5 Do's And Don'ts For Success In The Competitive Private Credit Job Market

Table of Contents

2.1 DO: Build a Strong Network in Private Credit

Networking is paramount in the private credit job market. It's not just about who you know, but about building genuine relationships with professionals in the industry. These connections can lead to unadvertised opportunities, valuable insights, and mentorship that can significantly boost your career trajectory.

- Attend industry conferences and events: SuperReturn, the industry's leading global private equity and debt event, is a great starting point. Look for smaller, specialized conferences focusing on specific niches within private credit, such as direct lending or distressed debt.

- Utilize LinkedIn effectively: Optimize your LinkedIn profile with keywords relevant to private credit, such as "credit underwriting," "financial modeling," and "private debt investing." Actively connect with recruiters specializing in finance and professionals working in private credit firms. Engage with industry discussions and share relevant content to establish your expertise.

- Conduct informational interviews: Reach out to professionals in private credit for informational interviews. This allows you to learn about their career paths, gain valuable insights into the industry, and potentially make a lasting connection.

- Join relevant professional organizations: Membership in organizations like the CFA Institute or industry-specific private credit groups provides networking opportunities, access to industry news, and enhances your professional credibility.

2.2 DO: Develop Specialized Skills for Private Credit

The private credit job market demands a specific skillset. Beyond general finance knowledge, you need demonstrable expertise in areas directly relevant to private credit investing. Investing time in honing these skills will significantly improve your competitiveness.

- Financial modeling and analysis: Mastering LBO modeling and discounted cash flow (DCF) analysis is crucial for evaluating potential investments.

- Credit underwriting and risk assessment: Develop a deep understanding of credit analysis, including assessing borrower creditworthiness, structuring debt facilities, and managing risk.

- Due diligence and deal structuring: Experience in conducting thorough due diligence and structuring complex debt transactions is highly valued.

- Strong understanding of legal and regulatory frameworks: Familiarity with the legal and regulatory landscape governing private credit is essential.

- Excellent communication and presentation skills: Effectively communicating complex financial information to both technical and non-technical audiences is vital.

2.3 DO: Tailor Your Resume and Cover Letter

Generic applications rarely succeed in the competitive private credit job market. Each application should be meticulously tailored to the specific requirements of the role and the firm.

- Keywords optimization: Carefully review the job description and incorporate relevant keywords into your resume and cover letter. This helps applicant tracking systems (ATS) identify your application.

- Highlight quantifiable achievements and results: Quantify your accomplishments whenever possible. Instead of saying "Improved efficiency," say "Improved efficiency by 15% resulting in X dollars saved."

- Focus on skills and experience relevant to the target role: Don't include irrelevant information. Focus on the skills and experience most directly related to the specific private credit job you're applying for.

- Use a professional and clean resume format: Choose a professional and easy-to-read format, either chronological or functional, depending on your experience level.

2.4 DON'T: Underestimate the Importance of Soft Skills

While technical skills are essential, soft skills are equally critical for success in the private credit job market. Employers value candidates who possess strong interpersonal skills and can work effectively within a team.

- Teamwork and collaboration: Private credit involves working closely with colleagues, investors, and borrowers. Strong teamwork skills are crucial.

- Problem-solving and critical thinking: The ability to analyze complex situations, identify problems, and develop effective solutions is highly valued.

- Strong work ethic and dedication: Long hours and demanding workloads are common in private credit. A strong work ethic and commitment to excellence are necessary.

- Professionalism and communication (written and verbal): Maintaining professional conduct and communicating effectively, both verbally and in writing, is paramount.

- Resilience and adaptability: The private credit market can be volatile. Resilience and the ability to adapt to changing circumstances are vital.

2.5 DON'T: Neglect Your Online Presence

Your online presence reflects your professional image. A well-maintained online profile can significantly enhance your chances of landing a private credit job, while a negative online presence can severely hinder your prospects.

- LinkedIn profile optimization: Ensure your LinkedIn profile is complete, professional, and includes a compelling headline, summary, and work experience section. Seek endorsements and recommendations from colleagues and supervisors.

- Review online presence: Conduct a Google search of your name to assess your online reputation. Check your social media profiles for any content that may be unprofessional or damaging.

- Address any negative or unprofessional content: Take steps to remove or rectify any negative or unprofessional content you find online.

- Showcase projects or achievements online: Consider creating a portfolio website or blog to showcase your skills and experience in private credit.

Conclusion: Securing Your Place in the Private Credit Job Market

Securing a role in the competitive private credit job market requires a strategic approach. By focusing on building a strong network, developing specialized skills, tailoring your applications, cultivating essential soft skills, and maintaining a positive online presence, you can greatly increase your chances of success. Start building your network today! Research upcoming private credit conferences and begin tailoring your resume and cover letter to target specific roles within the private credit industry. The rewards of a successful career in private credit are significant, and with dedication and the right strategy, you can achieve your goals.

