Analyzing The Bank Of Canada's Rate Pause: Key Takeaways From FP Video's Expert Interviews

Table of Contents

H2: Inflation's Persistent Grip and the Rate Pause Rationale

The Bank of Canada's mandate is to maintain price stability and full employment. However, stubbornly high inflation rates, as measured by the Consumer Price Index (CPI), have challenged this mandate. While headline inflation may be showing signs of cooling, core inflation – a measure that excludes volatile items like food and energy – remains elevated. This persistence of underlying inflationary pressures was a key discussion point among the experts interviewed on FP Video.

- Current Inflation Rates and the Bank of Canada's Target: Experts discussed the gap between current inflation figures and the Bank of Canada's 2% target. The discrepancy highlighted the ongoing challenge in bringing inflation back to the desired level.

- Persistence of Underlying Inflationary Pressures: The interviews explored the factors driving persistent inflation, including supply chain disruptions, strong consumer demand, and global inflationary pressures. Experts debated the effectiveness of past interest rate hikes in curbing these underlying pressures.

- Reasoning Behind the Rate Pause: The Bank's decision to pause rate increases, despite high inflation, was analyzed in detail. Experts discussed whether this pause signifies a change in strategy or a tactical adjustment to assess the impact of previous rate hikes. Some suggested the pause allows the Bank to observe the lagged effects of its previous tightening measures on the economy.

- Shift in Monetary Policy Strategy?: The interviews explored whether the pause signifies a fundamental shift in the Bank of Canada's overall monetary policy strategy. This included considering the potential for future rate cuts or a prolonged period of holding rates steady.

- Contrasting Expert Perspectives: Importantly, FP Video’s interviews highlighted differing opinions among economic experts. Some argued that the pause is premature given the persistent inflationary pressures, while others supported the Bank's cautious approach, emphasizing the potential risks of overtightening monetary policy.

H2: Assessing the Impact on the Canadian Economy

The Bank of Canada's rate pause will undoubtedly have significant repercussions for the Canadian economy. FP Video's experts provided nuanced analyses of the potential impacts across various sectors.

- Impact on GDP Growth: Experts weighed in on the likely effects of the rate pause on Gross Domestic Product (GDP) growth. While a pause could potentially stimulate economic activity by lowering borrowing costs, it could also allow inflation to remain elevated, hindering long-term growth.

- Effects on Employment: The interviews examined the potential impact on the Canadian job market. Lower interest rates might support employment growth, but persistent inflation could lead to wage stagnation and potentially job losses in certain sectors.

- Influence on the Housing Market and Consumer Spending: The experts discussed how the rate pause would influence the already cooling Canadian housing market and consumer spending patterns. Reduced borrowing costs might provide some support to the housing market, but the overall impact remains uncertain.

- Economic Forecast based on the Rate Pause: Based on the analysis presented in the interviews, the outlook for future economic performance varied depending on the assumed trajectory of inflation and global economic conditions.

- Potential Risks and Uncertainties: The experts highlighted several potential risks and uncertainties associated with the rate pause, including the possibility of a more persistent inflationary environment and the implications for future interest rate adjustments.

H2: Looking Ahead: Future Interest Rate Projections and Uncertainty

Predicting future interest rate movements remains a challenging task, but FP Video's expert interviews provided valuable insights into potential scenarios.

- Expert Predictions on Future Interest Rates: The interviews offered a range of projections for future interest rate movements, reflecting the inherent uncertainty surrounding the economic outlook. Some experts anticipated further rate hikes if inflation remained stubbornly high, while others foresaw a prolonged period of rate stability.

- Influencing Factors: Several key factors influencing these projections were highlighted, including the trajectory of inflation, global economic conditions, and the evolution of geopolitical risks.

- Uncertainty Surrounding Future Monetary Policy: The level of uncertainty surrounding the Bank of Canada's future monetary policy decisions was a recurring theme. Experts emphasized the data-dependent nature of the Bank's decisions, suggesting that future rate adjustments would hinge on incoming economic data and inflation trends.

