5 Do's And Don'ts To Secure A Private Credit Role In Today's Market

Table of Contents

5 Do's to Secure a Private Credit Role

Do 1: Network Strategically

Building a strong network is paramount in the private credit industry. Networking isn't just about collecting business cards; it's about building genuine relationships.

- Attend Industry Events: Conferences, workshops, and networking events offer invaluable opportunities to connect with private credit professionals.

- Leverage LinkedIn: Optimize your LinkedIn profile, actively engage in relevant groups, and connect with individuals working in private credit firms you admire.

- Informational Interviews: Reach out to professionals for informational interviews. These conversations provide insights into the industry and can lead to unexpected opportunities. Target specific firms and individuals within those firms whose work resonates with you.

For example, one successful candidate secured an interview through a LinkedIn connection made at a private equity conference six months prior to their job application. This highlights the power of consistent and strategic networking within the private credit networking community.

Do 2: Tailor Your Resume and Cover Letter

Generic applications rarely succeed in a competitive field like private credit. Each application should be meticulously crafted to highlight your skills and experience relevant to the specific job description.

- Customize for Each Application: Don't use a generic private credit resume or private debt resume. Tailor your resume and cover letter to each opportunity.

- Quantify Achievements: Instead of simply listing responsibilities, quantify your accomplishments using metrics and data. For example, "Increased efficiency by 15% through process improvement" is far more impactful than "Improved processes."

- Incorporate Keywords: Carefully review the job description and incorporate relevant keywords, such as financial modeling, credit analysis, and underwriting, throughout your resume and cover letter.

Do 3: Showcase Your Financial Modeling Skills

Proficiency in financial modeling is a cornerstone of private credit roles. Demonstrate your expertise to potential employers.

- Master Essential Software: Become proficient in Excel, Bloomberg Terminal, and other relevant financial modeling software. LBO modeling and DCF modeling are particularly crucial in private credit.

- Develop a Portfolio: Create a portfolio of your best modeling work, showcasing your skills in credit modeling and other relevant areas.

- Explain Your Approach: Be prepared to discuss your modeling assumptions, methodology, and the rationale behind your conclusions during interviews.

Do 4: Master the Interview Process

The interview stage is your chance to shine. Thorough preparation is crucial.

- Prepare for Different Interview Styles: Anticipate behavioral questions, technical questions, and case study interviews. Practice answering common private credit interview questions.

- Research the Firm: Before each interview, thoroughly research the firm's investment strategy, recent deals, and team members.

- Ask Insightful Questions: Prepare thoughtful questions to demonstrate your genuine interest and understanding of the firm and the private credit market.

