Analysis Of Tesla's Q1 Earnings: 71% Net Income Decrease And Political Challenges

Table of Contents

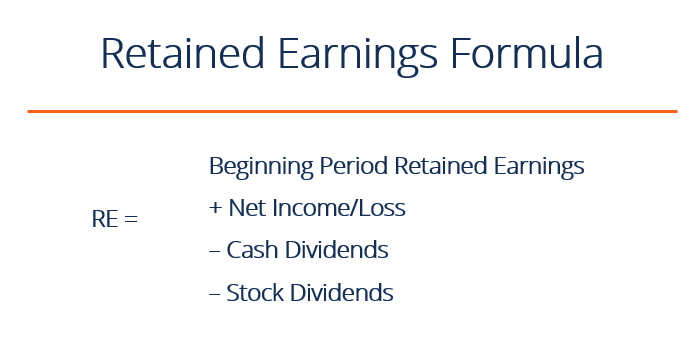

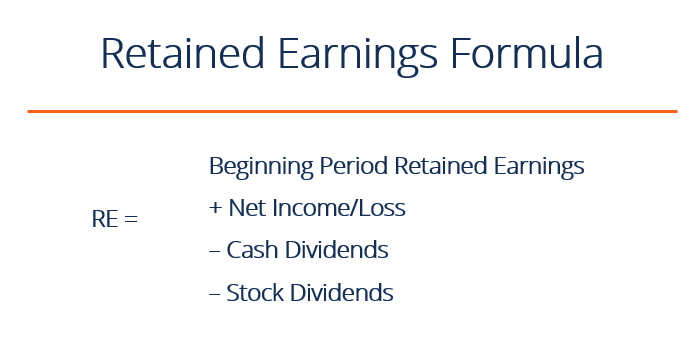

Deconstructing the 71% Net Income Decrease in Tesla's Q1 Earnings

The sharp drop in Tesla's Q1 net income is a multifaceted issue demanding a thorough examination. Several key factors contributed to this significant decrease, impacting the company's overall profitability and investor confidence.

Impact of Price Cuts

Tesla's aggressive price cuts, implemented across its vehicle lineup, significantly impacted profitability margins.

- Rationale: The price reductions aimed to boost sales volume and increase market share in a fiercely competitive electric vehicle (EV) market. Tesla faced growing pressure from established automakers and emerging EV startups.

- Short-term vs. Long-term Implications: While the price cuts generated higher sales volumes in the short term, they squeezed profit margins, directly contributing to the substantial decrease in net income reported in Tesla's Q1 earnings. The long-term impact remains uncertain, depending on Tesla's ability to maintain sufficient sales volume to offset lower profit margins per vehicle.

- Investor Sentiment: The aggressive price cuts negatively impacted investor sentiment, leading to a sell-off in Tesla stock. Investors questioned the sustainability of Tesla's business model in light of the diminished profitability. The Q1 report revealed a direct correlation between the price cuts and the reduction in profit margins, causing concern among stakeholders.

Production and Supply Chain Issues

Disruptions in Tesla's production process and supply chain also played a role in the decline of Q1 earnings.

- Bottlenecks and Shortages: Reports indicated potential bottlenecks in certain manufacturing processes and ongoing challenges securing raw materials essential for EV production. This led to production slowdowns and reduced output compared to previous quarters.

- Logistical Challenges: Global supply chain disruptions, including shipping delays and port congestion, further hampered Tesla's ability to deliver vehicles efficiently and maintain optimal production levels.

- Production Numbers: Comparing Q1 2024 production figures to previous quarters reveals a noticeable decrease, directly contributing to lower revenue and ultimately, the substantial decline in net income. The Q1 earnings report specifically highlighted these logistical hurdles as a key factor affecting overall profitability.

Increased Operational Costs

A significant increase in operational expenses further exacerbated the decline in Tesla's Q1 net income.

- R&D Spending: Tesla's substantial investment in research and development, while essential for long-term innovation, added significantly to operational costs.

- Marketing and Administrative Costs: Increased marketing and administrative expenses, driven by expansion into new markets and ongoing business operations, also contributed to the overall cost increase.

- Sustainability of Costs: The sustainability of these elevated operational costs is a critical concern for investors. Future earnings will depend on Tesla's ability to manage expenses efficiently while continuing to invest in innovation and growth. The Q1 earnings report detailed these increased costs and their impact on the bottom line.

Navigating the Turbulent Waters: Tesla's Political Challenges

Beyond the financial challenges, Tesla faces significant political headwinds that impact its global operations and profitability.

Geopolitical Risks and International Market Volatility

Political instability and economic fluctuations in key international markets significantly affected Tesla's performance during Q1.

- Trade Wars and Tariffs: Ongoing trade tensions and associated tariffs imposed by various governments impacted Tesla's international sales and profitability.

- Regional Political Risks: Political instability and uncertainty in certain regions disrupted supply chains and created challenges for market access and sales.

- Currency Fluctuations: Significant fluctuations in exchange rates negatively impacted the profitability of Tesla's international operations.

Regulatory Scrutiny and Government Policies

Government regulations and policies worldwide pose ongoing challenges for Tesla's operations.

- Environmental Regulations: Stringent environmental regulations in various countries added to Tesla's operational costs and influenced its production strategies.

- Subsidies and Incentives: The availability of government subsidies and incentives for EV adoption varies significantly across different regions, affecting Tesla's competitive landscape and profitability.

- Safety Standards and Recall Issues: Meeting stringent safety standards and dealing with potential recalls add significant costs and can negatively impact brand reputation.

Public Relations and Brand Image

Negative publicity and controversies also played a role in influencing Tesla’s brand perception and investor confidence.

