5 Essential Do's And Don'ts: Succeeding In The Private Credit Market

Table of Contents

Do: Thorough Due Diligence: Understanding Your Investments in the Private Credit Market

Investing in the private credit market demands meticulous due diligence. A superficial analysis can lead to significant losses. Thorough investigation is paramount to success.

Credit Analysis: Go beyond superficial numbers.

Before committing to any private credit investment, a comprehensive credit analysis is crucial. This goes beyond simply reviewing the headline numbers. You need a deep dive into the financial health of the borrower.

- Analyze cash flow: Examine the borrower's ability to generate sufficient cash flow to meet its debt obligations.

- Debt service coverage ratio (DSCR): Assess the borrower's ability to cover its debt payments with its operating income. A healthy DSCR is essential.

- Leverage ratios: Evaluate the borrower's debt levels relative to its equity. High leverage indicates higher risk.

- Collateral value: Determine the value of any collateral securing the loan. Independent appraisals are recommended.

- Qualitative factors: Don't overlook the qualitative aspects. Consider the experience and track record of the management team, the industry's competitive landscape, and the overall business strategy. Independent verification of all information is crucial.

Legal and Regulatory Compliance: Navigate the complex regulatory landscape.

The private credit market operates within a complex regulatory framework. Ignoring legal and regulatory requirements can lead to severe consequences.

- Understand relevant regulations: Familiarize yourself with all applicable lending, securities, and privacy regulations. These regulations vary significantly depending on the jurisdiction and the specific type of private credit investment.

- Seek legal counsel: Consult with legal professionals experienced in private credit transactions. They can help ensure compliance and protect your interests.

Do: Build a Strong Network in the Private Credit Market

Networking is essential for success in the private credit market. Building strong relationships with key players can unlock valuable deal flow and insights.

Networking Events and Conferences: Attend industry events to connect with potential borrowers and investors.

Industry events provide unparalleled opportunities to connect with potential borrowers, investors, and other professionals.

- Attend relevant conferences: Research and attend industry conferences and workshops focused on private credit, finance, and alternative investments.

- Build relationships: Actively engage with other attendees, including fund managers, lawyers, accountants, and other professionals working within the private credit market.

Leverage Online Platforms: Utilize online tools for sourcing deals and connecting with potential partners.

Online platforms and resources are increasingly important in connecting with potential partners and sourcing deals in the private credit market.

- Utilize online platforms: Explore dedicated online platforms, forums, and industry news sources that focus on private credit investments and deal sourcing.

