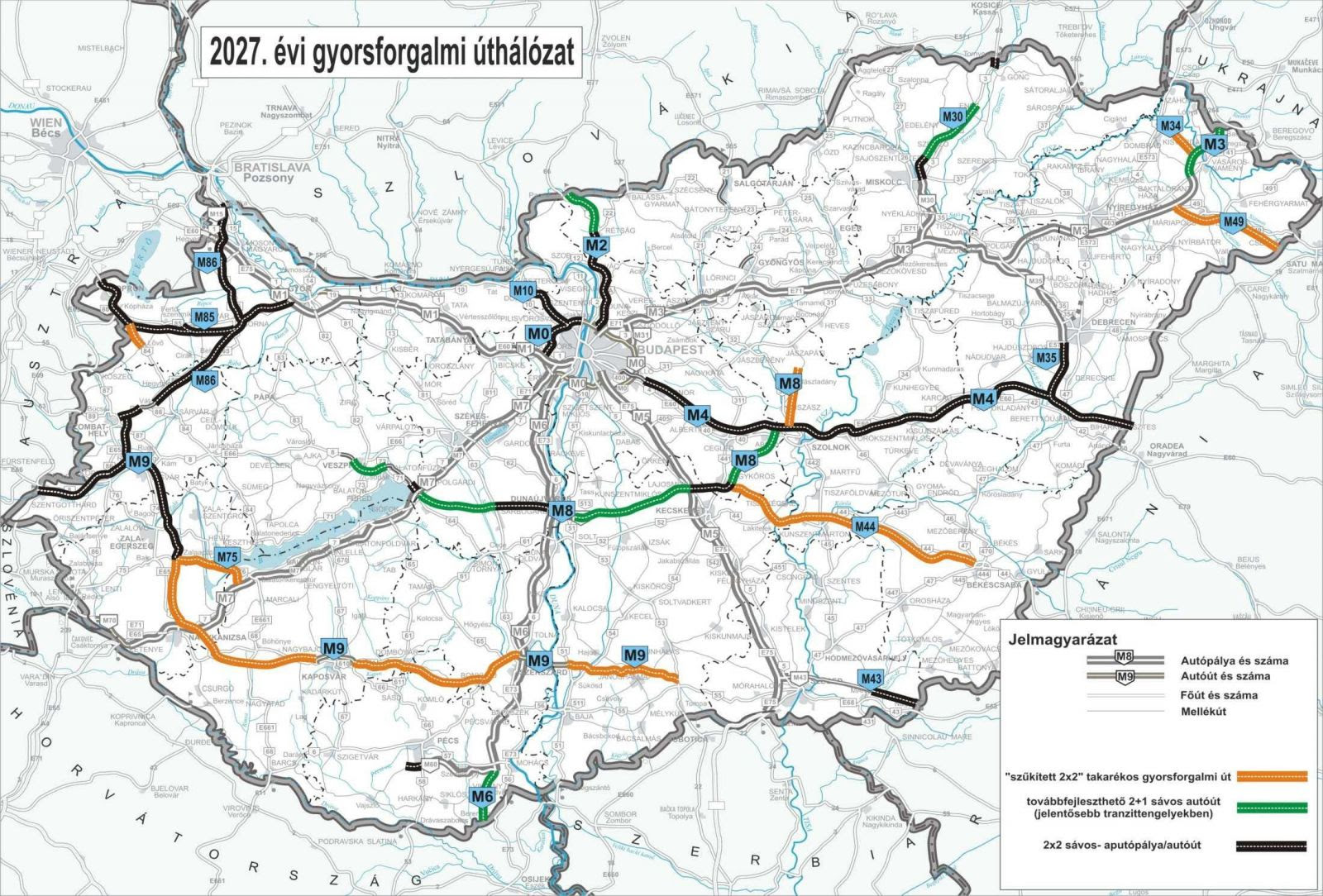

M3 As Autopalya Tervezett Forgalomkorlatozasok Es Utepitesek

Apr 23, 2025

M3 As Autopalya Tervezett Forgalomkorlatozasok Es Utepitesek

Apr 23, 2025