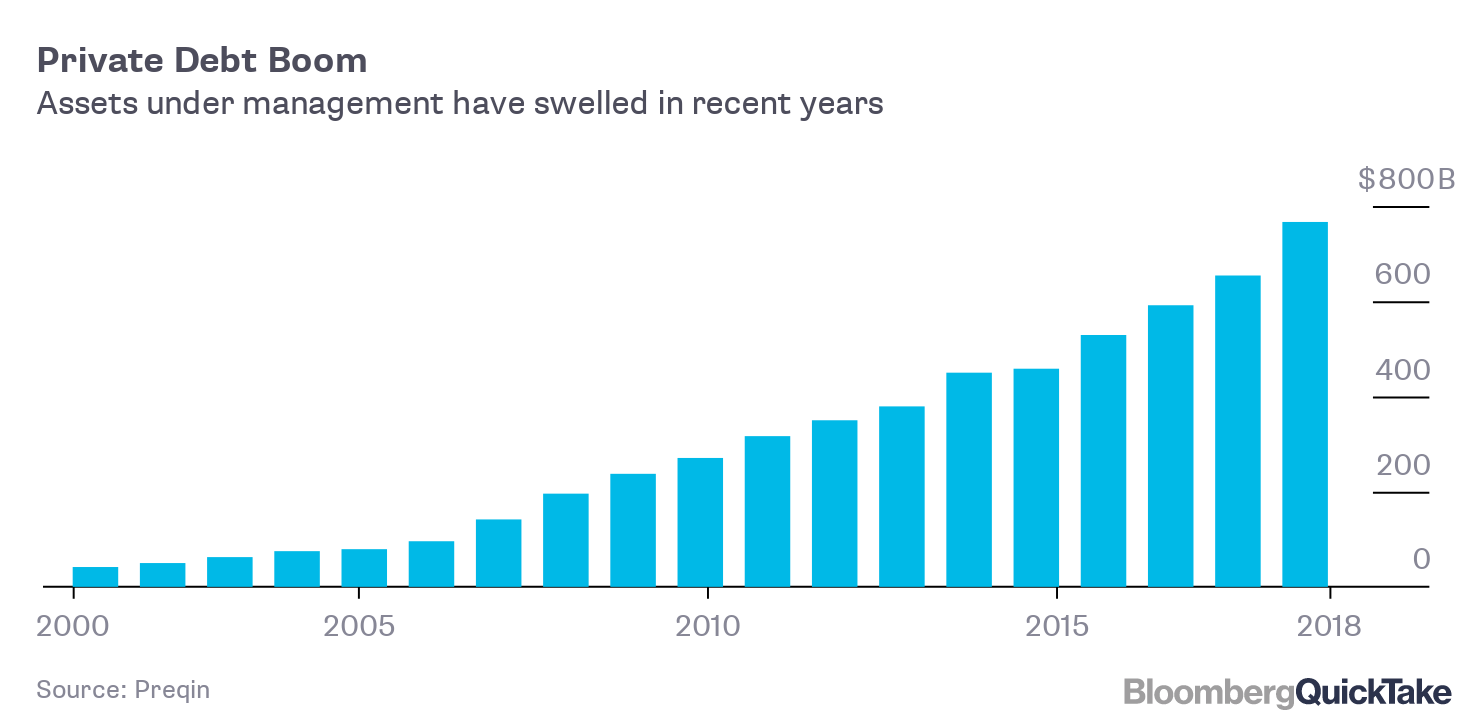

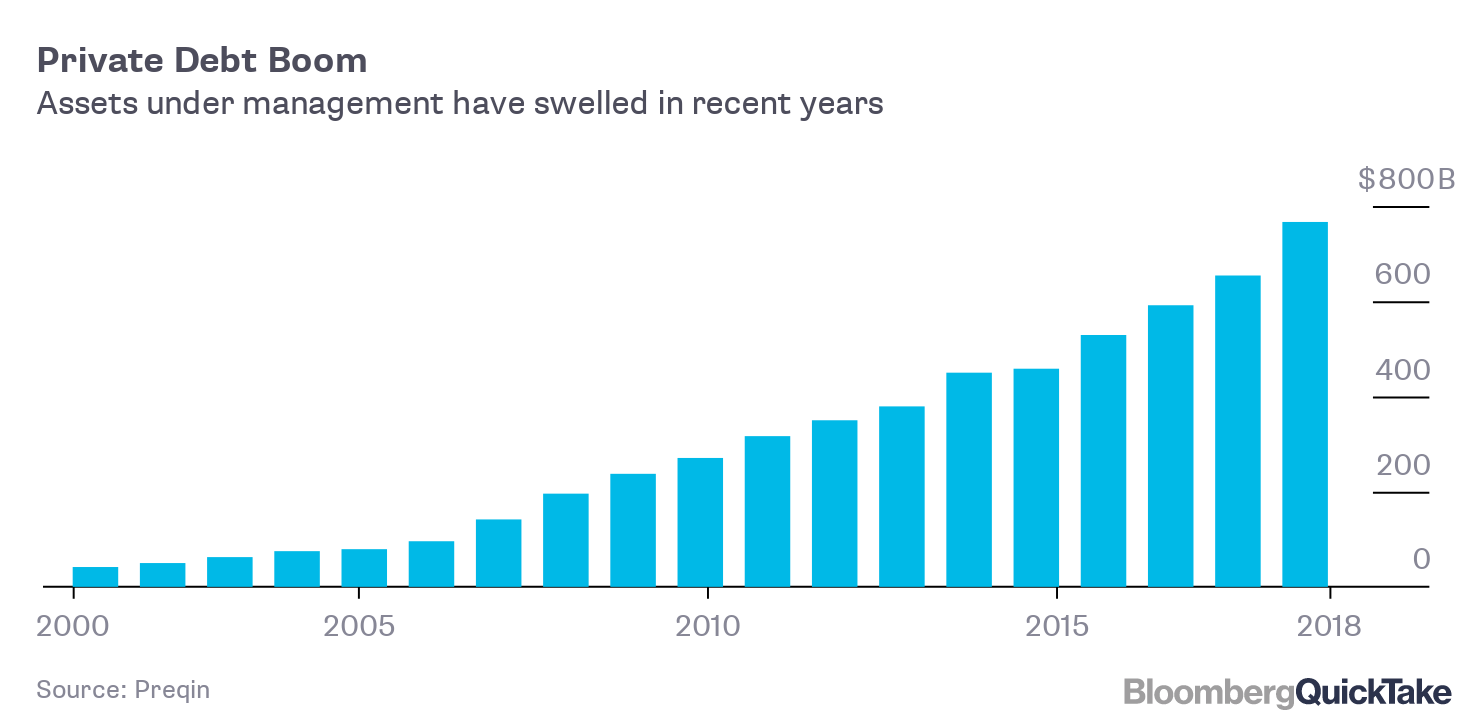

5 Key Actions To Secure A Private Credit Role During The Current Boom

Table of Contents

Network Strategically Within the Private Credit Industry

Building a strong network is paramount in the private credit industry. It's a relationship-driven field, and knowing the right people can open doors to otherwise unavailable opportunities. Here's how to leverage your network effectively:

Leverage LinkedIn Effectively:

- Optimize your profile: Use relevant keywords like private credit, leveraged finance, direct lending, distressed debt, credit analysis, and financial modeling. A strong headline and summary showcasing your expertise are critical.

- Engage actively: Don't just passively observe; like, comment, and share relevant posts to increase your visibility. Engage with industry leaders and recruiters directly.

- Join relevant groups: Participate in discussions within LinkedIn groups focused on private credit, finance, and investment. Share your insights and ask thoughtful questions.

- Utilize advanced search: LinkedIn's advanced search allows you to target specific professionals within private credit firms, enabling you to connect with the right people.

Attend Industry Events and Conferences:

- Network effectively: Private credit conferences offer invaluable networking opportunities. Prepare elevator pitches that concisely highlight your skills and career goals.

- Prepare for conversations: Research firms attending the conference and individuals you want to connect with. Come prepared with questions to show genuine interest.

- Follow up diligently: After the event, send personalized follow-up emails or LinkedIn messages to maintain connections.

Informational Interviews:

- Reach out proactively: Don't be afraid to reach out to professionals for informational interviews. Explain your interest in private credit and request 15-20 minutes of their time.

- Prepare thoughtful questions: Show your understanding of the industry by asking insightful questions about their career path, the firm's culture, and current market trends.

- Show gratitude: Send a thank-you note after the interview expressing your appreciation for their time and insights.

Master the Essential Private Credit Skills

Possessing the right skills is crucial for securing a private credit role. Employers look for individuals with a strong foundation in financial modeling, credit analysis, and legal and regulatory compliance.

Develop Financial Modeling Expertise:

- Proficiency in Excel: Master advanced Excel functions, including financial modeling techniques for discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and sensitivity analysis.

- Specialized tools: Familiarize yourself with industry-standard financial modeling software and platforms.

- Real-world practice: Work on case studies and practice building models for different private credit transactions (e.g., unitranche, mezzanine, senior secured).

