Are Stock Investors Prepared For More Market Downturns?

Table of Contents

Assessing Current Investor Sentiment

Understanding prevailing investor sentiment is key to gauging potential market shifts. Are investors overly optimistic, potentially setting the stage for a correction, or are they bracing themselves for further declines? Analyzing investor sentiment, alongside key economic indicators, provides valuable insights into market dynamics.

Optimism vs. Pessimism

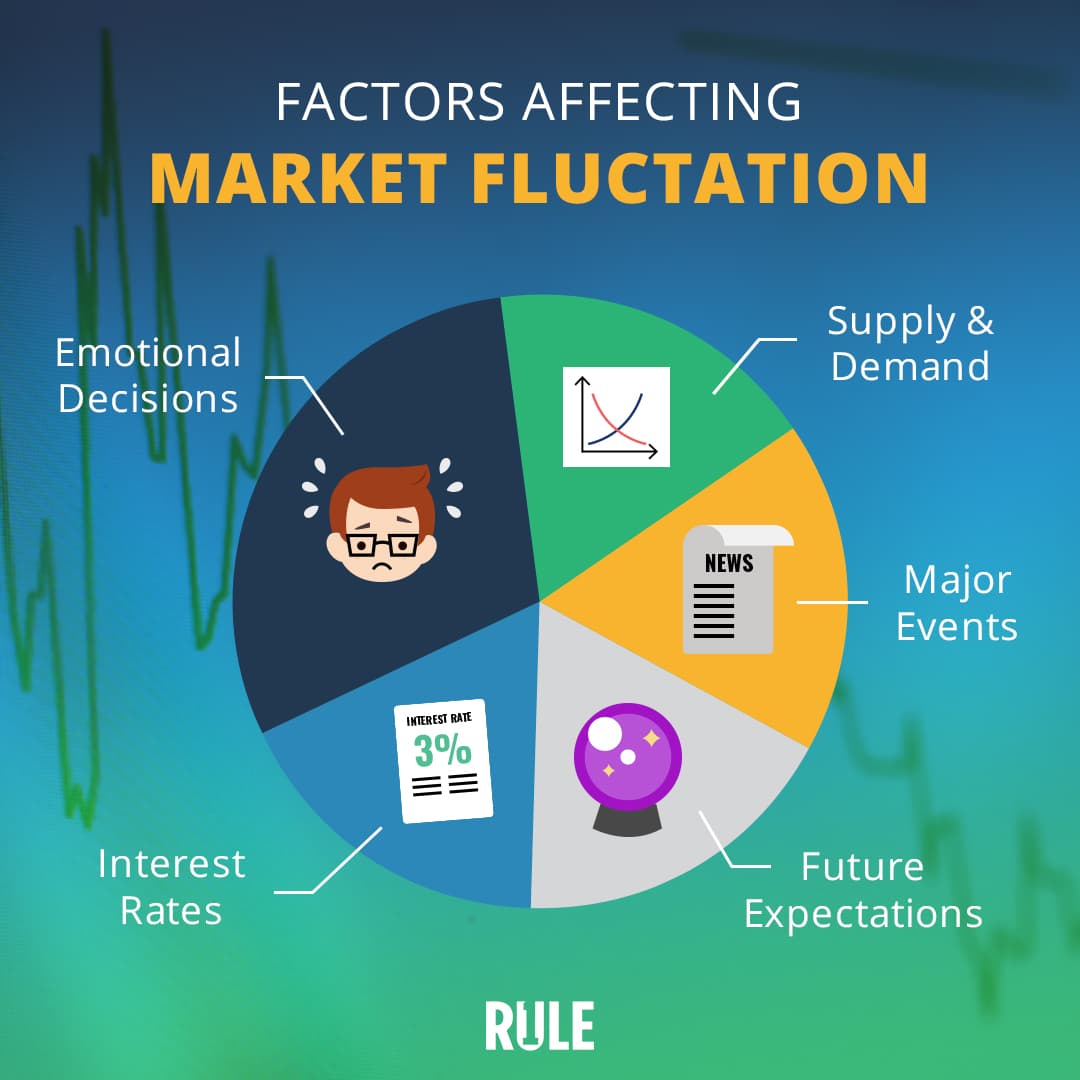

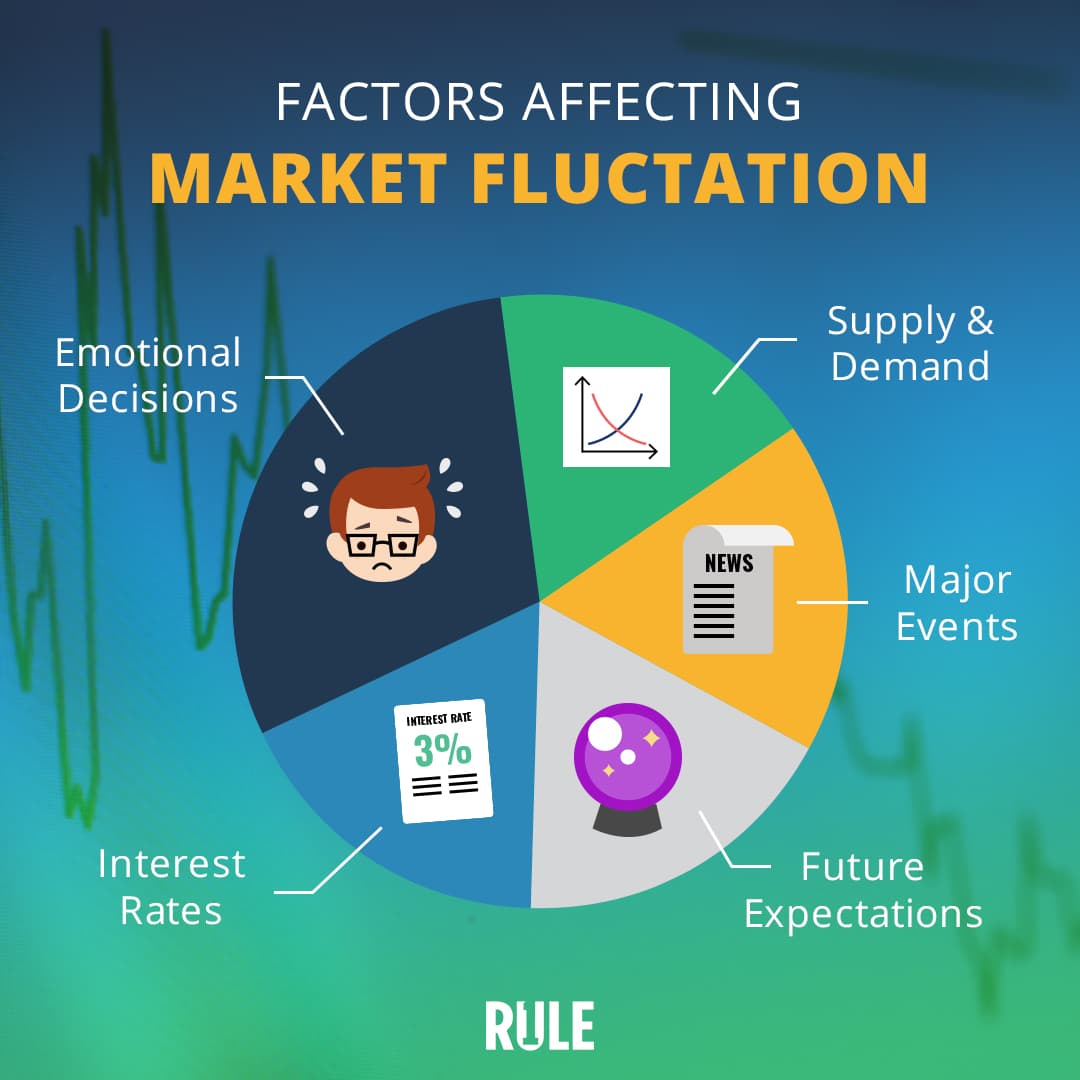

Several factors influence investor sentiment. Recent economic news, such as inflation rates, interest rate hikes, and unemployment figures, significantly impacts investor confidence. Positive economic data tends to fuel optimism, driving stock prices higher, while negative news can trigger fear and lead to market corrections.

- Impact of Recent Economic News: Positive reports on GDP growth, for example, often boost investor confidence, while rising inflation can create uncertainty and trigger selling pressure.

- The Role of Fear and Greed: These primal emotions heavily influence market behavior. Periods of extreme greed often precede market peaks, while excessive fear can lead to panic selling during downturns.

- Significant Shifts in Investor Behavior: Observing changes in trading volume, the movement of money into or out of specific asset classes, and the rise or fall of market indices can indicate shifts in investor sentiment.

The Role of Diversification in Mitigating Risk

Diversification is a cornerstone of sound investment strategy. Spreading your investments across various asset classes reduces the overall risk of significant losses during market downturns.

Portfolio Diversification Strategies

A well-diversified portfolio mitigates the impact of market volatility by reducing exposure to any single asset or sector.

- Geographic Diversification: Investing in companies and assets across different countries reduces dependence on a single economy's performance.

- Sector Diversification: Investing across various sectors (technology, healthcare, energy, etc.) safeguards against sector-specific downturns.

- Asset Allocation: A strategic allocation of assets – stocks, bonds, real estate, commodities, and cash – balances risk and return potential. This balance should align with your risk tolerance and financial goals.

- Growth vs. Value Stocks: A mix of growth stocks (with high potential but higher risk) and value stocks (more stable, potentially slower growth) provides a balanced approach.

Understanding Your Risk Tolerance

Before making any investment decisions, accurately assessing your personal risk tolerance is vital. Your investment strategy should directly reflect your comfort level with potential losses.

Assessing Personal Risk Profile

Determining your risk tolerance requires a frank evaluation of your financial situation, investment goals, and emotional response to market fluctuations.

- Risk Tolerance Questionnaires: Online questionnaires and consultations with financial advisors can help determine your risk profile.

