Analysis: Broadcom's Extreme Price Hike For VMware And Its Impact

Table of Contents

The Magnitude of the Price Increase

The price increases following Broadcom's acquisition of VMware are substantial and affect various key products within the VMware portfolio. Let's examine some specific examples:

- vSphere: The core virtualization platform, vSphere, has seen significant price increases across its licensing tiers. vSphere Standard pricing saw a reported 20% increase, while Enterprise Plus experienced a 25% jump. This directly impacts enterprise budgets and long-term IT planning.

- vSAN: VMware's software-defined storage solution, vSAN, also faced price hikes, ranging from 15% to 20% depending on the configuration and licensing model. This increase adds to the overall cost of virtualization infrastructure.

- NSX: VMware's network virtualization platform, NSX, experienced price increases mirroring those of vSphere, with similar percentage increases across its licensing options. This impacts organizations heavily reliant on network virtualization for their cloud and on-premise operations.

These price increases are not merely incremental adjustments. Compared to previous pricing models and competitor offerings, VMware's new pricing structure under Broadcom is considerably more expensive, placing significant pressure on existing customers and potentially hindering new adoption.

- Percentage Increases:

- vSphere Standard: 20%

- vSphere Enterprise Plus: 25%

- vSAN: 15-20%

- NSX: 20-25% (depending on edition)

Broadcom's Rationale Behind the Price Hike

Several factors might explain Broadcom's decision to implement such significant price hikes. These include:

- Increased Profitability: The acquisition cost necessitates a return on investment, and increasing prices is a direct method to boost profitability.

- Shareholder Value Maximization: Boosting profits directly increases shareholder value, a key driver for publicly traded companies like Broadcom.

- Cost Recovery from Acquisition: The massive acquisition cost needs to be recouped, and price increases are one way to accelerate this process.

- Market Consolidation Strategy: By increasing prices, Broadcom might aim to force smaller competitors out of the market, leading to greater market share and control.

Broadcom's long-term strategy for VMware likely involves significant integration, leveraging synergies across its existing portfolio, and ultimately establishing market dominance in enterprise software and cloud computing. This aggressive pricing strategy could be a key component of that plan. Potential cost-cutting measures post-acquisition might also indirectly contribute to the price increases, as operational efficiencies aren't necessarily passed onto the customer.

- Possible Explanations:

- Increased R&D investment in VMware products

- Debt repayment related to the acquisition

- Market consolidation strategy to eliminate competition

Impact on VMware Customers and the Competitive Landscape

The price hikes are already causing considerable unease among VMware customers. Reactions include:

- Increased Scrutiny of Licensing Agreements: Businesses are carefully reviewing their contracts to assess the true cost implications.

- Search for Alternative Virtualization Solutions: Many organizations are exploring alternatives such as AWS, Azure, and Google Cloud, which might offer more cost-effective options.

- Budgetary Constraints Forcing Re-evaluation: Many companies are re-evaluating their VMware deployments due to budgetary limitations caused by the price increases.

This shift creates a significant opportunity for competitors. The increased cost of VMware products under Broadcom makes rival cloud platforms and open-source virtualization solutions more attractive. This could lead to a considerable shift in market share, particularly as cloud adoption continues to accelerate.

- Customer Reactions:

- Increased pressure to negotiate contracts

- Budget reallocations impacting overall IT strategy

- Active exploration of alternative cloud providers

Regulatory Scrutiny and Antitrust Concerns

Broadcom's acquisition of VMware and subsequent price increases have naturally attracted significant regulatory scrutiny. Antitrust concerns center on:

- Reduced Competition: The acquisition reduces the number of major players in the enterprise software market, potentially leading to less innovation and higher prices overall.

- Monopolistic Practices: The aggressive price hikes raise concerns about potential monopolistic behavior, squeezing out smaller competitors and limiting customer choice.

- Potential for Stifled Innovation: Reduced competition can stifle innovation as the dominant player might have less incentive to invest in new technologies.

Potential regulatory actions could range from investigations and fines to even a forced divestiture of parts of VMware. Such actions would significantly impact Broadcom's pricing strategy and its market position, potentially leading to price reductions or changes in its overall business strategy.

- Regulatory Concerns:

- Investigations by antitrust authorities in multiple jurisdictions

- Potential for fines and mandated changes to business practices

- Pressure to reconsider pricing strategies

Conclusion

Broadcom's aggressive price hikes following the VMware acquisition raise significant concerns regarding competition, customer satisfaction, and regulatory scrutiny. The magnitude of these Broadcom VMware price hikes could reshape the competitive landscape of the enterprise software market, potentially benefiting rival cloud providers and alternative virtualization solutions. The long-term impact remains to be seen, but the immediate effect is increased pressure on existing VMware customers and a surge in interest in competitor offerings.

Call to Action: Understanding the full impact of Broadcom's pricing strategy on your organization is crucial. Conduct a thorough review of your VMware licensing agreements and explore alternative solutions to mitigate the impact of these Broadcom VMware price hikes. Don't wait – analyze your options now to safeguard your business.

Featured Posts

-

John Travolta And Rotten Tomatoes A Statistical Analysis Of His Film Career

Apr 24, 2025

John Travolta And Rotten Tomatoes A Statistical Analysis Of His Film Career

Apr 24, 2025 -

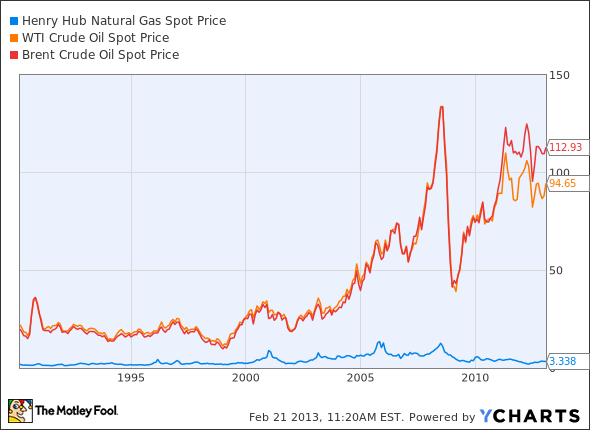

Eus Plan To Phase Out Russian Gas Spot Market In Focus

Apr 24, 2025

Eus Plan To Phase Out Russian Gas Spot Market In Focus

Apr 24, 2025 -

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 24, 2025

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 24, 2025 -

Tarantinov Prezir Film S Travoltom Koji Nikad Nece Pogledati

Apr 24, 2025

Tarantinov Prezir Film S Travoltom Koji Nikad Nece Pogledati

Apr 24, 2025 -

Alterya Joins Chainalysis Strengthening Blockchain Security With Ai

Apr 24, 2025

Alterya Joins Chainalysis Strengthening Blockchain Security With Ai

Apr 24, 2025