Analyzing The Risks: Trump's Trade Actions And US Financial Stability

Table of Contents

Increased Tariffs and Their Impact on Inflation

Impact on Consumer Prices

Tariffs, essentially taxes on imported goods, directly impact consumer prices. By increasing the cost of imported products, tariffs lead to higher prices for consumers, potentially reducing their disposable income and overall spending. This ripple effect can significantly dampen economic growth.

- Examples: Tariffs imposed on steel and aluminum impacted the prices of numerous consumer goods, from automobiles to construction materials. Similarly, tariffs on goods from China affected the cost of electronics, clothing, and countless other items.

- Data Points: Inflation rates demonstrably rose during periods of heightened tariff implementation under the Trump administration. While other factors contributed, the impact of tariffs on consumer prices cannot be ignored. Analyzing the Consumer Price Index (CPI) during these periods reveals a clear correlation.

- Keyword Integration: The increased tariff impact on consumer prices fueled inflation and significantly affected the overall economic landscape, resulting in a measurable trade war effect on the financial stability of the US.

Disruption of Global Supply Chains

Uncertainty and Investment

Trump's erratic trade policies created significant uncertainty for businesses, hindering long-term planning and investment decisions. The constant threat of new tariffs or trade restrictions forced companies to reassess their supply chains, leading to disruptions and increased costs.

- Examples: Businesses reliant on imported components faced delays and shortages due to trade disputes. Companies scrambled to diversify their supply chains, relocating production or finding alternative suppliers, a costly and time-consuming process.

- Case Studies: Many manufacturers experienced significant production slowdowns and financial losses due to supply chain disruptions caused by Trump's trade actions. Detailed case studies of these businesses illustrate the real-world consequences of trade uncertainty.

- Keyword Integration: This trade uncertainty significantly impacted business investment, highlighting the fragility of global supply chains and their direct impact on US financial stability in the face of disruptive trade policies.

The Dollar's Volatility and International Trade

Currency Fluctuations and Trade Deficits

Trade disputes significantly influence the value of the US dollar and subsequently affect the trade deficit. Fluctuations in the dollar's exchange rate can exacerbate trade imbalances and create further economic instability.

- Bullet Points: A strong dollar can make US exports more expensive and imports cheaper, widening the trade deficit. Conversely, a weak dollar can boost exports but also increase the cost of imports. Trump's trade actions contributed to significant volatility in the dollar's value.

- Data Points: Analyzing data on dollar exchange rates and trade deficits during periods of heightened trade tension reveals a clear correlation between Trump's trade actions and currency fluctuations.

- Keyword Integration: The interplay between the US dollar, currency volatility, and the resulting trade deficit significantly contributed to the risks to US financial stability under the influence of Trump's trade policies. Understanding the exchange rates during these periods is crucial to fully grasp the consequences.

Impact on the Stock Market and Investor Confidence

Market Volatility and Investor Sentiment

Trump's unpredictable trade actions introduced significant volatility into the stock market, impacting investor sentiment and confidence. The uncertainty surrounding future trade policies led to market fluctuations and heightened risk aversion.

- Bullet Points: Announcements of new tariffs or trade disputes often triggered sell-offs in the stock market, reflecting investor concerns about the potential economic fallout. The resulting market uncertainty further contributed to financial instability.

- Data Points: Analyzing stock market indices like the Dow Jones Industrial Average and the S&P 500 during periods of trade tensions reveals the impact of Trump's actions on market performance.

- Keyword Integration: The resulting stock market volatility, stemming from diminished investor confidence and market uncertainty, underscored the significant impact of Trump's trade war on US financial stability.

Conclusion: Analyzing the Risks: Trump's Trade Actions and US Financial Stability

In summary, Trump's trade actions presented considerable risks to US financial stability. The increased tariffs fueled inflation, disrupting consumer spending and contributing to rising consumer prices. The unpredictable nature of these policies caused significant supply chain disruptions, impacting business investment and long-term planning. Further, the resulting dollar volatility and heightened trade deficit added to the overall instability. Finally, the market uncertainty undermined investor confidence and triggered stock market volatility.

The cumulative effect of these factors underscores the considerable risks associated with unpredictable trade policies. The consequences extended beyond mere economic fluctuations and posed serious threats to the overall financial health of the United States. Continue analyzing the risks of Trump's trade actions and their effect on US financial stability by exploring further research and analysis on this critical topic. Understanding these past events is vital for informing future economic policies and mitigating similar risks in the future.