Do 5: Highlight Your Understanding of the Private Credit Market

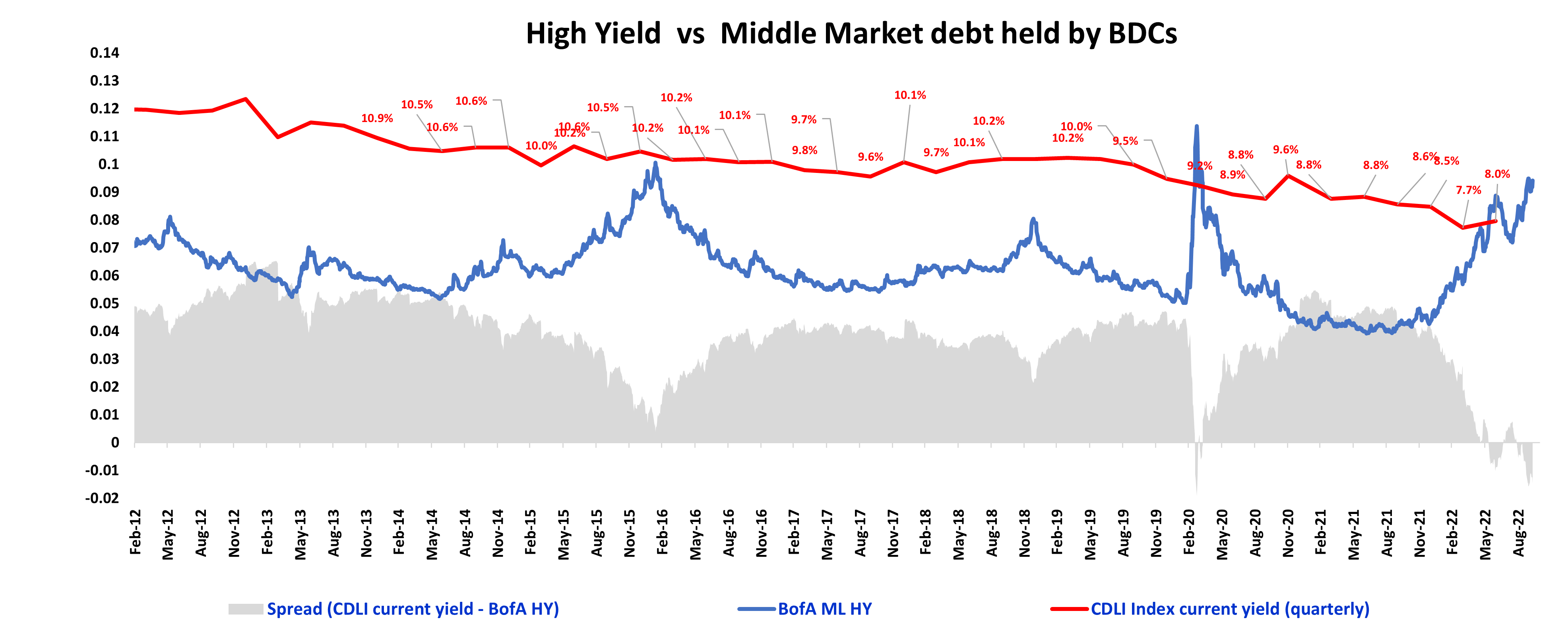

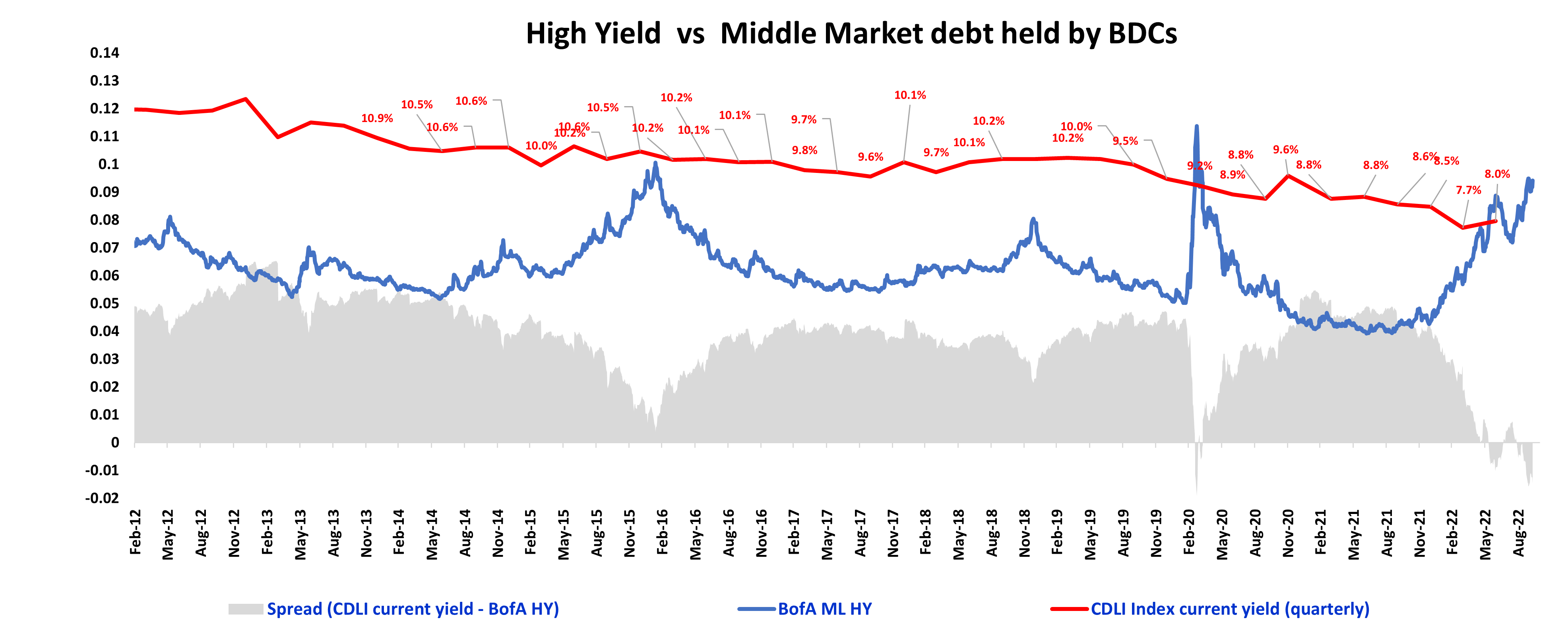

Demonstrate a strong understanding of current private credit market trends and various private debt strategies.