Featured Posts

-

Brewers Fall To Diamondbacks In Dramatic Ninth Inning Finish

Apr 23, 2025

Brewers Fall To Diamondbacks In Dramatic Ninth Inning Finish

Apr 23, 2025 -

Marches Parisiens Decryptage Fdj Et Schneider Electric Semaine Du 17 Fevrier

Apr 23, 2025

Marches Parisiens Decryptage Fdj Et Schneider Electric Semaine Du 17 Fevrier

Apr 23, 2025 -

Revue De Marche Bfm Bourse Lundi 24 Fevrier

Apr 23, 2025

Revue De Marche Bfm Bourse Lundi 24 Fevrier

Apr 23, 2025 -

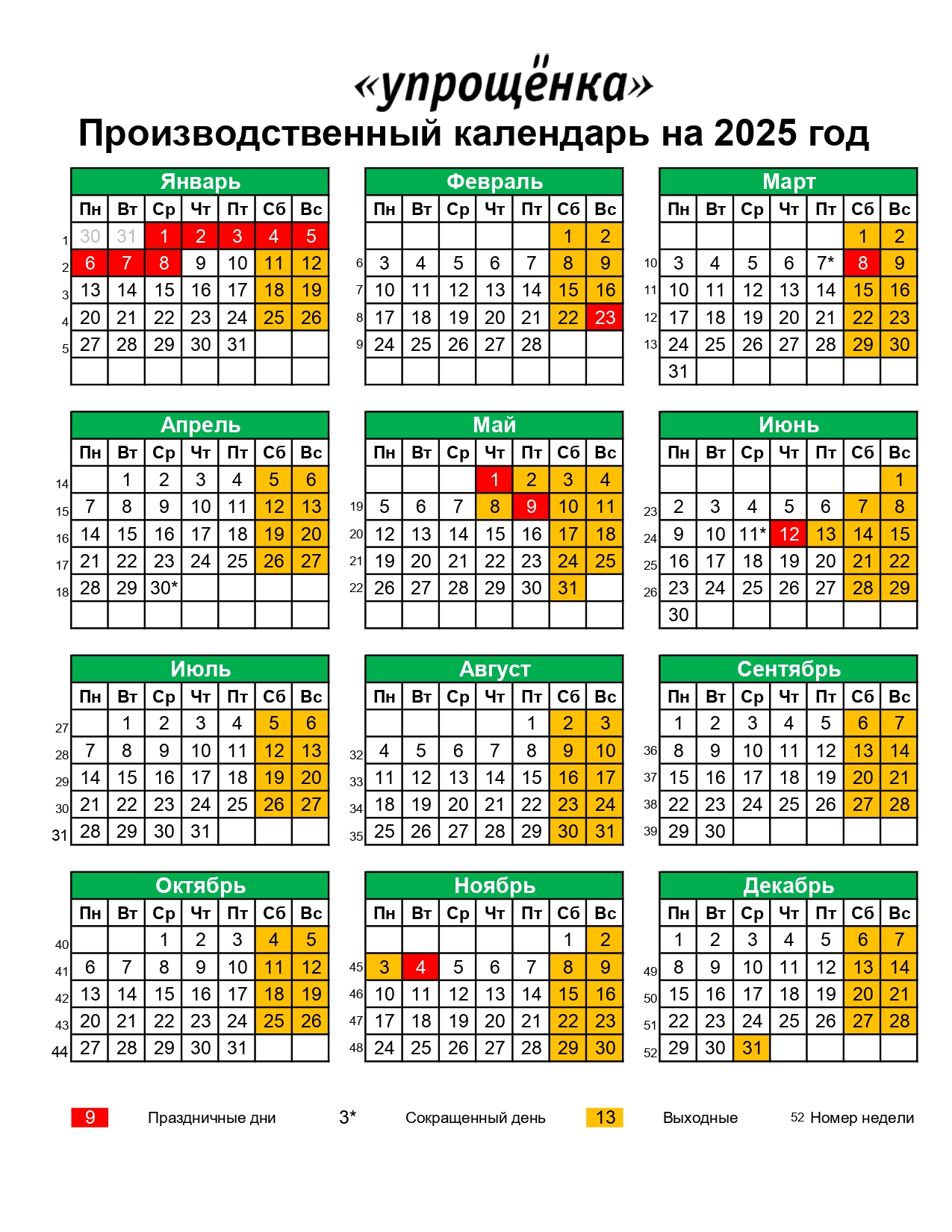

3 Marta 2025 Goda Chistiy Ponedelnik Polnoe Rukovodstvo Po Velikomu Postu

Apr 23, 2025

3 Marta 2025 Goda Chistiy Ponedelnik Polnoe Rukovodstvo Po Velikomu Postu

Apr 23, 2025 -

Podcast Good Morning Business Emission Complete Du 24 Fevrier

Apr 23, 2025

Podcast Good Morning Business Emission Complete Du 24 Fevrier

Apr 23, 2025