Featured Posts

-

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

Apr 22, 2025

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

Apr 22, 2025 -

Ftc Appeals Activision Blizzard Acquisition Ruling Whats Next

Apr 22, 2025

Ftc Appeals Activision Blizzard Acquisition Ruling Whats Next

Apr 22, 2025 -

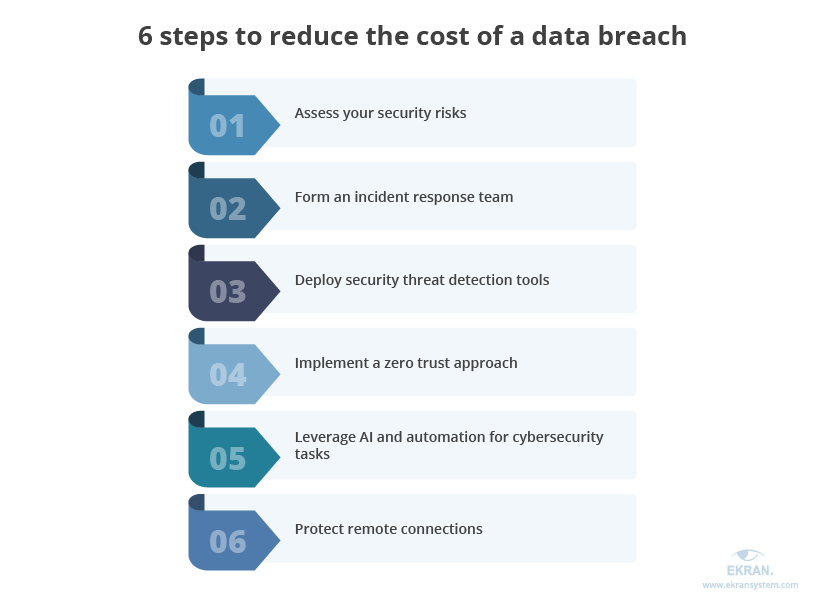

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 22, 2025

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 22, 2025 -

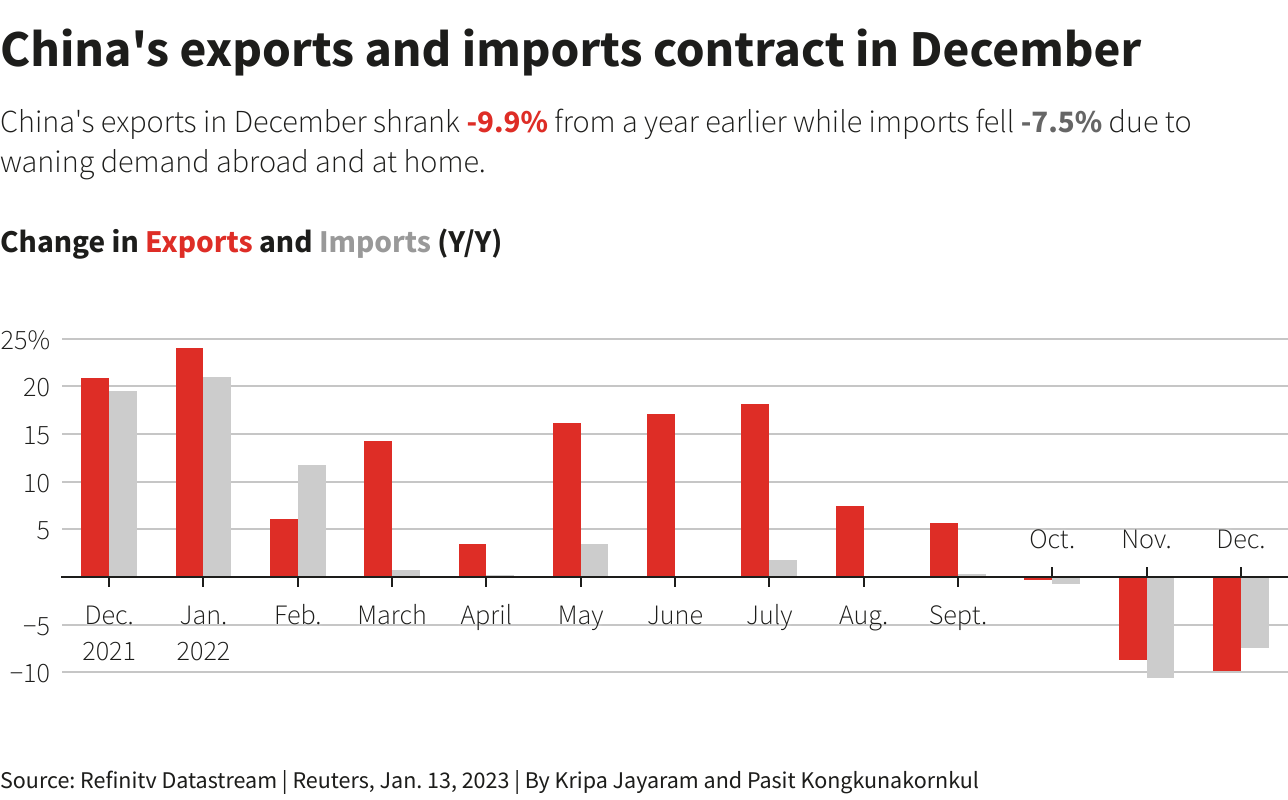

Chinas Economy Exposed By Reliance On Exports And Tariffs

Apr 22, 2025

Chinas Economy Exposed By Reliance On Exports And Tariffs

Apr 22, 2025 -

Navigating The Chinese Market Bmw Porsche And The Future Of Luxury Car Sales

Apr 22, 2025

Navigating The Chinese Market Bmw Porsche And The Future Of Luxury Car Sales

Apr 22, 2025