- Stay Updated: Follow industry news, read relevant publications, and attend industry events to stay informed about alternative lending trends.

- Know the Strategies: Familiarize yourself with different private credit strategies, such as direct lending, mezzanine financing, and other forms of private debt strategies.

- Understand Regulations: Show understanding of the regulatory environment impacting alternative lending.

5 Don'ts to Avoid When Seeking a Private Credit Role

Don't 1: Neglect Your Online Presence

Your online presence reflects your professionalism. Maintain a positive and consistent image.

- Professional LinkedIn Profile: Ensure your LinkedIn profile is up-to-date, professional, and showcases your relevant skills and experience.

- Accessible Resume and Cover Letter: Make it easy for recruiters to access your resume and cover letter online, perhaps through a professional website.

- Avoid Unprofessional Social Media Posts: Be mindful of your online activity on all social media platforms.

Don't 2: Submit Generic Applications

Sending the same resume and cover letter to multiple firms shows a lack of effort and genuine interest.

- Tailor to Each Job Description: Always customize your application materials to align precisely with each specific job posting. This demonstrates your attention to detail and genuine interest.

- Show Enthusiasm: Convey your genuine enthusiasm for the specific firm and role in your cover letter.

Don't 3: Underestimate the Importance of Networking

Relying solely on online job boards limits your opportunities. Active networking significantly increases your chances.

- Attend Industry Events: Networking at private credit conferences and other industry events can create valuable connections.

- Don't Just Use Job Boards: While job boards are helpful, networking expands your reach beyond listed vacancies.

Don't 4: Lack Technical Skills

Developing strong technical skills is non-negotiable in private credit.

- Master Financial Modeling: Continuously hone your skills in financial modeling skills, credit analysis skills, and underwriting skills.

- Software Proficiency: Demonstrate your proficiency in relevant software, such as Excel and Bloomberg Terminal.

Don't 5: Ignore the Importance of Soft Skills

Technical skills are crucial, but soft skills are equally important.

- Develop Strong Soft Skills: Cultivate strong communication, teamwork, and problem-solving skills, which are essential for success in this collaborative environment. Highlight these soft skills throughout your application and interview process.

- Demonstrate Professionalism: Maintain a professional demeanor in all interactions.

Securing Your Private Credit Career: Key Takeaways and Next Steps

To successfully navigate the competitive private credit job market, remember these key takeaways: strategically network, tailor your applications, showcase your technical expertise, master the interview process, and demonstrate your understanding of the private credit market. Avoid neglecting your online presence, submitting generic applications, underestimating networking, lacking technical skills, and ignoring the importance of soft skills.

Start implementing these do's and don'ts today to boost your chances of securing your dream private credit role!

Featured Posts

-

The China Factor Analyzing The Market Headwinds For Bmw Porsche And Beyond

Apr 24, 2025

The China Factor Analyzing The Market Headwinds For Bmw Porsche And Beyond

Apr 24, 2025 -

Us Tariffs Drive Chinas Lpg Imports Towards The Middle East

Apr 24, 2025

Us Tariffs Drive Chinas Lpg Imports Towards The Middle East

Apr 24, 2025 -

White House Announces Decline In Canada U S Border Apprehensions

Apr 24, 2025

White House Announces Decline In Canada U S Border Apprehensions

Apr 24, 2025 -

Fatal Incident Shark Activity And Missing Swimmer At Israeli Beach

Apr 24, 2025

Fatal Incident Shark Activity And Missing Swimmer At Israeli Beach

Apr 24, 2025 -

Instagrams Latest Move A Dedicated Video Editing App To Compete With Tik Tok

Apr 24, 2025

Instagrams Latest Move A Dedicated Video Editing App To Compete With Tik Tok

Apr 24, 2025