Do: Diversify Your Private Credit Portfolio

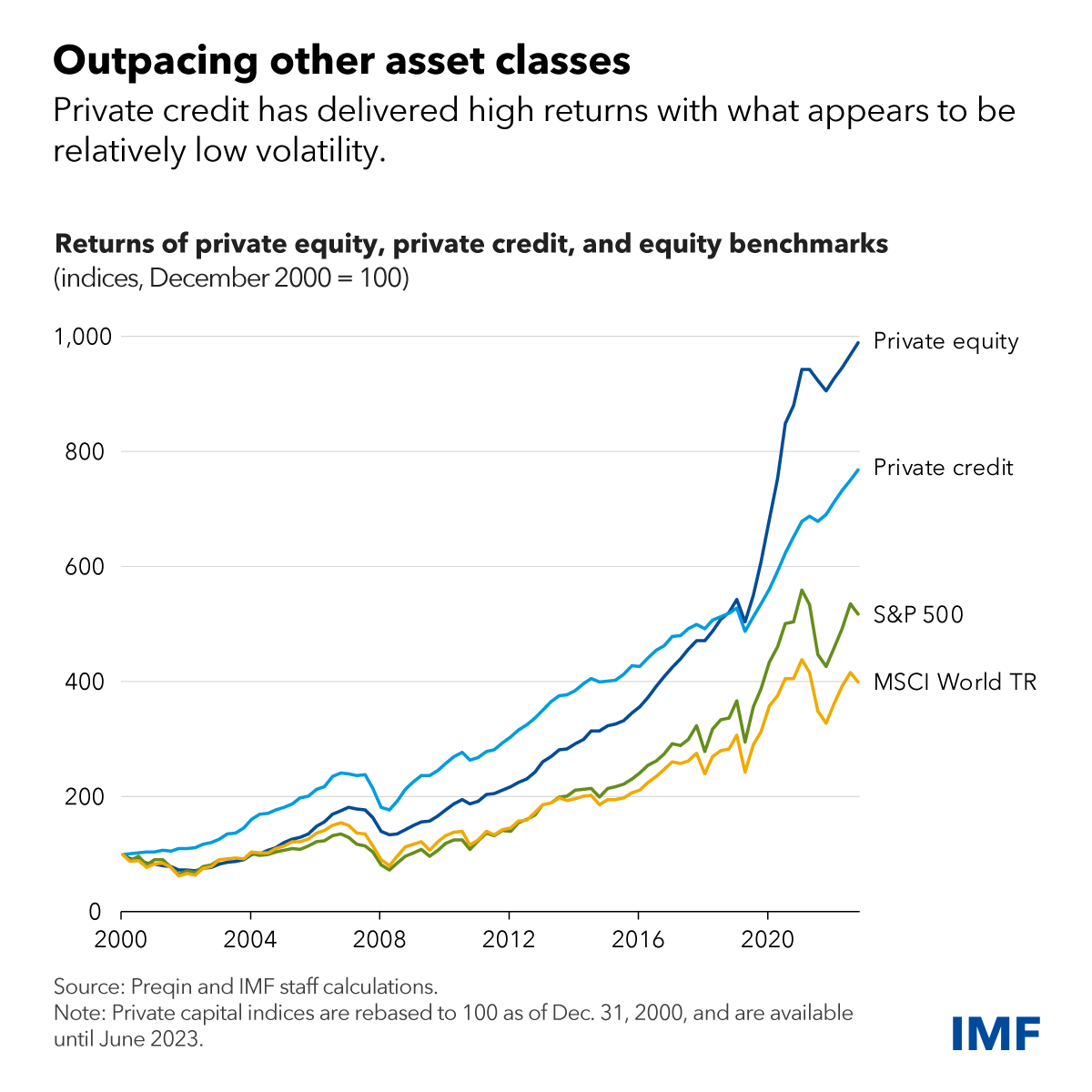

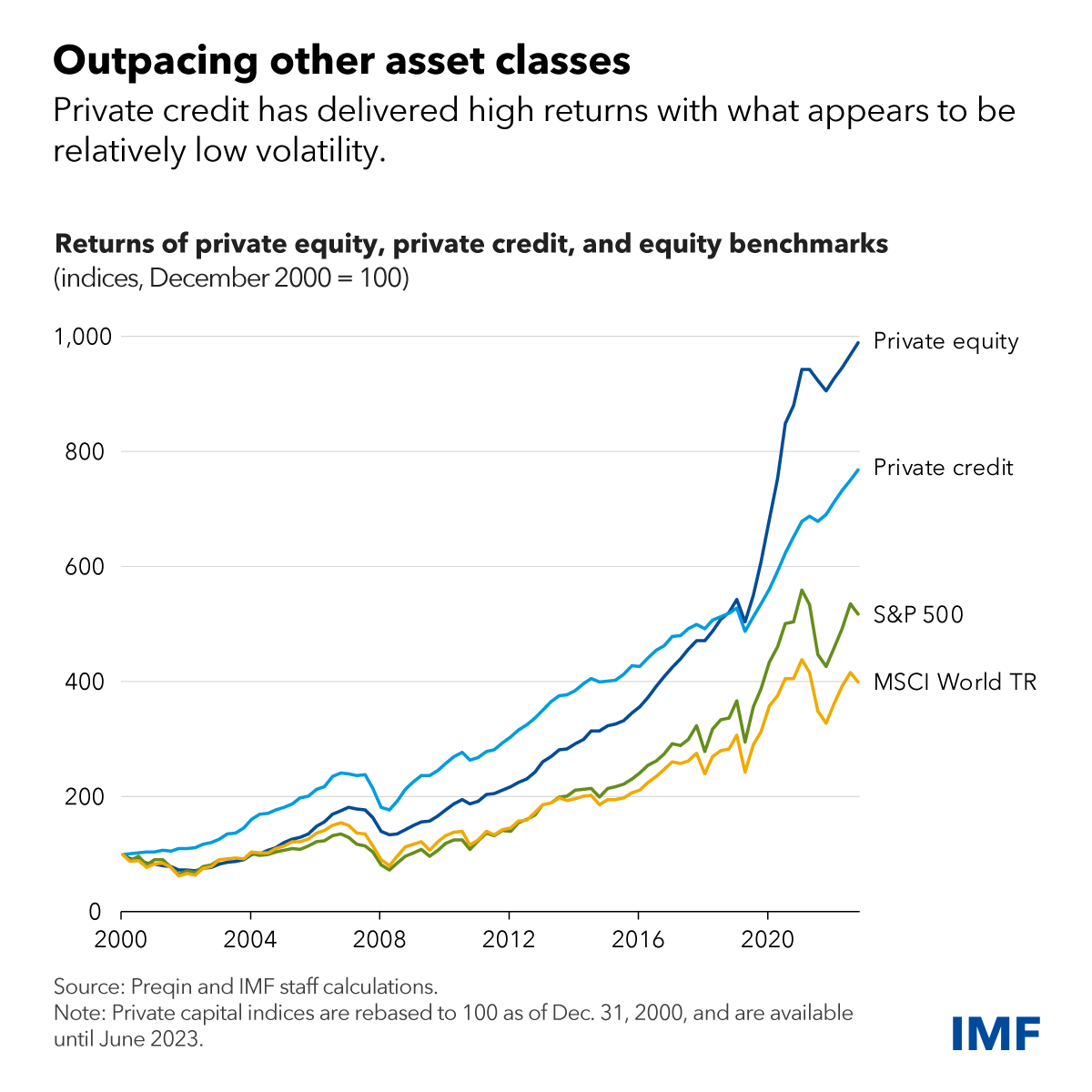

Diversification is a cornerstone of sound investment strategy, and the private credit market is no exception. Spreading your investments across different asset classes and borrowers can significantly mitigate risk.

Asset Class Diversification: Don't put all your eggs in one basket.

The private credit market encompasses a variety of asset classes, each with its own risk and return profile.

- Senior secured loans: These offer higher seniority in the capital structure, providing greater protection in case of default.

- Mezzanine debt: This sits between senior secured debt and equity, offering a higher return but with greater risk.

- Distressed debt: Investing in debt of companies in financial distress can generate high returns, but also carries significant risk.

Borrower Diversification: Spread risk across multiple borrowers.

Concentrating your investments in a few borrowers exposes you to significant risk if one experiences financial difficulties.

- Diversify across industries: Invest in borrowers across different industries to reduce your exposure to sector-specific risks.

- Diversify geographically: Consider investing in borrowers across different geographic regions to mitigate regional economic downturns.

Don't: Underestimate the Importance of Exit Strategies in the Private Credit Market

Having a well-defined exit strategy is crucial for successful investing in the private credit market. Without a clear plan, liquidity can become a significant challenge.

Plan for Liquidity: Consider how you will exit your investments.

Knowing how and when you will exit your investments is critical for maximizing returns.

- Refinancing: Explore opportunities to refinance the debt at a higher price or more favorable terms.

- Sale to another investor: Identify potential buyers for your investments.

- IPO: If the borrower is a promising company, an IPO can provide an excellent exit opportunity. Planning your exit strategy early in the investment process is crucial for success.

Ignore Market Cycles: Understand the cyclical nature of the private credit market.

Like any market, the private credit market experiences cyclical trends. Understanding and adapting to these cycles is vital for long-term success.

- Monitor market trends: Stay informed about macroeconomic factors that could impact the private credit market, such as interest rate changes and overall economic conditions.

- Position your portfolio accordingly: Adjust your investment strategy to account for anticipated market fluctuations.

Don't: Neglect Risk Management in the Private Credit Market

Risk management is paramount in the private credit market. Thorough risk assessment and ongoing monitoring are essential to protect your investments.

