1050% Price Hike: AT&T Sounds Alarm On Broadcom's VMware Deal

Table of Contents

AT&T's Concerns Regarding the VMware Acquisition

AT&T's central concern revolves around the projected cost of VMware licensing after Broadcom takes the reins. The company alleges a staggering 1050% increase in licensing fees, a claim that has sent shockwaves through the industry. While specific evidence supporting this exact figure may still be emerging, the underlying concern is clear: a substantial and potentially crippling price increase.

This price hike could severely impact AT&T's network infrastructure and operational costs. The company relies heavily on VMware's virtualization technology, and a drastic increase in licensing fees would translate directly into increased operational expenditure (OPEX). This could force AT&T to make difficult choices, potentially impacting service quality and innovation.

- Increased operational expenditure (OPEX) for AT&T: A significant budget reallocation would be necessary to absorb the increased licensing costs.

- Potential impact on AT&T's services and pricing for consumers: Higher operational costs could lead to increased prices for consumers or a reduction in service quality.

- Concerns about reduced competition and innovation in the market: A dominant player controlling VMware could stifle competition and innovation within the virtualization market, potentially harming the telecom industry as a whole.

Broadcom's Response and Justification for the Price Increase

Broadcom has yet to directly address the specific 1050% figure cited by AT&T. However, they have generally defended their acquisition strategy, highlighting potential synergies and long-term benefits. Broadcom's justification likely centers on arguments related to increased research and development costs, the need for significant investments in VMware's future, and the overall market consolidation strategy.

- Broadcom's explanation of the pricing strategy: The official response will likely focus on a long-term vision for VMware and the value it brings to its clients.

- Potential synergies resulting from the VMware acquisition: Broadcom may point to efficiency gains and cost reductions across its operations as justification for the increased pricing.

- Broadcom's long-term vision for VMware: The future direction of VMware and its integration with other Broadcom products will likely influence the pricing model.

Regulatory Scrutiny and Potential Antitrust Concerns

Given the magnitude of the Broadcom-VMware deal and the potential impact on competition, regulatory scrutiny is almost certain. Antitrust authorities in various jurisdictions will likely investigate the acquisition's impact on pricing and competition within the virtualization and telecom sectors. The likelihood of legal challenges depends on the evidence presented and the findings of these investigations. Previous regulatory actions involving Broadcom and similar large acquisitions will be crucial precedents in this case.

- Relevant antitrust laws and regulations: The investigation will be guided by laws such as the Sherman Act (in the US) and equivalent legislation in other countries.

- Potential legal challenges to the acquisition: Depending on the investigation's findings, legal challenges could delay or even block the acquisition.

- The role of regulatory bodies in overseeing the deal: Regulatory bodies will play a crucial role in determining the fairness and competitiveness of the acquisition.

Impact on the Telecom Industry and Consumers

The potential ripple effects of the Broadcom-VMware deal and the associated VMware price hike extend far beyond AT&T. The entire telecom industry could face increased costs, potentially leading to higher prices for consumers. Telecom companies may need to explore alternative virtualization solutions, potentially slowing down innovation and hindering infrastructure upgrades.

- Potential price increases for consumers: Higher operational costs for telecom providers could ultimately result in increased service charges for consumers.

- Impact on network infrastructure investments: Increased VMware licensing costs could reduce the budget available for crucial network infrastructure improvements.

- Long-term consequences for competition and innovation: The acquisition could lead to reduced competition and potentially stifle innovation within the telecom and virtualization sectors.

Conclusion: Understanding the Implications of the Broadcom-VMware Deal

The alleged 1050% VMware price hike following Broadcom's acquisition presents a critical challenge to the telecom industry. AT&T's concerns highlight the potential for significant cost increases, reduced competition, and ultimately, higher prices for consumers. The regulatory scrutiny surrounding this deal will be crucial in determining its long-term impact. The future of virtualization and its cost within the telecom sector hangs in the balance. Stay informed about developments in the Broadcom-VMware deal and its impact on the telecom industry by following industry news and regulatory updates. Understanding the implications of this "VMware price hike" and the "Broadcom acquisition" is crucial for navigating the evolving landscape of the telecom industry analysis and the future of virtualization.

Featured Posts

-

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 28, 2025

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Documents

Apr 28, 2025 -

Michael Jordan And Denny Hamlin A Partnership Fueled By Criticism

Apr 28, 2025

Michael Jordan And Denny Hamlin A Partnership Fueled By Criticism

Apr 28, 2025 -

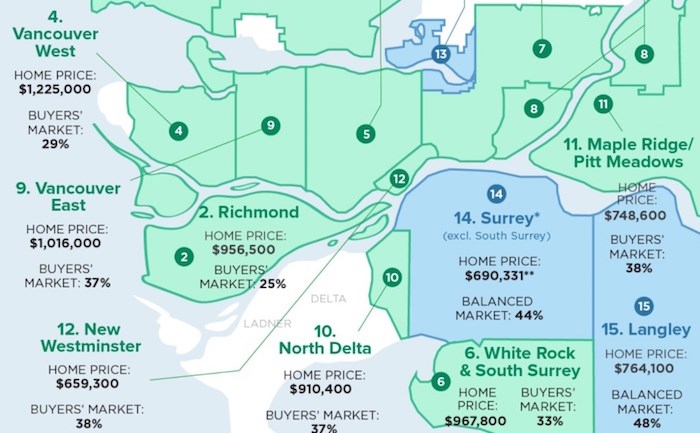

Metro Vancouver Housing Market Update Slower Rent Growth But Prices Still Climbing

Apr 28, 2025

Metro Vancouver Housing Market Update Slower Rent Growth But Prices Still Climbing

Apr 28, 2025 -

Chinas Targeted Tariff Exemptions For Us Imports

Apr 28, 2025

Chinas Targeted Tariff Exemptions For Us Imports

Apr 28, 2025 -

Denny Hamlin Gets Michael Jordans Backing The You Boo Him Mentality

Apr 28, 2025

Denny Hamlin Gets Michael Jordans Backing The You Boo Him Mentality

Apr 28, 2025