- Elon Musk's Controversies: The actions and statements of Elon Musk, Tesla's CEO, have occasionally generated negative publicity that impacted the company's image.

- Safety Concerns and Product Recalls: Reports of safety issues and product recalls have influenced public perception and potentially impacted sales.

- Impact on Investor Confidence: Negative news and controversies can erode investor confidence and trigger sell-offs, influencing Tesla's stock valuation.

The Future of Tesla's Q1 Earnings and Beyond

Tesla's Q1 earnings report revealed a challenging quarter, marked by a significant net income decrease and mounting political challenges. The aggressive price cuts, production and supply chain disruptions, increased operational costs, and the complex geopolitical landscape all contributed to the disappointing results. However, Tesla's long-term prospects remain tied to its technological innovation, market leadership in the EV sector, and its ability to adapt to the changing global environment. The company's ability to navigate these challenges will be crucial to its future success. Successful management of costs, effective supply chain optimization, and deft navigation of the complex political landscape will be key determinants of Tesla’s future profitability.

Stay tuned for further analysis of Tesla's Q2 earnings and ongoing developments that will continue to shape the future of this influential electric vehicle manufacturer. Understanding Tesla's Q1 earnings is crucial for anyone invested in the future of the automotive industry.

Featured Posts

-

Reduced Consumer Spending A Challenge For Credit Card Issuers

Apr 24, 2025

Reduced Consumer Spending A Challenge For Credit Card Issuers

Apr 24, 2025 -

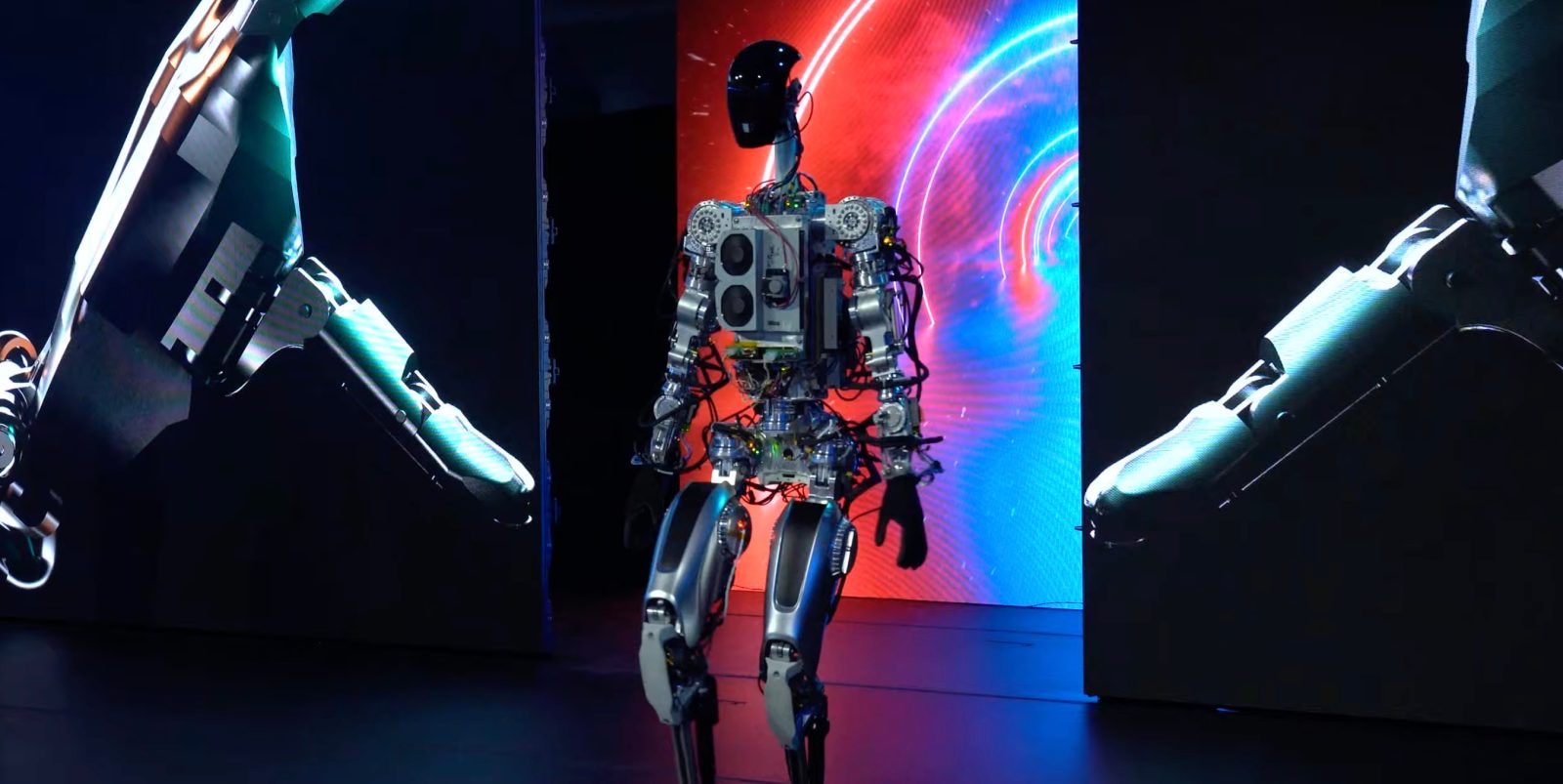

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

India And Saudi Arabia Joint Venture Two New Oil Refineries Planned

Apr 24, 2025

India And Saudi Arabia Joint Venture Two New Oil Refineries Planned

Apr 24, 2025 -

Increased Fundraising Efforts At Elite Universities A Response To Political Pressure

Apr 24, 2025

Increased Fundraising Efforts At Elite Universities A Response To Political Pressure

Apr 24, 2025 -

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025