Understand Credit Analysis and Due Diligence:

- Credit analysis techniques: Develop expertise in analyzing financial statements, assessing credit risk, and determining appropriate credit metrics and ratios (e.g., leverage, interest coverage, debt-to-equity).

- Due diligence procedures: Understand the steps involved in conducting thorough due diligence on potential investments, including financial statement analysis, legal reviews, and operational assessments.

- Industry benchmarks: Familiarize yourself with industry benchmarks and comparative analysis to accurately assess the creditworthiness of potential borrowers.

Enhance Your Understanding of Legal and Regulatory Frameworks:

- Compliance knowledge: Stay updated on the legal and regulatory landscape affecting private credit, including compliance requirements, best practices, and relevant regulations.

- Continuing education: Consider pursuing relevant certifications or taking continuing education courses to enhance your understanding of private credit legal frameworks.

Tailor Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression. Make them count!

Highlight Relevant Experience:

- Quantify achievements: Use numbers to demonstrate your impact. For example, instead of "Improved efficiency," write "Improved efficiency by 15% through process optimization."

- Action verbs: Start your bullet points with strong action verbs that showcase your accomplishments (e.g., managed, developed, analyzed, negotiated).

- Transferable skills: Highlight transferable skills from previous roles that are relevant to private credit, even if they're from different industries.

Customize for Each Application:

- Keyword optimization: Integrate keywords from the job description into your resume and cover letter to improve your chances of applicant tracking system (ATS) success.

- Targeted approach: Tailor your application to each specific job, highlighting the skills and experience most relevant to the position and the company's investment strategy.

Seek Professional Review:

- Feedback is key: Have trusted individuals (e.g., mentors, career counselors) review your resume and cover letter before submitting them.

- Professional assistance: If needed, consider professional resume writing services to enhance your application materials.

Ace the Private Credit Interview Process

The interview stage is critical. Preparation is key to success.

Prepare for Behavioral Questions:

- STAR method: Use the STAR method (Situation, Task, Action, Result) to answer behavioral questions concisely and effectively.

- Highlight soft skills: Showcase your teamwork, communication, problem-solving, and leadership abilities.

Demonstrate Technical Proficiency:

- Financial modeling skills: Be prepared to discuss your financial modeling experience and answer questions about your approach to building models.

- Case study preparation: Practice solving case studies related to private credit transactions and due diligence.

Research the Firm and Interviewers:

- Deep dive: Thoroughly research the firm's investment strategy, portfolio companies, and team members.

- Ask insightful questions: Prepare thoughtful questions to demonstrate your interest and understanding of the firm.

Stay Updated on Industry Trends and Developments

The private credit landscape is constantly evolving. Staying informed is crucial.

Follow Industry News:

- Stay current: Read industry publications, blogs, and news sources regularly to stay abreast of the latest trends and developments in private credit.

- Follow thought leaders: Follow key influencers and thought leaders on social media platforms like LinkedIn and Twitter to stay informed about industry insights and discussions.

Attend Webinars and Online Courses:

- Continuous learning: Participate in online learning opportunities to enhance your skills and knowledge. Look for industry-specific webinars and online courses focusing on private credit.

Conclusion:

Securing a private credit role during this boom requires proactive effort and strategic planning. By networking effectively, mastering essential skills, tailoring your application materials, acing the interview process, and staying updated on industry trends, you significantly increase your chances of landing your dream job. Don't delay; start implementing these five key actions today to advance your career in the exciting world of private credit. Take control of your future and secure your place in the booming private credit sector!

Featured Posts

-

Planirajte Svoju Uskrsnju Kupovinu Otvorene Trgovine

Apr 23, 2025

Planirajte Svoju Uskrsnju Kupovinu Otvorene Trgovine

Apr 23, 2025 -

Pavel Pivovarov I Aleksandr Ovechkin Novaya Kollektsiya Mercha

Apr 23, 2025

Pavel Pivovarov I Aleksandr Ovechkin Novaya Kollektsiya Mercha

Apr 23, 2025 -

Nine Home Runs Power Yankees To Victory In 2025 Season Opener

Apr 23, 2025

Nine Home Runs Power Yankees To Victory In 2025 Season Opener

Apr 23, 2025 -

Colis Reutilisables Hipli Optimisez Vos Expeditions Et Reduisez Votre Impact

Apr 23, 2025

Colis Reutilisables Hipli Optimisez Vos Expeditions Et Reduisez Votre Impact

Apr 23, 2025 -

Broadcoms V Mware Deal At And T Highlights Extreme 1 050 Cost Increase

Apr 23, 2025

Broadcoms V Mware Deal At And T Highlights Extreme 1 050 Cost Increase

Apr 23, 2025