Credit Risk: Assess the creditworthiness of borrowers thoroughly.

Credit risk is inherent in the private credit market. Thorough due diligence and ongoing monitoring are essential to mitigate this risk.

- Conduct ongoing monitoring: Regularly review the financial performance of borrowers and address any emerging issues proactively.

Market Risk: Understand broader economic factors.

Macroeconomic factors can significantly impact the private credit market. Understanding these factors is essential for mitigating market risk.

- Interest rate changes: Changes in interest rates can significantly impact the value of private credit investments.

- Economic downturns: Economic downturns can increase default rates and reduce the value of private credit investments.

Conclusion: Mastering the Private Credit Market: Key Takeaways and Next Steps

Successfully navigating the private credit market requires a combination of thorough due diligence, strategic networking, portfolio diversification, careful planning for exits, and proactive risk management. By adhering to the "do's" and avoiding the "don'ts" outlined above, you can significantly improve your chances of success in this dynamic market. Remember, the private credit market offers significant opportunities, but it's crucial to approach it with a well-informed and cautious strategy.

Don't hesitate to conduct thorough research and seek professional advice before making any investments in the private credit market. Consider consulting with experienced financial advisors specializing in alternative investments to help you craft a sound strategy for participating in the private credit market.

Featured Posts

-

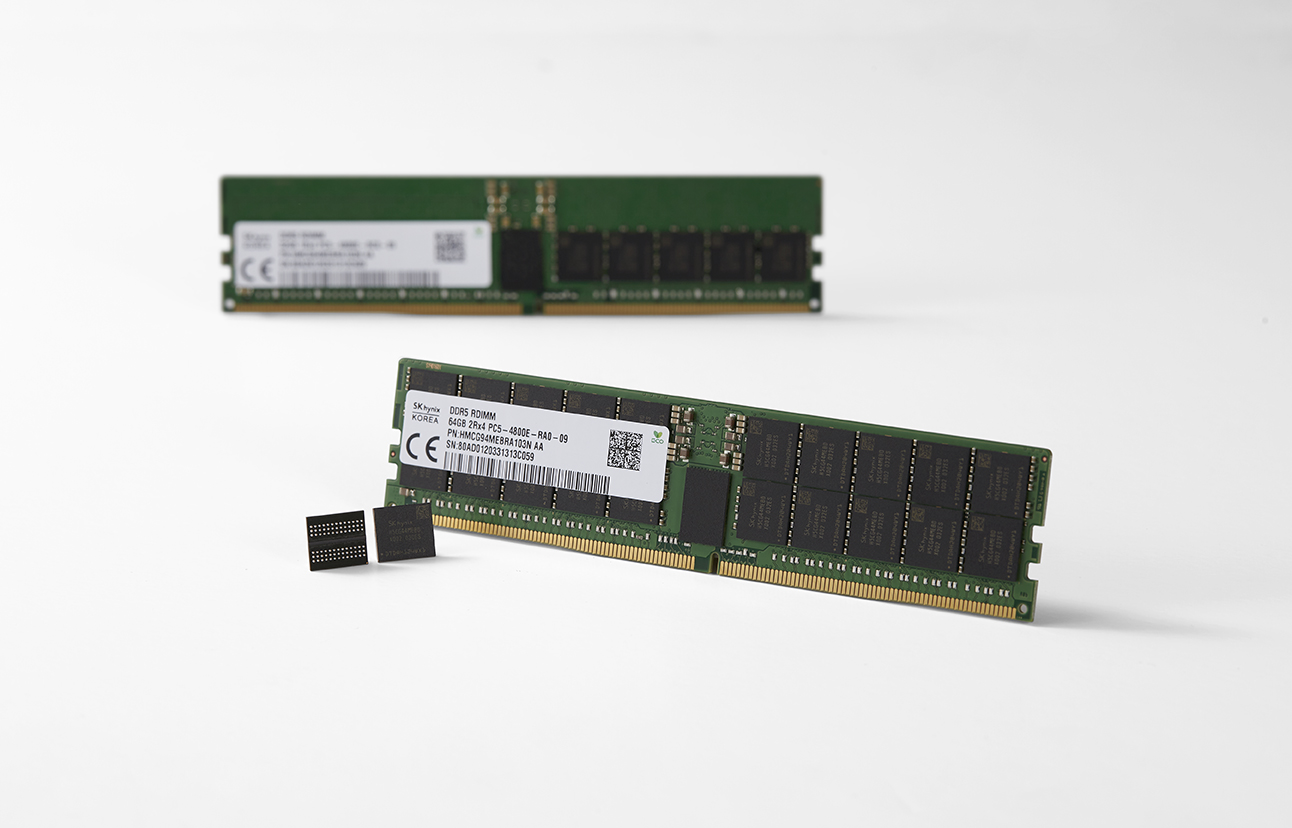

Sk Hynix Emerges As Dram Leader The Impact Of Artificial Intelligence

Apr 24, 2025

Sk Hynix Emerges As Dram Leader The Impact Of Artificial Intelligence

Apr 24, 2025 -

127 Years Of Brewing History Ends Anchor Brewing Company Shuts Down

Apr 24, 2025

127 Years Of Brewing History Ends Anchor Brewing Company Shuts Down

Apr 24, 2025 -

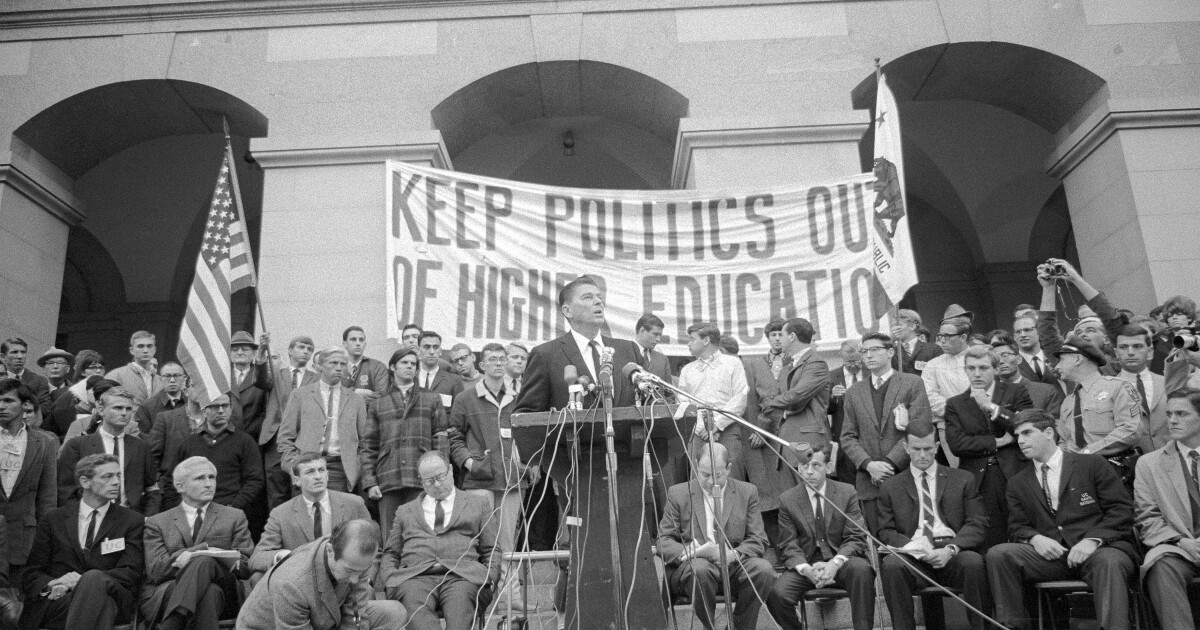

Funding Strategies For Elite Universities Amidst Political Scrutiny

Apr 24, 2025

Funding Strategies For Elite Universities Amidst Political Scrutiny

Apr 24, 2025 -

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025 -

Brett Goldstein Compares Ted Lassos Return To A Miraculous Cat Comeback

Apr 24, 2025

Brett Goldstein Compares Ted Lassos Return To A Miraculous Cat Comeback

Apr 24, 2025