- Potential Scenarios and Associated Risks: The experts outlined various potential scenarios and their associated risks, ranging from a soft landing to a more pronounced economic slowdown or even a recession.

- Dissenting Views on Future Interest Rates: The interviews highlighted differing expert opinions on the likely path of future interest rate adjustments, reflecting the complexity and uncertainty inherent in economic forecasting.

H3: The Role of Global Economic Factors

Global economic conditions play a significant role in shaping the Bank of Canada's monetary policy decisions.

- Influence of Global Economic Events: The experts discussed how global inflation, recessionary risks in major economies, and geopolitical instability can influence the Bank’s decisions.

- Impact of Global Inflation and Recessionary Risks: The interviews highlighted the transmission of global inflation and recessionary risks to the Canadian economy, underscoring the interconnectedness of global financial markets.

- Geopolitical Instability and Supply Chain Disruptions: The impact of geopolitical instability and persistent supply chain disruptions on the Canadian economy and the Bank's policy response were also key discussion points.

3. Conclusion:

The Bank of Canada's rate pause is a complex issue with far-reaching implications for the Canadian economy. FP Video's expert interviews offered valuable insights into the rationale behind the decision, its potential effects on inflation, economic growth, and the future trajectory of interest rates. While a degree of uncertainty remains, expert opinions provided a clearer picture of the current economic landscape and potential scenarios. The differing perspectives highlight the multifaceted nature of this crucial monetary policy decision and the ongoing challenges in navigating the current economic climate.

Call to Action: To stay informed on the evolving situation and gain deeper insights into the Bank of Canada's monetary policy decisions, continue watching FP Video's expert analyses and stay updated on their insightful coverage of the Bank of Canada's rate pause and its ongoing implications for the Canadian economy. Learn more about the Bank of Canada's interest rate decisions by exploring further resources and analysis available online. Understanding the Bank of Canada's actions is crucial for navigating the complexities of the Canadian economic landscape.

Featured Posts

-

Fan Graphs Power Rankings March 27th April 6th Analysis

Apr 23, 2025

Fan Graphs Power Rankings March 27th April 6th Analysis

Apr 23, 2025 -

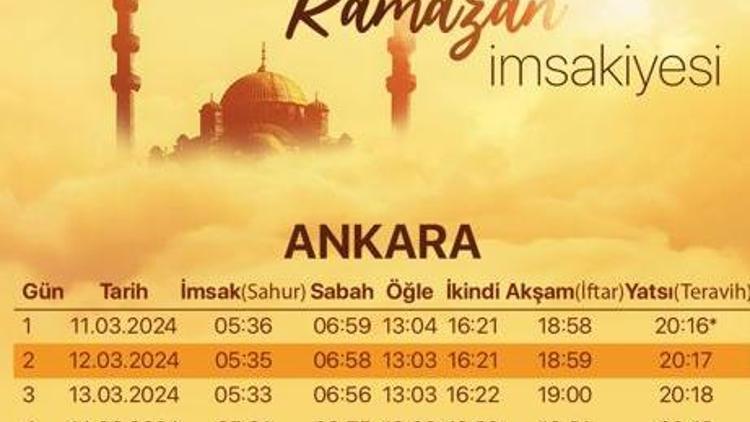

Ankara 10 Mart 2025 Pazartesi Iftar Ve Sahur Saatleri

Apr 23, 2025

Ankara 10 Mart 2025 Pazartesi Iftar Ve Sahur Saatleri

Apr 23, 2025 -

Retail Leaders From Walmart And Target To Confer With Trump On Tariffs

Apr 23, 2025

Retail Leaders From Walmart And Target To Confer With Trump On Tariffs

Apr 23, 2025 -

Best And Worst Uk Diy Stores A Consumer Report

Apr 23, 2025

Best And Worst Uk Diy Stores A Consumer Report

Apr 23, 2025 -

Unveiling The Mystery How Shota Imanaga Throws Mlbs Best Splitter

Apr 23, 2025

Unveiling The Mystery How Shota Imanaga Throws Mlbs Best Splitter

Apr 23, 2025