- High vs. Low-Risk Tolerance: High-risk tolerance might allow for a greater allocation to equities, while low-risk tolerance might favor a more conservative approach with a higher proportion of bonds and cash.

- The Importance of an Emergency Fund: Having 3-6 months' worth of living expenses in an easily accessible emergency fund provides a safety net and reduces the pressure to sell investments during market downturns.

The Importance of Long-Term Investing

Market downturns are an inevitable part of the investment landscape. Adopting a long-term investment horizon is crucial to weathering these fluctuations and benefiting from the market's historical resilience.

Riding Out Market Cycles

A long-term perspective allows you to ride out short-term market volatility and focus on your long-term financial goals.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of market conditions, reduces the impact of market timing.

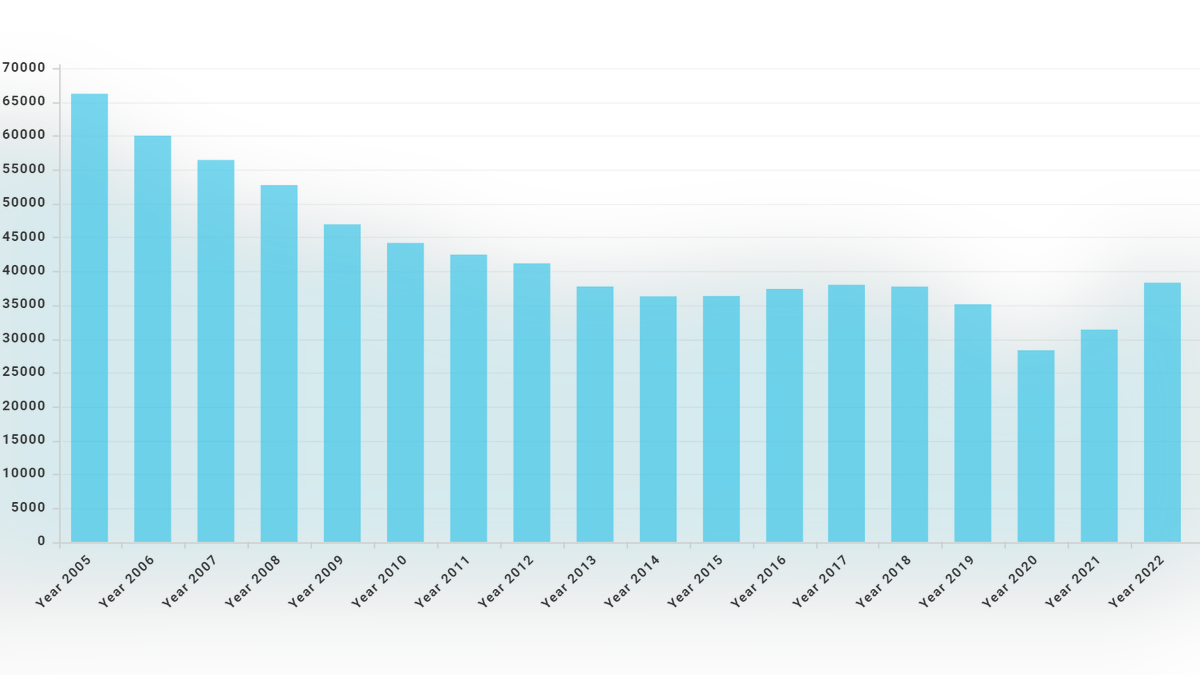

- Historical Market Performance: Historically, the stock market has demonstrated a strong tendency to recover and grow over the long term, despite periodic downturns.

- Emotional Discipline: Sticking to a long-term investment strategy requires discipline and emotional resilience, as short-term losses can be unsettling.

Conclusion

Preparing for market downturns involves understanding current investor sentiment, diversifying your portfolio strategically, assessing your risk tolerance, and adopting a long-term investment approach. By incorporating these strategies, you can enhance your ability to navigate market volatility and achieve your long-term financial objectives.

Are you prepared for the next market downturn? Take proactive steps today to review your portfolio, diversify your investments, and develop a long-term investment strategy that aligns with your risk tolerance. Remember that while market downturns are inevitable, with the right preparation, you can navigate them successfully and emerge stronger.

Featured Posts

-

Razer Blade 16 2025 Review Is The Premium Price Worth The Ultra Performance

Apr 22, 2025

Razer Blade 16 2025 Review Is The Premium Price Worth The Ultra Performance

Apr 22, 2025 -

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

Apr 22, 2025

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

Apr 22, 2025 -

Tik Tok And Trump Tariffs How Businesses Are Circumventing Them

Apr 22, 2025

Tik Tok And Trump Tariffs How Businesses Are Circumventing Them

Apr 22, 2025 -

Returning To Classes At Fsu The Aftermath Of The Deadly Campus Shooting

Apr 22, 2025

Returning To Classes At Fsu The Aftermath Of The Deadly Campus Shooting

Apr 22, 2025 -

Understanding The Value Of Middle Managers Benefits For Businesses And Employees

Apr 22, 2025

Understanding The Value Of Middle Managers Benefits For Businesses And Employees

Apr 22, 2025